Beyond Insurance: Practical Strategies to Minimize Everyday Risks

Beyond Insurance: The 2025 Guide to Minimizing Everyday Risks

You insure your car against a crash that might happen once a decade, but do you insure your back against the chair you sit in for eight hours a day? Do you insure your bank account against the password you’ve used since 2018?

We are culturally conditioned to think of “risk management” as buying a policy. We pay a premium, file a document, and assume we are safe. But insurance is reactive—it only kicks in after the disaster has occurred. It writes a check; it doesn’t prevent the trauma.

Real safety comes from Personal Risk Management Strategies—a proactive system of lifestyle engineering designed to stop problems before they start. The stakes have never been higher. According to data from the Federal Trade Commission (FTC) released in March 2025, consumers reported losing over $12.5 billion to fraud in 2024, a stunning 25% increase over the previous year.

That is not a statistic you can just buy an insurance policy to fix. That requires a change in behavior.

In my years analyzing personal security and financial resilience, I’ve found that most catastrophic losses aren’t caused by “acts of God.” They are caused by slow-moving habits, ignored maintenance, and digital complacency. This article is your blueprint for “Lifestyle Risk Management”—actionable systems to protect your physical, digital, and financial life in 2025.

The Psychology of Risk: Why We Ignore the Obvious

Why do we fear a plane crash but text while driving? Why do we fear a shark attack but refuse to update our software?

The answer lies in the Optimism Bias. It’s the cognitive glitch that whispers, “That won’t happen to me.” We view ourselves as the protagonist of a movie where disaster strikes the extras, not the star. To master everyday risk mitigation, you must first accept that you are statistically just as vulnerable as anyone else.

— Morgan Housel, Author of The Psychology of Money

The “Swiss Cheese Model” of Prevention

In professional safety circles, we use the “Swiss Cheese Model.” Imagine several slices of Swiss cheese stacked side by side. Each slice represents a layer of defense (a smoke detector, a strong password, an emergency fund). No single layer is perfect; they all have holes. A disaster only happens when the holes in every slice align, allowing the threat to pass through.

Your goal isn’t to be perfect. Your goal is to add enough slices of cheese so the holes never align. If your password fails (slice 1), your Two-Factor Authentication catches it (slice 2). If that fails, your bank alerts catch it (slice 3). This is system-based safety.

Digital Fortress: Protecting Your Invisible Life

If you lose your wallet, it’s a hassle. If you lose your digital identity, it can be a decade-long nightmare. The digital landscape has shifted from “annoying spam” to “predatory extraction.”

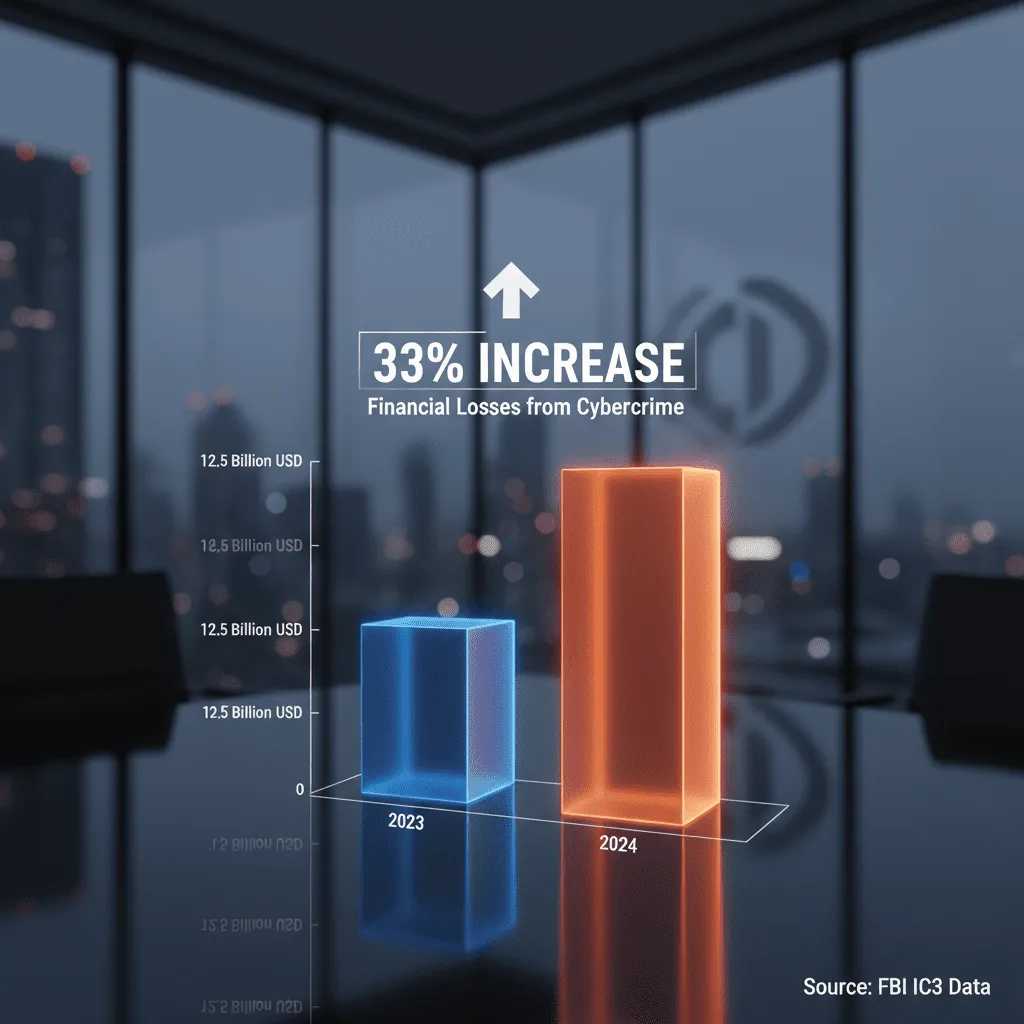

According to the Identity Theft Resource Center (ITRC) 2024 Annual Data Breach Report, while the number of compromises held steady, the number of victim notices increased by a staggering 312%. This means when a breach happens, it hits significantly more people. Furthermore, the FBI Internet Crime Complaint Center (IC3) 2024 Report details losses exceeding $16 billion—a 33% jump from 2023.

Credential Hygiene: The Foundation

The ITRC report highlights that stolen credentials were the leading attack vector in 2024 breaches. If you are reusing passwords, you are not managing risk; you are inviting it.

The “system” here is simple but non-negotiable:

- Use a Password Manager: Your brain cannot remember 50 unique, complex passwords. Outsourcing this to a manager removes the human error element.

- Enable MFA (Multi-Factor Authentication): This is your second slice of Swiss cheese. Even if a hacker buys your password on the dark web, they cannot replicate the code on your phone.

The Art of Digital Decluttering

We often discuss hoarding in physical homes, but digital hoarding is a massive security vulnerability. Every old account you leave open is a potential backdoor into your current life.

— Dr. Susan Albers, Psychologist, Cleveland Clinic Newsroom (Jan 2024)

Beyond the mental toll, unused accounts often lack current security updates. A breach in an old forum account you haven’t used in ten years can leak a password you still use for your banking. Delete what you don’t use. Decrease your surface area of attack.

Social Engineering Awareness

Technology has improved, so criminals have pivoted to hacking humans. Phishing is no longer just poorly spelled emails from “princes.” With the rise of AI, scams are personalized and highly convincing.

FTC data shows that investment scams caused consumers to lose $5.7 billion in 2024—more than any other category. If an opportunity arrives via text or unsolicited email promising guaranteed returns, recognize it immediately as a risk, not an opportunity.

Physical Sanctuary: Engineering a Safer Home

When we think of home safety, we buy cameras to catch burglars. However, statistically, the danger is already inside the house. In 2023 alone, National Safety Council (NSC) data indicates that an estimated 175,300 preventable injury-related deaths occurred in homes and communities.

Fire Prevention: It’s Not the Wiring, It’s the Dinner

You might worry about an electrical fire in the walls, but the real threat is on the stove. According to the NFPA Home Structure Fires Report 2024, cooking is the leading cause of reported home fires (48%) and home fire injuries.

The Risk Management Strategy:

- Keep a fire extinguisher in the kitchen (not under the sink): In a panic, you won’t dig for it. Mount it visibly near the exit, away from the stove.

- Smart monitoring: Install smart smoke detectors that alert your phone. If a fire starts while you’re at the grocery store, a standard alarm just beeps until the house burns down. A smart alarm summons help.

The Ergonomics of Remote Work

This is the silent risk of the modern era. We traded commute traffic for chronic back pain. A Chubb / American Chiropractic Association survey revealed that 41% of Americans have experienced new or increased back, neck, and shoulder pain since they started working remotely.

This isn’t just discomfort; it’s a long-term medical liability. A $200 ergonomic chair or a monitor arm is not a luxury purchase; it is a preventative medical device. Invest in your workspace setup to prevent debilitating injury later.

Financial Resilience: The “Sleep Well” System

Financial risk management is often confused with “getting rich.” They are different skills. Getting rich requires offense; staying rich requires defense.

The Emergency Fund as Self-Insurance

Insurance has deductibles. Life has unexpected costs that don’t meet those deductibles. Your emergency fund is your self-insurance policy for the “micro-disasters”—the blown transmission, the sudden dental surgery, the layoff.

Without this liquidity, a minor risk (car trouble) becomes a major crisis (high-interest debt). As James Clear notes in Atomic Habits, “You do not rise to the level of your goals. You fall to the level of your systems.” Your savings rate is a system, not a goal.

Diversification Beyond Stocks

The Swiss Re Sigma Report 2024 notes that the global protection gap reached USD 1.83 trillion. This gap represents the difference between insured losses and total economic losses. You cannot rely on institutions to cover everything.

True diversification acts as a firewall. Do not have all your assets in one asset class, and do not have all your income from one source. The rise of the “side hustle” isn’t just about extra cash; it’s about redundancy. If your primary job fails, you have a backup generator.

Situational Awareness: The Lost Art of Paying Attention

We walk through the world with our heads down, staring at screens. This “smartphone blindness” makes us easy targets for crime and accidents. Situational awareness is the most effective, zero-cost risk mitigation tool available.

The Cooper Color Code

Adopted from military training, this system helps you gauge your mental state:

- Code White: Unaware and unprepared. (e.g., Scrolling TikTok while walking to your car). This is where victims are selected.

- Code Yellow: Relaxed awareness. You aren’t paranoid, but your head is up. You notice who is around you. This should be your default state.

- Code Orange: Specific alert. You see something wrong—a strange car, an aggressive dog. You are formulating a plan.

- Code Red: Action. The fight is on or you are fleeing.

Most modern risks happen because we linger in Code White. Simply shifting to Code Yellow reduces your profile as a victim significantly.

Transitional Spaces

Be hyper-vigilant in “transitional spaces”—driveways, parking lots, entryways, and elevators. These are the choke points where you are distracted (looking for keys, unlocking doors) and where your movement is restricted. Put the phone away before you enter a transitional space.

Action Plan: Your 30-Day Risk Detox

Don’t try to fix everything overnight. Use this schedule to layer your defenses.

Week 1: Digital Scrub

- Install a password manager and generate unique passwords for email and banking.

- Enable MFA on all financial and social accounts.

- Unsubscribe from and delete 5 unused accounts (retailers, old forums).

Week 2: Home Audit

- Check the manufacture date on your fire extinguishers (replace if >10 years).

- Clear the clutter from the area around your stove.

- Install water leak detectors near the water heater and washing machine.

Week 3: Financial Buffers

- Calculate 3 months of “bare bones” expenses. Set an auto-transfer to build this fund.

- Review your credit report for unauthorized accounts.

- Check beneficiary designations on all insurance and retirement accounts.

Week 4: Health & Situational

- Adjust your monitor height so the top of the screen is at eye level.

- Practice “Code Yellow” when walking to your car this week.

- Schedule that preventative health screening you’ve been putting off.

Frequently Asked Questions

How do I conduct a personal risk assessment?

Start by listing your assets (health, income, data, property). Then, list the threats to each (illness, layoff, hack, fire). finally, evaluate your current defenses. If a threat has high probability or high impact, and your defense is weak, that is your priority area to fix.

Is identity theft insurance worth it?

It can be, but read the fine print. Many policies only help with the “cleanup” (legal fees, phone calls) rather than reimbursing stolen money. Prevention (freezing your credit, using strong passwords) is often more effective than insurance.

What is the difference between risk avoidance and risk reduction?

Risk Avoidance means eliminating the activity entirely (e.g., not investing in crypto to avoid volatility). Risk Reduction means engaging in the activity but taking steps to limit the downside (e.g., investing in crypto but only 1% of your portfolio). For everyday life, reduction is usually more practical than avoidance.

What are the 4 types of personal risk management?

The four classic strategies are:

1. Avoid (Don’t do the risky thing).

2. Reduce (Wear a seatbelt, use a firewall).

3. Share/Transfer (Buy insurance).

4. Retain (Accept the risk and save money to cover it, like a deductible).

Conclusion

Risk is an inevitable byproduct of living a full life. You cannot eliminate it entirely—as WHO World Health Statistics 2024 remind us, noncommunicable diseases remain a global challenge, reminding us that our health is our most volatile asset. However, you can manage it.

By moving beyond the passive reliance on insurance and adopting a proactive “Lifestyle Risk Management” mindset, you shift from being a victim-in-waiting to the architect of your own safety. The goal isn’t to live in fear; it’s to build a system so robust that you can live with freedom.

Don’t wait for the crisis to force your hand. Start your 30-day detox today. Build your fortress, slice by slice.