Claim Denied? What to Do When Your Insurance Won’t Pay Up

Claim Denied? The Step-by-Step Guide to Fighting Back When Insurance Won’t Pay (2025 Edition)

You paid your premiums on time every single month. You trusted the brochure, the friendly agent, and the promise of protection. Now, when you need them most, your insurer says “No.”

It feels like a betrayal. I’ve seen clients break down in tears over a rejected roof claim or a denied medical procedure. But here is the thing: In the insurance industry, “No” is rarely the final word. It is often just the opening move in a negotiation.

You are not alone in this fight. The landscape has shifted dramatically in the last two years. With the rise of AI-driven claims adjustments and stricter exclusions due to climate risks, denials are hitting record highs. In fact, Weiss Ratings reported on June 11, 2025, that 14 large U.S. insurers closed nearly 47.5% of homeowner claims with zero payment.

But there is good news. You have rights, and you have a process. This guide isn’t just advice; it’s a counter-intelligence playbook. We will break down the exact 5-step appeal process, legal leverage points, and “bad faith” warning signs you need to overturn that denial.

Why Was Your Claim Actually Denied? (Decoding the Letter)

Before you can fight back, you have to understand the language of the enemy. Insurance companies rarely speak in plain English; they speak in codes, clauses, and exclusions. When you receive a denial letter or an Explanation of Benefits (EOB), it usually falls into one of three buckets.

1. The “Big Three” Reasons

In my experience reviewing hundreds of files, the vast majority of denials stem from these categories:

- Administrative Errors: This is the most common and easiest to fix. A misspelled name, a wrong policy number, or an incorrect billing code. According to the American Medical Association (AMA), lack of prior authorization was the top reason for health claim denials in 2024.

- Medical Necessity (Health) or “Sudden vs. Gradual” (Property): This is subjective. The insurer argues the treatment wasn’t needed or the damage to your home was “wear and tear” rather than a storm.

- Exclusions: The fine print. This is where they say, “We cover water damage, but not this type of water damage.”

Ryan Mandell, Director of Claims Performance at Mitchell International, noted in a 2025 trends report that algorithms are becoming the new adjusters. Insurers are using AI to determine values instantly. This means your “No” might have come from a computer, not a human. Your goal is to force a human to review the file.

Understanding the “Wear and Tear” Trap

For homeowners, this is the silent killer of claims. In 2024 and 2025, insurers aggressively expanded “cosmetic damage exclusions.” If your roof was damaged by hail, but the insurer claims it was “old anyway,” they are using the wear and tear exclusion.

Amy Bach, Executive Director of United Policyholders, stated in 2024: “We are seeing a massive shift where insurers are using ‘cosmetic damage exclusions’ to deny roof claims that would have been paid five years ago.”

Immediate Triage: 4 Steps to Take Within 24 Hours

The moment you hear your claim is denied, the clock starts ticking. But panic is your enemy. Here is the triage protocol I recommend to every client.

-

Do Not Get Angry on the Phone (The “Record Everything” Rule)

It’s tempting to scream at the adjuster. Don’t. Calls are recorded, and aggressive behavior can be used to label you as “uncooperative.” Instead, be politely persistent. Log every call: date, time, name of the representative, and a summary of what was said.

-

Request a Formal “Certified” Denial Letter

If they told you “No” over the phone, it doesn’t count. Demand a written denial letter sent via certified mail. Why? Because state laws require them to cite the specific policy language they are relying on. This pins them down so they can’t change their story later.

-

Review Your Policy’s “Declarations Page” and “Exclusions”

Pull out your policy. Look at the “Dec Page” (the summary) and the specific section cited in their denial letter. Does the policy actually say what they claim it says? You’d be surprised how often an adjuster misquotes their own policy.

-

Check Statutes of Limitations

Every state has a deadline for how long you have to appeal or file a lawsuit. In some states, it’s one year; in others, it’s three. Don’t let them stall you until the clock runs out.

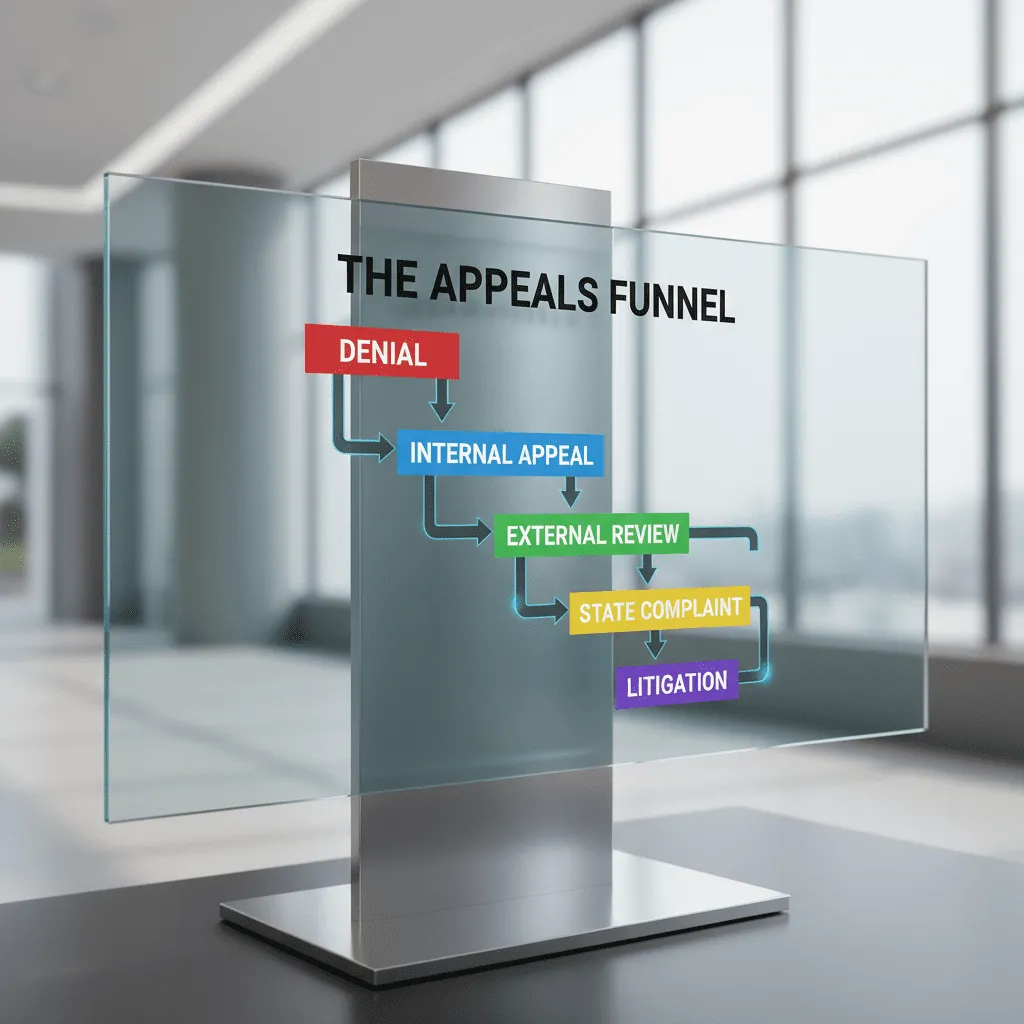

The Appeal Funnel: How to Fight a Denial and Win

Most people give up after the first denial. That is exactly what the insurance business model counts on. ValuePenguin analysis from December 2024 indicates that while denial rates are high, 44% to 80% of denied claims are overturned when patients pursue a full appeal. The odds are actually in your favor if you fight.

Level 1: The Internal Appeal (Writing the Perfect Demand Letter)

This is your first formal counter-strike. You are asking the insurance company to review its own decision. Do not just write “I disagree.” You must write a Demand Letter.

What to include:

- The Claim Number: Put this in bold at the top.

- The Facts: A chronological timeline of the loss or treatment.

- The Evidence: Photos, police reports, medical records, or contractor estimates.

- The “Why”: Specifically refute the reason given in the denial letter. If they said “Not Medically Necessary,” attach a letter from your doctor titled “Letter of Medical Necessity.”

Level 2: The External Review (Third-Party Assessment)

If the internal appeal fails (and it often does), you have the right to an External Review. This is particularly relevant in health insurance under the Affordable Care Act.

An independent third party—not an employee of the insurance company—will review your file. Their decision is usually binding on the insurer. According to a 2024 analysis of CMS data by the Kaiser Family Foundation (KFF), external reviews frequently overturn decisions regarding “experimental” treatments when backed by current medical standards.

Level 3: The “Nuclear Option” (Filing a State Complaint)

If the external review fails or isn’t applicable (like in some property claims), it’s time to escalate to the regulator. Every state has an Insurance Commissioner or Department of Insurance. Their job is to police the industry.

When you file a complaint, the state sends a formal inquiry to the insurer. The insurer must respond, usually within 15 to 30 days. This costs the insurer time and legal resources, often motivating them to settle small to mid-sized claims just to make the headache go away.

When to Call for Backup: Public Adjusters vs. Attorneys

Sometimes, the DIY approach isn’t enough. If you’re dealing with a six-figure home loss or a complex liability dispute, you need a mercenary. But which kind?

What is a Public Adjuster?

A Public Adjuster (PA) is an insurance pro who works for you, not the company. They are best for property claims (fire, hurricane, water damage). They handle the paperwork, the estimates, and the negotiation.

Cost: They typically take 10% to 20% of the settlement. If you get nothing, they get nothing.

When to Hire an Insurance Lawyer

You need a lawyer when the issue is legal interpretation or “Bad Faith.” If the insurer is lying, interpreting the contract illegally, or violating state laws, a PA can’t help you—you need an attorney.

Cost: Many bad faith lawyers work on contingency (33% to 40% of the win). In some states, if you win, the insurer has to pay your legal fees on top of your claim.

According to LexisNexis Risk Solutions 2025 trends, bodily injury claim severity jumped 9.2%. In response, insurers are quicker to declare cars a “total loss” to cap their payouts. If they total your car, they will likely offer you “market value.” Always negotiate this. Their first offer is almost always lower than the actual cost to replace your vehicle.

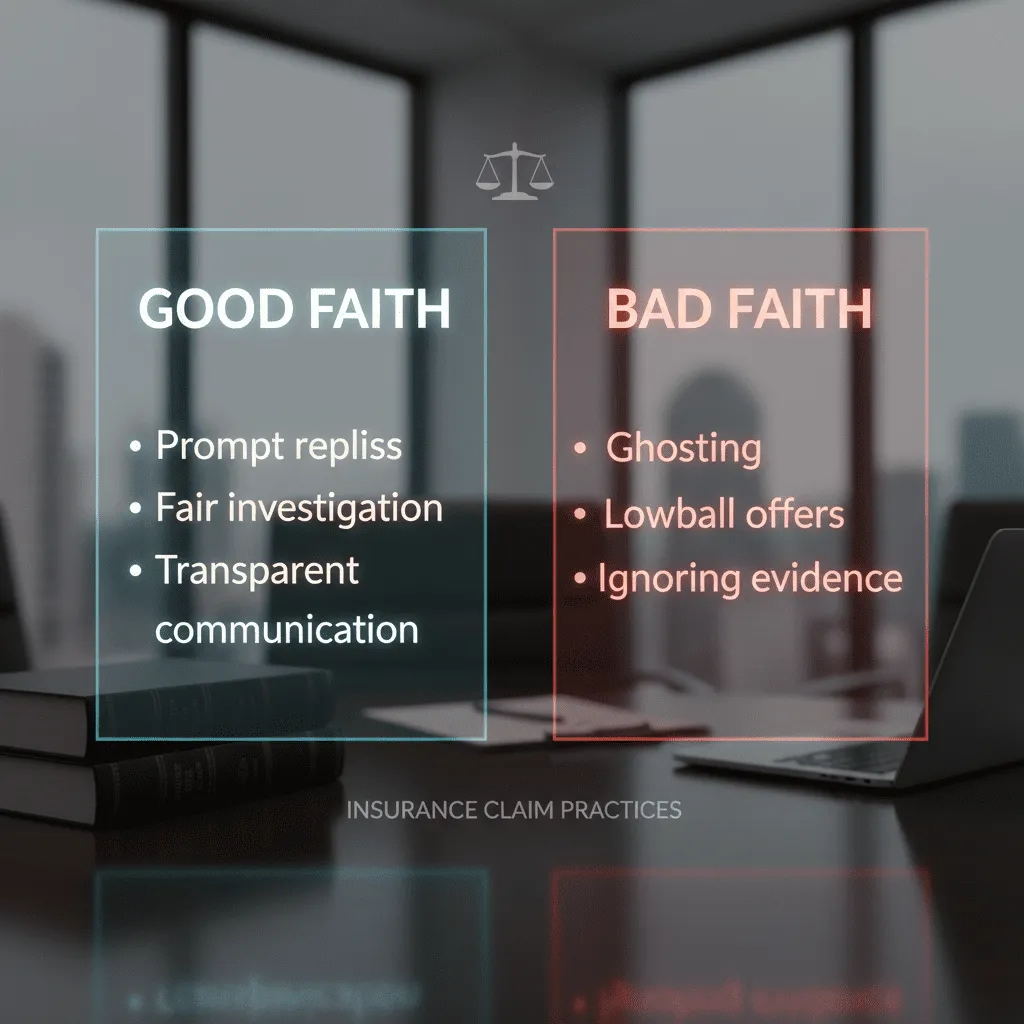

Is Your Insurer Acting in “Bad Faith”?

This is the most powerful weapon in your arsenal. “Bad Faith” is a legal concept established by landmark cases like Gruenberg v. Aetna Insurance Co. It means the insurer has an implied duty to treat you fairly. If they don’t, they can be sued for damages far exceeding the policy limit.

Top 5 Warning Signs of Bad Faith

- Unreasonable Delays: Taking months to answer simple emails.

- Failure to Investigate: Denying a claim without ever sending an adjuster to look at the damage.

- Lowballing: Offering a settlement that is comically lower than the estimates provided by licensed professionals.

- Misrepresenting the Policy: Telling you “that’s not covered” when the policy clearly says it is.

- Silence: Ignoring your calls and certified letters.

Cynthia Cox, Vice President at KFF, puts it bluntly: “Insurers are banking on your exhaustion. They know that less than 1% of patients appeal denied claims, yet the success rate for those who do is nearly 50%.” When they delay, they are hoping you will walk away. Staying in the fight is the only way to prove you won’t.

Industry-Specific Denial Tactics (2024-2025 Data)

Different types of insurance have different “favorite” ways to say no. Here is what I am seeing right now.

Health Insurance: The “Prior Authorization” Trap

As mentioned earlier, Experian Health’s 2024 State of Claims Survey shows that 77% of providers are concerned about payers not paying for authorized services. The tactic? Retrospective denial. They approve the surgery beforehand, but after it’s done, they claim it wasn’t “medically necessary.”

The Fix: Always get the authorization in writing, and ensure your doctor codes the claim exactly as authorized.

Home Insurance: The “Concurrent Causation” Clause

This is tricky. If your home is damaged by two things at once—one covered (wind) and one not covered (flood)—the insurer might deny the entire claim. This is known as concurrent causation.

The Fix: You need a structural engineer or a public adjuster to prove that the covered peril (wind) happened before or independently of the non-covered peril.

Conclusion: Don’t Let “No” Be the End

Receiving a denial letter is stressful, infuriating, and frightening. It threatens your financial stability and your peace of mind. But as we’ve explored, a denial is not a verdict—it is a business decision made by a corporation trying to protect its bottom line.

By understanding the codes, keeping meticulous records, and utilizing the appeals process, you shift the power dynamic. Whether it’s a $500 medical bill or a $50,000 roof claim, the principles remain the same: Be persistent, be professional, and be ready to escalate.

Remember the statistics: Nearly half of homeowners’ claims are initially closed without payment, yet nearly half of appeals are successful. The math proves that fighting back works. Take a deep breath, grab your file, and start writing that appeal letter today.

Frequently Asked Questions

Does filing an appeal raise my insurance premiums?

Generally, filing an appeal or disputing a claim denial does not directly raise your premiums. However, the initial act of filing the claim itself (even if denied) can sometimes impact rates, depending on state laws and the type of claim. Fighting for what you are owed typically carries no additional penalty.

How long does an insurance appeal take?

It varies by state and insurer type. Health insurance internal appeals usually must be resolved within 30 to 60 days. Property appeals can take longer, often 90 days or more. External reviews are usually faster, often deciding within 45 days.

Can I sue my insurance company for denying a claim?

Yes, you can sue for breach of contract and, in many cases, “bad faith.” If you can prove they acted maliciously or negligently, you may be entitled to damages beyond the original claim amount. Consult a specialized insurance attorney for this route.

What is the success rate of insurance appeals?

According to ValuePenguin data from late 2024, success rates for health insurance appeals range from 44% to 80%, depending on the specific type of denial and how far the patient pushes the process.

Can an insurance company deny a claim after approving it?

Yes, unfortunately. This is often called a “retroactive denial.” It usually happens if they discover you stopped paying premiums, or if they determine fraud or misrepresentation occurred after the fact. It is highly contentious and should be fought immediately.