Do You Really Need That? A Look at Niche Insurance Policies

Do You Really Need That? The Math Behind Niche Insurance Policies (2025 Guide)

By The Financial Risk Team | Updated March 2025

We live in the age of the “upsell.” From the checkout counter to the airline booking page, you are constantly asked to insure your life, your latte, and your laptop. But when does “peace of mind” become a waste of money? We analyzed 5+ industry reports from 2024-2025 to create a mathematical framework for saying “Yes” or “No.”

You’re standing at the counter (or, more likely, staring at a checkout screen), and the question pops up: “Add protection for just $9.99?”

It feels responsible. It feels safe. But in my 15 years analyzing consumer finance and risk management, I’ve found that this impulse is often where your budget goes to die. We are suffering from what I call “protection fatigue.”

The insurance industry has capitalized on our general anxiety about the future. According to a 2024 report by the Swiss Re Institute, global life premiums are projected to grow by 2.9% in real terms, a rate significantly higher than the previous decade’s average. As Jérôme Haegeli, Group Chief Economist at Swiss Re, notes, “The insurance industry has reached a new equilibrium after the challenges of recent years.”

Translation: They are selling more policies than ever. But does that mean you need them?

In this guide, we are stripping away the fear tactics and looking at the math. We aren’t just listing pros and cons; we are using 2024-2025 data to calculate the Risk vs. Reward ratio of the most popular niche policies.

The “Subscriptionification” of Protection

Why does everything have an insurance checkbox now? Because small premiums add up to massive revenue streams for insurers, while the payout ratios for “micro-insurance” (like ticket protection) are often incredibly low.

Before we dive into specific policies, let’s establish a golden rule for your financial life. I call it the 1% Rule.

If you make $80,000 a year, 1% is $800. If you break your $400 headphones, it hurts, but it doesn’t ruin you financially. Paying $50 a year to insure them is mathematically inefficient. Insurance is designed to transfer catastrophic risk (loss of home, health, life), not inconvenient risk.

The “Definitely Maybe” List (High Risk, High Reward)

These are the policies where the math actually supports the purchase—provided you fit specific criteria.

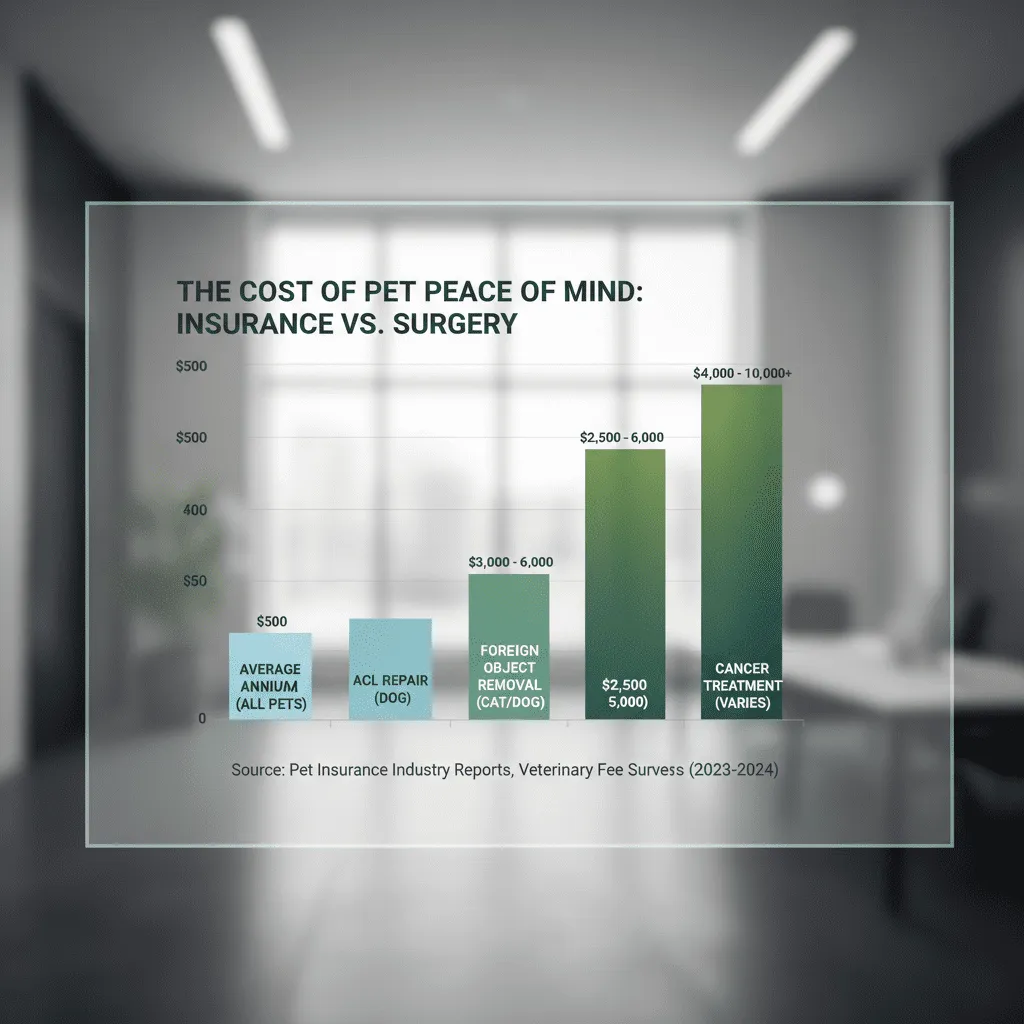

1. Pet Insurance: Not Just for Puppies

Years ago, I was skeptical of pet insurance. It felt like a luxury product for pampered pooches. The data from 2024 has completely changed my mind.

According to the North American Pet Health Insurance Association (NAPHIA) 2024 State of the Industry Report, the sector grew by 21.9%, surpassing the $4 billion mark for the first time. Total insured pets reached 6.25 million in North America.

Why the explosion? It’s not because people love their dogs more; it’s because veterinary costs have skyrocketed. We aren’t talking about routine checkups here. We are talking about the “catastrophic” veterinary event.

— Rick Faucher, President of NAPHIA (April 2024)

The Math: An ACL surgery for a large breed dog can cost upwards of $5,000. If you have a breed prone to hereditary conditions (like Golden Retrievers or French Bulldogs), the risk of a $5k+ bill is statistically significant.

Verdict: BUY (if you don’t have $5,000 in cash sitting in an emergency fund). Use an aggregator like Pawlicy to compare plans that cover hereditary conditions.

2. Travel Insurance: The Shift from “Cancellation” to “Medical”

Most people buy travel insurance because they are afraid of losing their airfare if they get the flu. This is the wrong way to look at it. The airlines have eliminated most change fees, and credit cards often cover trip interruption.

The real reason to buy travel insurance in 2025 is Emergency Medical.

According to Squaremouth’s 2024 Travel Trends & Claims Report, travel insurance claims increased by 18% in 2024 compared to 2023. More importantly, the nature of claims has shifted.

Case Study: The $25,000 Leg Break

Imagine you are hiking in a remote part of Spain and break your leg. A commercial stretcher flight back to the US can cost upwards of $25,000. Your domestic health insurance (BCBS, Aetna, Medicare) likely provides zero coverage outside the US borders.

Squaremouth data shows the average medical claim payout is roughly $1,654 for minor issues, but medical evacuation claims frequently exceed $17,000. You are insuring against the evacuation, not the lost luggage.

Verdict: BUY (for international travel only). Focus on policies with at least $100,000 in Emergency Medical and $250,000 in Medical Evacuation. Ignore the “cancel for any reason” upsells unless your trip costs over $10,000.

3. Cyber & Identity Theft Insurance: The New Necessity?

Ten years ago, identity theft insurance was largely a gimmick. Today, with the rise of AI-driven phishing and supply chain hacks, the landscape is terrifying.

The Identity Theft Resource Center (ITRC) 2024 Annual Data Breach Report revealed a shocking statistic: The number of victims skyrocketed by 312% in 2024. There were 3,205 publicly reported data compromises—an all-time high.

— Eva Velasquez, CEO of the Identity Theft Resource Center

The Nuance: Restoration vs. Reimbursement

Most people assume ID theft insurance pays you back for money stolen from your bank. However, banks are already legally required to reimburse fraudulent transactions (more on that later). The real value of this insurance is Restoration Services.

Fixing a stolen identity takes an average of 100 to 200 hours of phone calls, paperwork, and legal wrangling. Good cyber insurance assigns a case manager to do this for you.

Verdict: MAYBE. If you are a freelancer or have a high net worth, a dedicated cyber policy is smart. For everyone else, check if your homeowner’s insurance offers it as a cheap rider (usually $25/year).

The “Situational” List (Read the Fine Print)

4. Wedding Insurance

The wedding industry is volatile. The wedding insurance market is growing at a 7.8% CAGR, driven largely by high venue deposits.

You don’t need insurance for “change of heart” (most policies won’t cover cold feet anyway). You need coverage for Vendor Bankruptcy. If your venue shuts down 2 months before the date (a common occurrence in the post-2023 economy), you could lose a $15,000 deposit.

Verdict: BUY if your total budget exceeds $25,000. Ensure the policy explicitly covers vendor financial failure.

5. Gadget & Cell Phone Insurance

This is the classic AppleCare vs. Bank Card debate. Let’s do the math.

- Carrier Insurance: ~$15/month ($360 over 2 years) + $200 deductible = $560 cost.

- Refurbished Replacement: A 2-year-old iPhone often costs ~$450 to replace via secondary markets.

You are often pre-paying for the replacement. However, many premium credit cards (Amex Platinum, Chase Sapphire Reserve) offer complimentary cell phone protection if you pay your bill with the card. This is free coverage that renders carrier insurance obsolete.

Verdict: SKIP the carrier insurance. Use a credit card with built-in protection or self-insure.

The “Hard No” List (Stop Buying These)

Some policies are simply bad math. They prey on irrational fears rather than statistical reality.

6. Flight Crash / Accidental Death Insurance

You’ll see this when booking a flight. It pays out if the plane crashes. The odds of dying in a commercial plane crash are roughly 1 in 11 million. This is statistically irrational. If you need life insurance, buy a term life policy that covers you 24/7, not just for the 4 hours you are in the air.

7. Credit Card Loss Protection

Third-party companies often try to sell you protection for lost or stolen credit cards. Do not buy this.

Federal law (The Fair Credit Billing Act) limits your liability for unauthorized credit card charges to $50. In practice, most major issuers (Visa, Mastercard, Amex) have “Zero Liability” policies. Buying insurance for a $0 to $50 risk is the definition of a scam.

According to the FTC’s Consumer Sentinel Network Data Book 2024, while imposter scams resulted in $2.95 billion lost, only 22% of reports indicated a financial loss. This means the vast majority of attacks are stopped by current banking safeguards.

Decision Matrix: The “Need It” Calculator

Still unsure? Use this interactive calculator to determine if a specific policy is worth the premium.

Insurance Decision Calculator

Answer the following to see if you should buy coverage.

FAQ: Your Niche Insurance Questions Answered

Is flight accidental death insurance necessary?

Absolutely not. It covers an incredibly rare event. If you have dependents, you should have a standard Term Life Insurance policy that pays out regardless of how you die. Accidental death policies are high-profit margin products for insurers, not good value for you.

Does homeowners insurance cover jewelry theft?

Yes, but with limits. Most standard policies cap jewelry coverage at $1,000 to $2,000. If you have an engagement ring worth $10,000, you need a “floater” or “rider” specifically for that item. This usually costs about 1-2% of the item’s value annually.

Is gap insurance value worth it for cars?

If you put less than 20% down on a new car, yes. Depreciation happens the moment you drive off the lot. If your car is totaled in month 2, you might owe the bank $30,000 when the car is only worth $25,000. Gap insurance covers that $5,000 difference. However, buy it from your auto insurer, not the dealership. Dealerships often markup Gap insurance by 300%.

What about retroactive coverage for pre-existing conditions?

In the pet insurance world, pre-existing conditions are almost never covered. This is why getting insurance while the pet is a puppy/kitten is crucial. However, some travel insurance policies offer a “Pre-Existing Condition Waiver” if you purchase the policy within 14-21 days of your initial trip deposit.

Conclusion: Insuring the Catastrophe

The difference between smart financial planning and wasting money lies in understanding the difference between a catastrophe and an inconvenience.

In 2025, the data is clear:

- Pet Insurance is a hedge against the $5,000 vet bill, not the $50 vaccine.

- Travel Insurance is for the $25,000 medical evacuation, not the $300 flight change fee.

- Cyber Insurance is for the 200 hours of restoration work, not just the stolen funds.

Before you click “Add Protection” on your next purchase, pause. Run the numbers through the 1% Rule. If you can cover the loss with the cash in your wallet, keep the premium for yourself. If the loss would wipe out your savings, sign on the dotted line.

Disclaimer: This article provides financial information for educational purposes and does not constitute professional financial or legal advice. Insurance policies vary by provider and location. Always read the Product Disclosure Statement (PDS) before purchasing.