How to Assess Your Real Coverage Needs

Am I Underinsured? The 2025 Guide to Assessing Your Real Coverage Needs

By Financial Risk Analyst | Updated February 2025

If your home burned down today, would your insurance check cover the 2025 price of lumber, labor, and code upgrades, or are you still relying on the 2020 price?

It’s a terrifying question, but one that millions of Americans are ignoring. In my years working in risk assessment, I’ve seen a disturbing trend: policies are “set and forgotten,” while the world becomes exponentially more expensive.

Consider the devastating Marshall Fire in Colorado. It wasn’t just a tragedy of lost homes; it was a financial catastrophe caused by the gap between policy limits and reality. A groundbreaking research paper published in late 2024 revealed a staggering statistic: 74% of policyholders affected by the Marshall Fire were underinsured, with over a third categorized as “severely underinsured.”

This isn’t an isolated incident. It is a systemic crisis. Whether it’s your home, your car, or your life insurance, inflation has quietly eroded your safety net.

In this guide, we aren’t just defining terms. We are going to perform a rigorous “Declaration Page Audit” to uncover the silent wealth-killers hiding in your filing cabinet. We will look at hard data from late 2024 and 2025 to determine if you are truly protected against the risks of today.

The “Silent” Inflation: Why Your Policy Might Be Obsolete

The biggest mistake I see homeowners make is confusing Market Value with Reconstruction Cost. Your real estate agent cares about market value (what a buyer will pay for the house + land). Your insurance agent should care about reconstruction cost (what it costs to hire a crew and buy materials to rebuild the structure from scratch).

These two numbers have decoupled significantly in the last three years.

The $10 Trillion Risk: According to the CoreLogic 2024 Hurricane Risk Report, 32.7 million homes from Texas to Maine are at risk of hurricane damage with a total reconstruction cost of $10.8 trillion. This massive figure highlights how expensive rebuilding has become.

Why the discrepancy? It comes down to the “Three L’s”: Labor, Lumber, and Logistics. According to a 2024 report from the Insurance Information Institute (Triple-I) and APCIA, average property and casualty replacement costs have increased by a cumulative 45% since 2020.

If your policy limit (Coverage A) hasn’t increased by roughly that same 45% margin over the same period, you are likely walking into a financial buzzsaw.

3 Critical Home Insurance Gaps to Check Now

Grab your policy declaration page. Look for these three specific line items. If they are missing or low, you need to make a call immediately.

1. The “Extended Replacement” Trap

Many people believe that if their home is insured for $500,000, that’s the most they can get. But what if a regional disaster (like a wildfire or hurricane) causes a surge in demand for contractors, driving prices up by 30% overnight?

Standard policies cap out at the face value. Superior policies include Guaranteed Replacement Cost or Extended Replacement Cost. The latter usually provides an additional buffer of 25% to 50% above your limit. In 2025, with volatile material markets, a simple 100% replacement policy is risky.

2. Ordinance or Law Coverage: The Code Upgrade Killer

This is the sleeper threat of 2025. Building codes change constantly. If your home was built in 1990 and is destroyed today, you cannot rebuild it to 1990 standards. You must rebuild it to 2025 codes (modern electrical, hurricane straps, energy efficiency windows).

Standard insurance covers “like for like.” It does not pay for code upgrades unless you have “Ordinance or Law” coverage. According to the Policygenius 2024 Coverage Guide, most standard policies only provide 10% for this coverage. However, in states with strict codes like Florida, total demolition might be required if damage exceeds 50%, costing tens of thousands out of pocket if you lack this endorsement.

3. Inflation Guard Endorsement

Does your policy limit stay flat for 12 months? In a high-inflation environment, that’s dangerous. An Inflation Guard endorsement automatically adjusts your coverage limit pro-rata throughout the policy term—usually by 4% to 8% annually—to keep pace with rising costs. Without it, your coverage effectively shrinks every single day.

Auto Liability: Are You One Accident Away from Bankruptcy?

If you think your auto insurance is just about fixing your fender, you’re missing the bigger picture. Auto insurance is primarily asset protection. The real danger in 2025 isn’t the repair bill; it’s the lawsuit.

The Rise of “Nuclear Verdicts”

We are living in the era of “Social Inflation.” Juries are awarding record-breaking sums in accident cases. A frightening report from Marathon Strategies and Ohio Insurance Agents (2024) found that the number of nuclear verdicts—jury awards exceeding $10 million—rose 52% in 2024 over 2023.

If you are carrying state minimum liability limits, you are woefully exposed.

🚨 State Minimums are Not a Safety Standard

State minimums are simply the lowest amount you can buy to drive legally; they are not a recommendation for financial safety. Recognizing this inadequacy, the California Department of Insurance increased minimum liability limits to 30/60/15 effective January 1, 2025. Even with this increase, these limits are insufficient for anyone with a home or savings account.

My Recommendation: The 100/300/100 Rule

For most middle-class families, I recommend a minimum of 100/300/100 liability coverage:

- $100,000 bodily injury per person.

- $300,000 bodily injury per accident.

- $100,000 property damage.

Given that the average new car price hovers near $48,000, and many EVs cost significantly more, carrying a $15,000 or $25,000 property damage limit is a gamble that could cost you your savings.

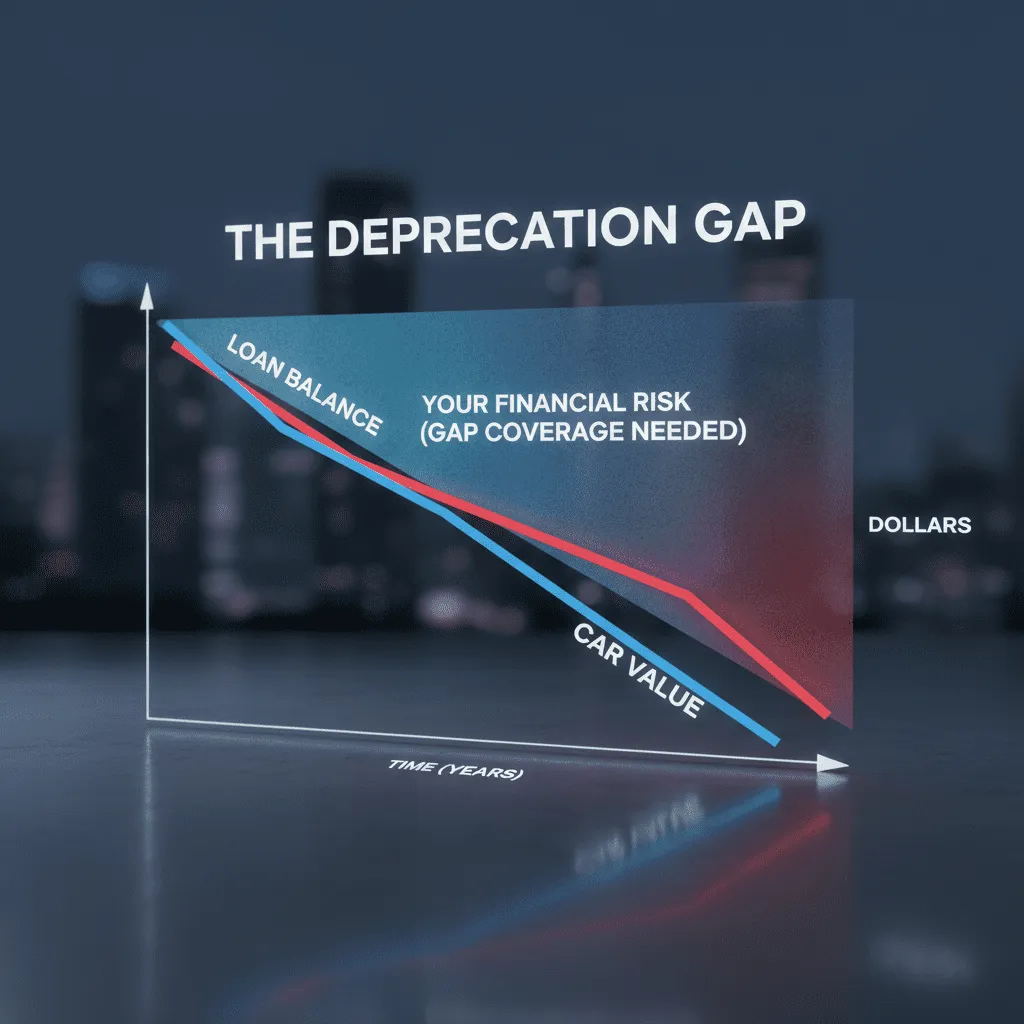

The GAP Insurance Necessity

With vehicle prices skyrocketing, the Global GAP insurance market is projected to reach $4.76 billion in 2025. Why? Because depreciation is steep. If you finance a car in 2025, you could be “underwater” (owing more than the car is worth) the moment you drive off the lot. If you total that car, standard insurance pays the value, not the loan balance. GAP insurance covers the difference.

The Umbrella Policy: The Wealth Shield You Forgot

Whenever I review a client’s portfolio, I look for an Umbrella policy first. It is, in my opinion, the most undervalued financial product in existence.

An Umbrella policy provides liability coverage above your home and auto limits. Remember those “nuclear verdicts” rising by 52%? An Umbrella policy is your defense.

The “Not Rich Enough” Myth: You do not need to be a millionaire to need an Umbrella policy. You just need to have future wages that can be garnished. For roughly $150 to $300 a year, you can secure $1 million in additional liability protection. It is the cheapest sleep you can buy.

Life Insurance: The “10x Income” Rule Revisited

Perhaps the most tragic form of underinsurance is in life coverage. We often buy a policy when a child is born and never look at it again. But inflation affects your death benefit’s purchasing power just as it affects the price of eggs.

The 102 Million Person Gap: According to the LIMRA 2024 Insurance Barometer Study, 102 million Americans acknowledge they need life insurance or more of it, representing 42% of the adult population. Furthermore, the gender gap is widening: Only 46% of women have coverage compared to 57% of men.

The Inflation Erosion: If you bought a $500,000 policy in 2015 to cover your mortgage and your kids’ college, run the numbers again. That $500,000 has roughly 30% less purchasing power today than it did a decade ago.

Furthermore, there is a massive misconception about cost. The LIMRA/Life Happens 2024 Study found that 72% of Americans overestimate the cost of life insurance, with many believing it is 3x more expensive than reality. Term life insurance remains incredibly affordable for the protection it offers.

🧮 Quick Life Insurance Gap Calculator

Estimate if your current coverage matches the 2025 economic reality.

Your 15-Minute “Declaration Page” Audit Checklist

Don’t wait for your renewal notice. Log into your insurance portal right now, download your Declaration Page (the summary sheet), and go through this checklist. It’s a 15-minute task that could save your financial future.

Homeowners Policy Audit

- Dwelling Limit (Coverage A): Does this equal roughly $150-$250 per square foot (depending on your local construction costs)? If it matches your market value, it might be wrong.

- Extended Replacement Cost: Is this endorsement present? Look for “+25%” or “+50%”.

- Inflation Guard: Verify the policy limit increases annually.

- Ordinance or Law: Is this limit at least 25% of Coverage A? (Standard is often 10%).

- Deductible: Can you afford the percentage-based deductible (e.g., 2% for wind/hail) in cash today?

Auto & Umbrella Audit

- Bodily Injury Liability: Is it at least 100/300?

- Property Damage: Is it at least $100,000?

- Uninsured/Underinsured Motorist: Do these limits match your liability limits? (Don’t insure a stranger better than you insure yourself).

- Umbrella Policy: Do you have one? If your net worth exceeds your auto liability limits, you are exposed.

Conclusion: Trust, But Verify

Insurance is one of the most important tools for a resilient society, a sentiment echoed by Maiclaire Bolton Smith, Vice President at CoreLogic. However, it is not a “set it and forget it” product. The economic landscape of 2025—defined by higher labor costs, social inflation, and climate risks—demands active management.

If you discovered a gap while reading this article, don’t panic, but do act. Insurance agents are currently navigating a hard market where premiums are rising. According to Breanne Armstrong at J.D. Power, insurers are still losing money on premiums, which means they are tightening guidelines. Locking in better coverage sooner rather than later is to your advantage.

Your Next Step: Call your agent. Ask them specifically: “If I have a total loss today, will my current limits cover the 2025 reconstruction costs including code upgrades?” Their answer will tell you everything you need to know.

Frequently Asked Questions

What is the 80% rule in home insurance?

The 80% rule states that an insurer will only fully cover the cost of damage to a house if the owner has purchased insurance coverage equal to at least 80% of the house’s total replacement value. If you are insured for less than 80%, the insurer may only pay a portion of the repair costs, effectively penalizing you for being underinsured.

Do I need umbrella insurance if I am not rich?

Yes. You do not need to be wealthy to be sued. If you cause a serious accident, the court can garnish your future wages for years. An umbrella policy protects your future income and current assets. With “nuclear verdicts” rising 52% in 2024, umbrella insurance is essential protection for the middle class.

How often should I review my insurance policy?

You should review your insurance policy annually. However, you should also conduct an immediate review after major life events (marriage, divorce, birth of a child), major purchases (renovations, jewelry), or significant economic shifts like the high inflation periods seen in 2024-2025.