Insider Tips for a Smoother Insurance Payout

Speed Up Your Claim: Insider Tips for a Smoother Insurance Payout (2025 Guide)

We need to talk about the waiting game. You file a claim, you assume the check is in the mail, and then… silence.

If you feel like insurance payouts are getting slower, you aren’t imagining it. According to the J.D. Power 2024 U.S. Auto & Property Claims Satisfaction Studies, the average repair cycle time for auto claims has crept up to 22.3 days. For catastrophic property claims, you’re looking at an agonizing average of 34.2 days.

That is nearly a week longer than we saw just a few years ago. In my years working alongside public adjusters and reviewing policy protocols, I’ve learned that the “file and wait” approach is the fastest way to financial stress. The system is designed for volume, not speed. To break through the bottleneck, you have to stop acting like a passive policyholder and start acting like a project manager.

This isn’t just about calling customer service and complaining. This is the insider playbook—using the same tactics public adjusters use—to cut your processing time by 30-50%. We’re going to cover how to weaponize digital evidence, the “Proof of Loss” trap that stalls 65% of claims, and the legal “nudge” letters that force adjusters to prioritize your file.

The “Digital First” Advantage: Why Analog Claims Fail

Let’s look at the data. The gap between digital and analog claims is massive. According to the J.D. Power 2024 U.S. Claims Digital Experience Study, digital claims settle in approximately 15 days, compared to nearly 28 days for traditional methods.

But here is the nuance most people miss: it’s not just about using the app; it’s about how you feed the algorithm.

The 15-Day Difference

Insurers are heavily investing in AI to triage claims. If you submit a claim via a phone call, a human has to transcribe it, assign it, and review it. If you submit via a portal with the right metadata, AI can often “fast-track” the approval for payout. Breanne Armstrong, Director of Insurance Intelligence at J.D. Power, noted in a recent press release that digital channels have now surpassed phone-based communication in customer satisfaction.

Acceptable Digital Evidence (The “Gold Standard”)

Don’t just send grainy JPEGs. Adjusters are looking for data they can plug into their estimating software (usually Xactimate). Here is what works in 2025:

- For Home Claims: Use 3D scanning apps or Matterport if possible. A simple walkthrough video is good, but a 3D scan allows the desk adjuster to measure walls without visiting.

- For Auto Claims: Timestamped 4K video. Walk around the car slowly. Zoom in on the VIN plate, the mileage, and the damage continuity (showing the damage is part of one event).

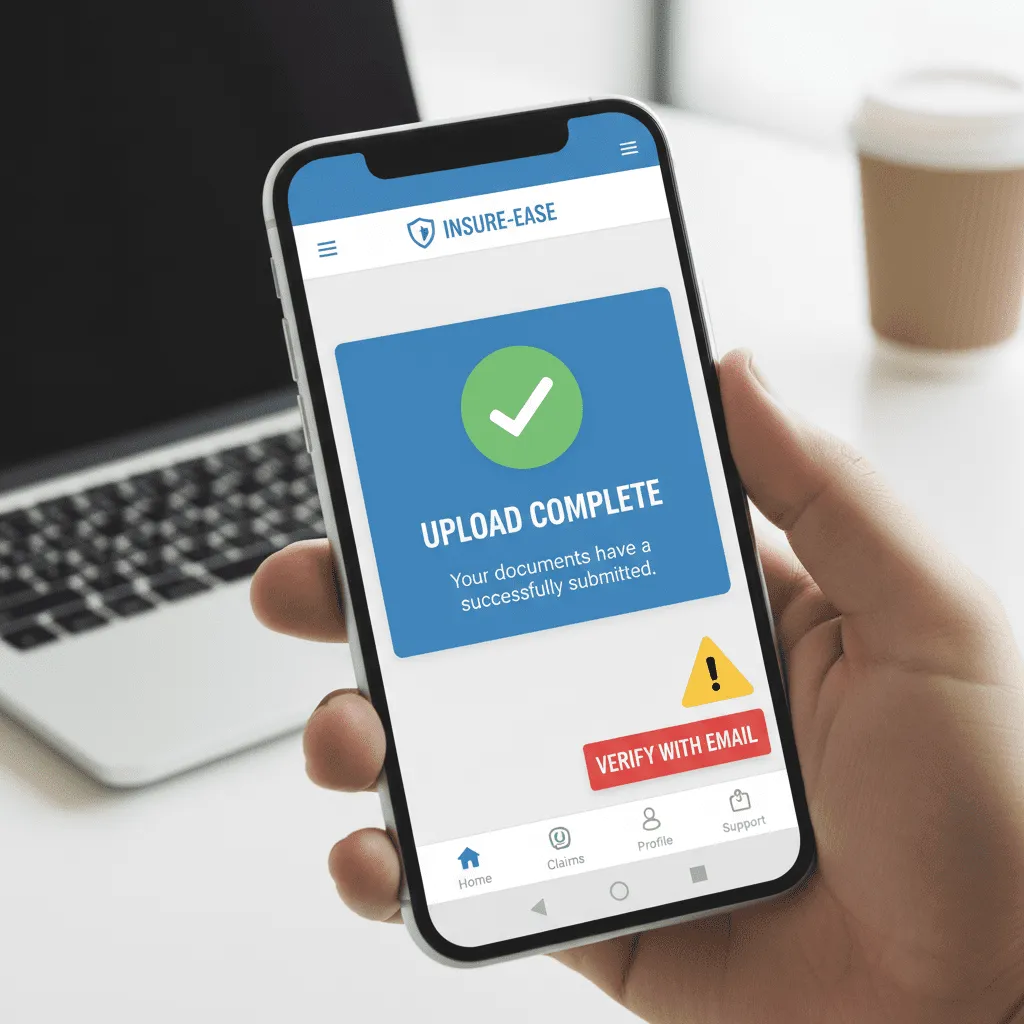

The “Portal Trap”

I’ve seen this happen a hundred times. You upload a document to the insurer’s app. The app says “Received.” You think you’re done.

You are not done.

Automated portals are notorious for “black holing” documents that don’t fit specific file size or format criteria. While 2024 analysis from KFF/AJMC shows that 16% of healthcare denials are due to automated triggers like “missing info,” property claims suffer the same fate.

Insider Tip: Always double-tap. Upload to the portal, but immediately follow up with an email to your specific desk adjuster attached with a cloud link (Google Drive/Dropbox). Say this: “Uploaded to portal, but sending backup copy here to ensure file resolution isn’t compressed.”

The “Proof of Loss” Pivot: The Document That Starts the Clock

If you take nothing else from this article, remember this: Your insurance company does not have to pay you until you submit a sworn “Proof of Loss.”

Many people confuse the “Notice of Loss” (the first phone call you make) with the “Proof of Loss” (a legal document detailing the value). The clock for statutory deadlines—the laws that force them to pay interest if they are late—usually triggers from the Proof of Loss, not the first call.

State-Specific Deadlines

Knowing your state statutes is your biggest leverage. Insurers know these laws cold; they are betting you don’t. Here is a breakdown of prompt payment laws based on 2024-2025 statutes:

| State | Statute / Rule | The “Clock” |

|---|---|---|

| Texas | Texas Insurance Code Ch. 542 | Insurer must accept/reject within 15 business days of receiving all info. If they delay, they owe 18% interest/year. |

| Florida | Florida Statute 627.70131 | Insurers have strict timelines (generally 90 days) to make a claim decision or pay undisputed amounts. |

| California | CA Code of Regulations | Insurers must accept/deny within 40 days of receiving proof of claim. |

Note: These laws are subject to change and specific policy types. Always verify with your state’s Department of Insurance.

The “Incomplete Defense”

According to NAIC 2024 Insurance Complaint Data, claim handling delays account for 65.2% of all complaints. A common tactic adjusters use to reset the clock is the “incomplete information” request.

Day 29 arrives. They ask for one more utility bill. The 30-day clock resets. To stop this, submit a “Complete Package” cover letter listing every single attachment and stating: “This constitutes my full and final Proof of Loss.”

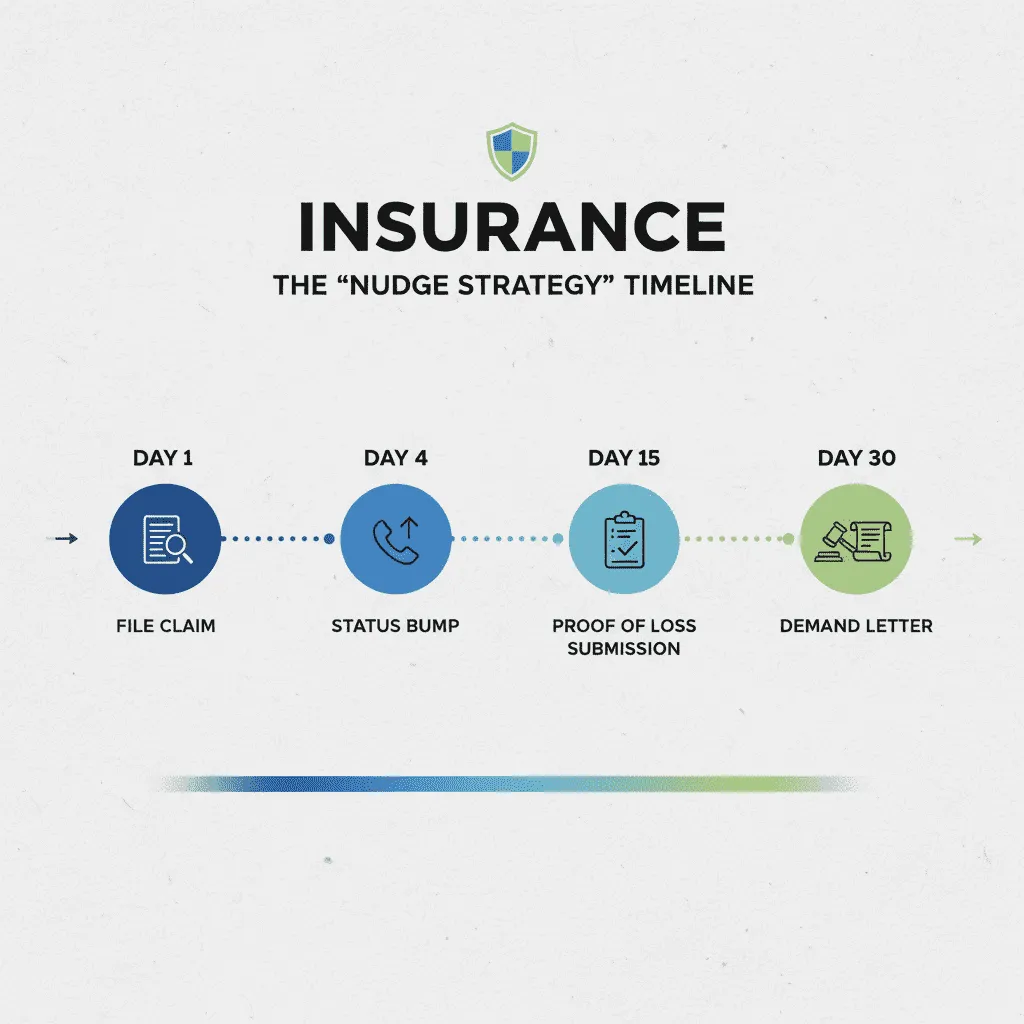

Insider Communication Tactics (The “Nudge” Strategy)

Mark Garrett, Director of Claims Intelligence at J.D. Power, said it best in a 2024 Claims Journal interview: “It turns out that two weeks after filing a claim maybe OK, but at around three weeks out, customers start getting unhappy. That’s where we see the break point.”

You need to manage the adjuster before you hit that three-week break point. Here is my “Nudge Strategy.”

The 72-Hour Rule

Adjusters are overwhelmed. They often handle 100+ files at once. If your file is quiet, it goes to the bottom of the stack. Never let an email sit for more than 3 business days. On the morning of the 4th day, send a “Status Bump.” Keep it polite but firm.

The “Reserve Rights” Rebuttal

You might receive a scary letter called a “Reservation of Rights.” This says the insurer is investigating but hasn’t confirmed coverage yet. Do not panic. This is standard procedure to protect them from bad faith lawsuits later. However, you should respond immediately asking for the specific policy language they are questioning. Force them to be specific, not vague.

Sample “Unreasonable Delay” Demand Letter

If you are past the 30-day mark with no answers, it’s time to stop asking and start demanding. Use this template. It references the “Unfair Claims Settlement Practices Act,” which exists in most states.

Dear [Adjuster Name],

It has been [Number] days since I submitted my sworn Proof of Loss regarding the above-referenced claim. To date, I have not received a coverage decision or payment.

According to [Your State’s] Unfair Claims Settlement Practices Act, insurers are required to acknowledge and act reasonably promptly upon communications with respect to claims. The average industry cycle time for this type of loss is currently 22 days (per J.D. Power 2024 benchmarks). We are now significantly past that timeframe.

Please consider this letter a formal request for a status update. If I do not receive a written update regarding the specific reason for this delay within 3 business days, I will be forced to file a formal complaint with the [State Name] Department of Insurance.

Regards,

[Your Name]

When to Call for Backup: Public Adjusters & Appraisers

Sometimes, despite your best efforts, the insurer lowballs you or ghosts you. This is where you have to make a business decision.

Public Adjuster ROI

A Public Adjuster (PA) works for you, not the insurance company. They take a percentage of the settlement (usually 10-20%). Is it worth it? Industry consensus among recovery experts suggests that for complex losses over $50,000, PAs can often uncover coverage you didn’t know you had, potentially increasing the payout enough to cover their fee and then some.

However, hiring a PA can sometimes slow the process initially because the insurer now has to deal with a professional adversary. Use this option for value disputes, not just speed.

The “Appraisal Clause” Shortcut

This is the best-kept secret in property insurance. If you and the insurer agree there is damage but disagree on the price, you can invoke the “Appraisal Clause” found in most policies.

Unlike mediation (which is non-binding), appraisal is binding. You hire an appraiser, they hire one, and the two pick an umpire. It bypasses the court system and the adjuster’s ego. I’ve seen appraisals resolve year-long disputes in 45 days.

FAQ: Navigating the Red Tape

Can I speed up a claim by accepting a partial payment?

Yes, and you should. Ask for an “undisputed payment.” This gets cash in your hand for immediate repairs while you continue to fight for the rest. Just ensure the check does not say “Full and Final Settlement” on the memo line or the attached letter. If it does, do not cash it.

What triggers an insurance bad faith lawsuit?

Bad faith occurs when an insurer unreasonably denies or delays a claim without cause. Warning signs include refusing to communicate, changing adjusters constantly to delay the process, or misrepresenting policy language. If you suspect this, document everything. Documentation is the kryptonite of bad faith.

Does hiring a public adjuster speed up claims?

Not always. In fact, it can initially slow things down as the insurer reassesses their defense. However, for large, complex claims, a PA ensures the claim is done right, preventing the back-and-forth of supplemental claims that can drag on for years.

Conclusion: The “Active Claimant” Mindset

The insurance machine is designed to move at its own pace, but you don’t have to be a cog in that wheel. The data from 2024 is clear: digital claims are faster, but only if the data is perfect. Statutory deadlines are powerful, but only if you trigger them with a Proof of Loss.

Don’t wait for them to call you. Use the 72-hour rule. Send the demand letter. Quote the statutes. When you shift from a passive victim to an active project manager, you change the dynamic. You aren’t just another file number; you’re the file they need to close today to avoid a headache.

Get your documentation organized, stay professional, and keep pushing. Your payout is waiting.