Life, Health, Auto: Which Insurance Policy is Right for *Your* Life Stage?

Life, Health, Auto: Which Insurance Policy is Right for Your Life Stage? (2025 Guide)

Is your insurance portfolio stuck in the past? In 2024, the average family health premium hit $25,572, and car insurance rates jumped 11%. If you aren’t actively adjusting your coverage to match your age, you are almost certainly overpaying for the wrong protection.

I’ve analyzed insurance portfolios for years, and the biggest mistake I see isn’t people refusing to buy insurance—it’s buying insurance for the wrong person. They protect themselves at 40 like they did at 25. But here is the reality: Insurance isn’t a “set it and forget it” product. It must evolve from a safety net in your 20s, to a financial fortress in your 40s, and finally to a legacy tool in your 60s.

Using the latest data from late 2024 and 2025, including reports from J.D. Power, KFF, and LIMRA, this guide breaks down exactly which policies you need—and which you can skip—decade by decade.

The Matrix Approach: Why Silos Fail

Most people treat their policies as separate bills. You pay your car insurance to one company and your health insurance to another, rarely thinking about how they interact. This is the “silo” trap.

The “Matrix Approach” recognizes that your risks overlap. For example, buying a safer “family car” in your 30s doesn’t just transport your kids; it lowers your auto premiums, freeing up the exact cash flow needed to buy the term life insurance policy you’ve been putting off.

$25,572

The average annual premium for employer-sponsored family health coverage in 2024.

Source: KFF 2024 Employer Health Benefits Survey

Phase 1: The Launch (Ages 18–25)

Primary Goal: Asset Protection & Liability Management.

Ah, the early years. You likely have few assets, but your liability risk is sky-high. In this stage, cash flow is tight, and one wrong move behind the wheel can wreck your financial future before it starts.

1. Auto Insurance: The Budget Killer

If you are in this demographic, you are painfully aware that car insurance is your enemy. According to Forbes Advisor’s 2025 data, the average cost of car insurance is $6,192 a year for an 18-year-old driver. Compare that to a 60-year-old who pays roughly $1,871, and you see the disparity.

The Strategy: Telematics.

With rates rising 11.2% in the last year alone according to J.D. Power’s 2024 Auto Study, the only reliable way to lower this cost is by proving you aren’t a statistic. Usage-Based Insurance (UBI) or “telematics” tracks your driving. If you drive safely, you can slash premiums by 30-40%. At this age, trading privacy for affordability is often a necessary calculation.

2. Health Insurance: The Safety Net

You are young and healthy, but you are not invincible. Under current law, you can stay on your parents’ plan until age 26. Do this if you can. If you are independent, avoid the temptation to go uninsured.

Look for a “Catastrophic” health plan if you are under 30. These have low premiums but very high deductibles. They won’t pay for your flu shot, but they will stop a broken leg from bankrupting you.

3. Life Insurance: Do You Need It?

Probably not. If you are single with no dependents and no co-signed debt (like student loans your parents signed for), you likely don’t need life insurance yet. Save that premium money for an emergency fund.

Case Study: The “Launch” Phase

Age 23

Situation: Entry-level job, renting an apartment, driving a 10-year-old Honda.

The Fix:

- Auto: Liability only (drop collision on the old car) + Renters Insurance (bundled).

- Health: Silver Plan with high deductible to lower monthly costs ($477/mo avg).

- Life: Skip it. Focus on debt repayment.

Phase 2: The Build (Ages 26–40)

Primary Goal: Income Replacement & Family Security.

This is the “squeeze” phase. You might be buying a home, getting married, or having children. Suddenly, your death or disability would be a financial catastrophe for others.

1. Life Insurance: The Critical Gap

This is the most under-insured demographic. According to the LIMRA 2024 Insurance Barometer, 102 million adults say they need (or need more) life insurance. Yet, confusion stops them.

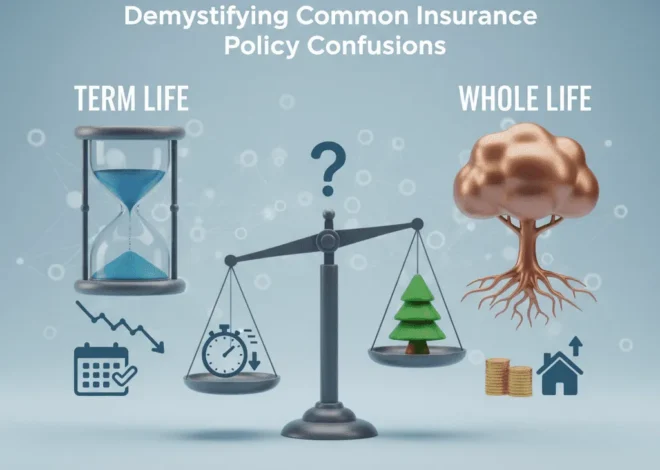

The Move: Term Life.

Forget Whole Life for now—it’s expensive and often unnecessary for young families on a budget. You need coverage, and lots of it. A healthy 30-year-old can often secure $500,000 of term coverage for under $25/month. Lock this in before you develop high blood pressure or other health issues. The rule of thumb: 10-12x your annual income.

2. Health Insurance: The Family Shock

When you add a spouse and kids, premiums explode. As noted by KFF, the average family premium is over $25,000. Even if your employer pays a large chunk, workers contribute an average of $6,296 annually.

Pro Tip: If your employer offers a High-Deductible Health Plan (HDHP) with a Health Savings Account (HSA), take a serious look at it. The HSA offers triple tax advantages that can act as a secondary retirement vehicle.

3. Auto & Home: The Bundle is King

Now that you own a home and perhaps multiple cars, bundling is non-negotiable. However, don’t just bundle for the discount; look at the liability limits. The state minimums (often 25/50/25) are insufficient for a homeowner. One lawsuit could force a sale of your home. Bump your auto liability to at least $100k/$300k.

“Employers are shelling out the equivalent of buying an economy car for every worker every year to pay for family coverage.”

Phase 3: The Peak Earning Phase (Ages 41–55)

Primary Goal: Wealth Preservation & Risk Management.

You are likely earning the most money of your career right now. You have assets to protect: a home with equity, retirement accounts, and cars. This makes you a target for lawsuits.

1. The Umbrella Policy

If you take one thing from this article, let it be this: Get an Umbrella Policy.

Once your net worth exceeds your auto/home liability limits (usually $500,000), you are exposed. An umbrella policy sits on top of your existing insurance and provides an extra $1 million to $5 million in liability coverage. It is surprisingly cheap—often $200 to $400 a year for a $1 million policy. It protects your future earnings from being garnished in a major lawsuit.

2. Disability Insurance: The Forgotten Asset

What is your biggest asset? It’s not your house. It’s your ability to earn an income for the next 15 years. If you become disabled and can’t work, your financial plan crumbles. Check your employer’s Long-Term Disability (LTD) coverage. If it covers less than 60% of your income, you need a supplemental private policy.

3. Re-evaluating Life Insurance

As you approach 50, your term policy might be expiring. Do you renew? According to Swiss Re Institute’s November 2024 report, the demand for savings-focused insurance products is rising due to higher interest rates. This might be the time to look at permanent insurance or annuities, but only if your retirement savings are maxed out.

Phase 4: The Legacy Phase (Ages 55+)

Primary Goal: Cost Management & Legacy Transfer.

1. Auto Insurance: The “U-Turn”

Auto insurance rates follow a U-shape curve. They are high when you are 18, bottom out in your 50s, and start creeping up again around age 70 due to slower reaction times and increased accident severity for seniors.

If you are retired and driving less, call your insurer. Ask about “low-mileage discounts.” If you drive fewer than 7,500 miles a year, you are subsidizing high-mileage drivers if you don’t speak up.

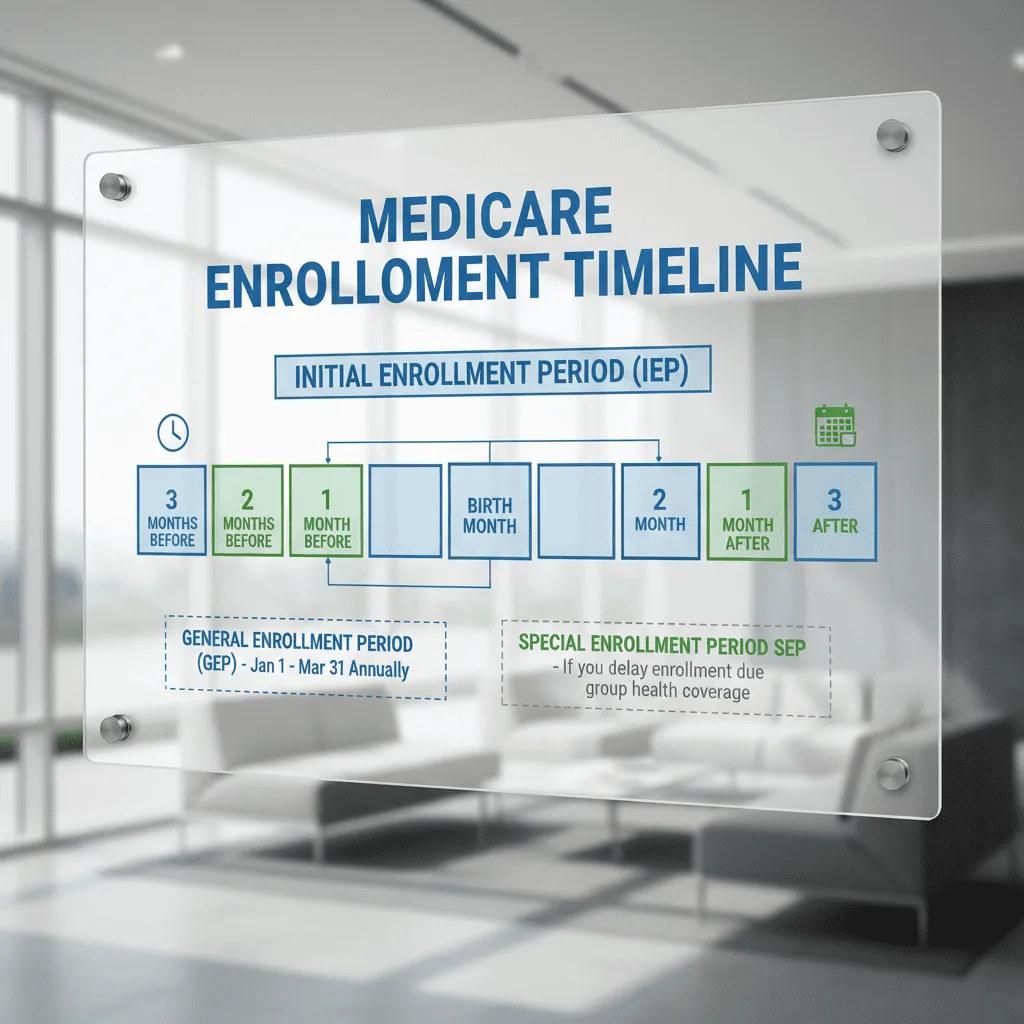

2. Health: The Medicare Bridge

If you retire before 65, you face a dangerous gap before Medicare kicks in. COBRA is expensive, and private market plans can be astronomical for 60-year-olds. Planning for this “gap cost” is a crucial part of retirement planning.

2025 Trend Alert: The Trust Factor

In 2025, price isn’t the only metric that matters. Trust is eroding.

J.D. Power’s 2024 Auto Study revealed a startling statistic: 51% of customers say they have little trust in their auto insurer. This is driven by rising rates and poor claims experiences.

Why this matters to you: A cheap policy is worthless if the carrier fights you on every claim. When shopping, don’t just look at the premium. Look at the “Claims Satisfaction Score.” Companies like Amica, Erie, and NJM often score higher on trust than the big national advertisers. In your later years, paying an extra $20 a month for a carrier that actually pays out is a wise investment.

Expert Insight

Breanne Armstrong, Director of Insurance Intelligence at J.D. Power, notes: “Insurers are in a tough position right now. With repair costs still rising… insurers are still losing money, despite passing along huge price increases.”

Translation: Don’t expect rates to drop soon. Your best defense is a clean record and smart bundling.

Frequently Asked Questions

At what age does car insurance typically go down?

Is life insurance worth it in your 20s?

How much life insurance do I need for a family of 4?

Can I drop collision coverage on my older car?

Conclusion: The Birthday Audit

Insurance is complex, but ignoring it is dangerous. The market in 2025 is characterized by high costs and low trust, making your choices more critical than ever.

My final advice is simple: Perform an “Insurance Audit” every birthday. Ask yourself three questions:

- Has my net worth increased enough to require an Umbrella policy?

- Have my family circumstances (marriage, kids, divorce) changed my life insurance needs?

- Is my car insurance rate reflecting my current age and driving habits?

Don’t let a policy written for your 25-year-old self dictate your protection at 40. Your life has evolved. Your insurance should too.