Planning for the Unexpected: Building Your Personal Risk Management Shield

Planning for the Unexpected: Building Your Personal Risk Management Shield (2025 Guide)

We are living in an era of “Polycrisis.” It’s a term economists use when multiple global systems fail simultaneously, but for you and me, it feels much more personal. It’s the anxiety of reading about a data breach exposing your social security number while watching your home insurance premiums double due to climate risks.

In the past, personal risk management was simple: buy auto insurance, save for a rainy day, and write a will. But in 2025, that playbook is dangerously outdated. The threats we face—from AI-driven identity theft to extreme inflation—require a strategy that is as dynamic as the risks themselves.

I’ve spent years analyzing financial resilience, and if there is one thing I’ve learned, it’s that “hoping for the best” is not a plan. Real security comes from building a Personal Risk Management Plan—a strategic shield that goes beyond basic insurance to protect your wealth, your digital identity, and your legacy.

In this guide, we aren’t just talking about emergency funds. We are building a comprehensive, four-pillar fortress to weather the unexpected.

Why “Emergency Funds” Are No Longer Enough

Let’s start with the hard truth: most people are financially fragile. We often confuse “solvency” (having assets) with “liquidity” (having cash when you need it). You might have a million dollars in home equity, but if you get hit with a lawsuit or a medical emergency, you can’t pay the bills with your front porch.

If your risk management plan stops at “I have $1,000 in savings,” you are exposed. We need to move from basic savings to a Financial Resilience Strategy.

Pillar 1: The Financial Fortress (Asset Protection)

Your financial pillar acts as the foundation. If this cracks, the rest of the structure collapses. In my experience working with clients, this is where the biggest gaps usually lie—not because they don’t have money, but because they haven’t structured it to absorb shock.

The Liquidity Tier: Redefining the Emergency Fund

The old rule of “3 to 6 months of expenses” is a great starting point, but in a volatile labor market, it might be insufficient. If you work in a high-risk industry (like tech or real estate), I recommend extending that liquidity runway to 9 to 12 months. This money shouldn’t just sit in a checking account losing value to inflation; utilizing high-yield savings accounts ensures your shield keeps pace with purchasing power.

The Liability Shield: Umbrella Insurance

Here is a question I ask everyone: “If you were sued today for $2 million because your teenager caused a multi-car accident, would you go bankrupt?”

Most standard auto or home policies cap liability at $300,000 or $500,000. In a litigious society, that is often not enough. An Umbrella Insurance policy provides an extra layer of liability protection—often $1 million to $5 million in coverage—for a few hundred dollars a year. It is arguably the most cost-effective risk transfer tool available, yet it is frequently overlooked.

The Income Engine: Disability Insurance

We insure our cars and homes, but we often fail to insure the machine that pays for them: our ability to earn an income. The gap here is startling.

— John Carroll, Senior VP at LIMRA

If you rely on your salary, disability income insurance is not optional; it is critical infrastructure.

Pillar 2: The Digital Defense (Cyber & Identity)

Five years ago, cyber risk was something corporations worried about. Today, it is a personal crisis waiting to happen. The sheer volume of data we generate makes us targets, and the statistics from this year are genuinely alarming.

The “Mega-Breach” Era

We are witnessing a massive surge in data compromises. It’s not just about losing a password; it’s about the systematic harvesting of your digital identity.

This surge requires a change in behavior. You cannot rely on companies to protect your data. You must assume your data is already out there.

Locking the Digital Door

Cyber hygiene for individuals is the new “locking your front door.” According to the Allianz Risk Barometer 2024, cyber incidents rank as the top global risk (36%) for the third consecutive year. This isn’t just a corporate issue; it flows down to individuals through sophisticated phishing and ransomware.

— Michael Bruch, Global Head of Risk Advisory Services at Allianz Commercial

To build your digital shield, implement these immediate steps:

- Credit Freeze: Freeze your credit with all three bureaus (Equifax, Experian, TransUnion). It is the single most effective way to prevent financial identity theft.

- MFA Everywhere: Enable Multi-Factor Authentication on every account. SMS is okay, but an authenticator app (like Authy or Google Authenticator) is much safer.

- Digital Estate Planning: What happens to your cryptocurrency, cloud photos, and email accounts if you pass away? Create a “Digital Will” providing access instructions to a trusted executor.

Pillar 3: The Physical & Natural Shield

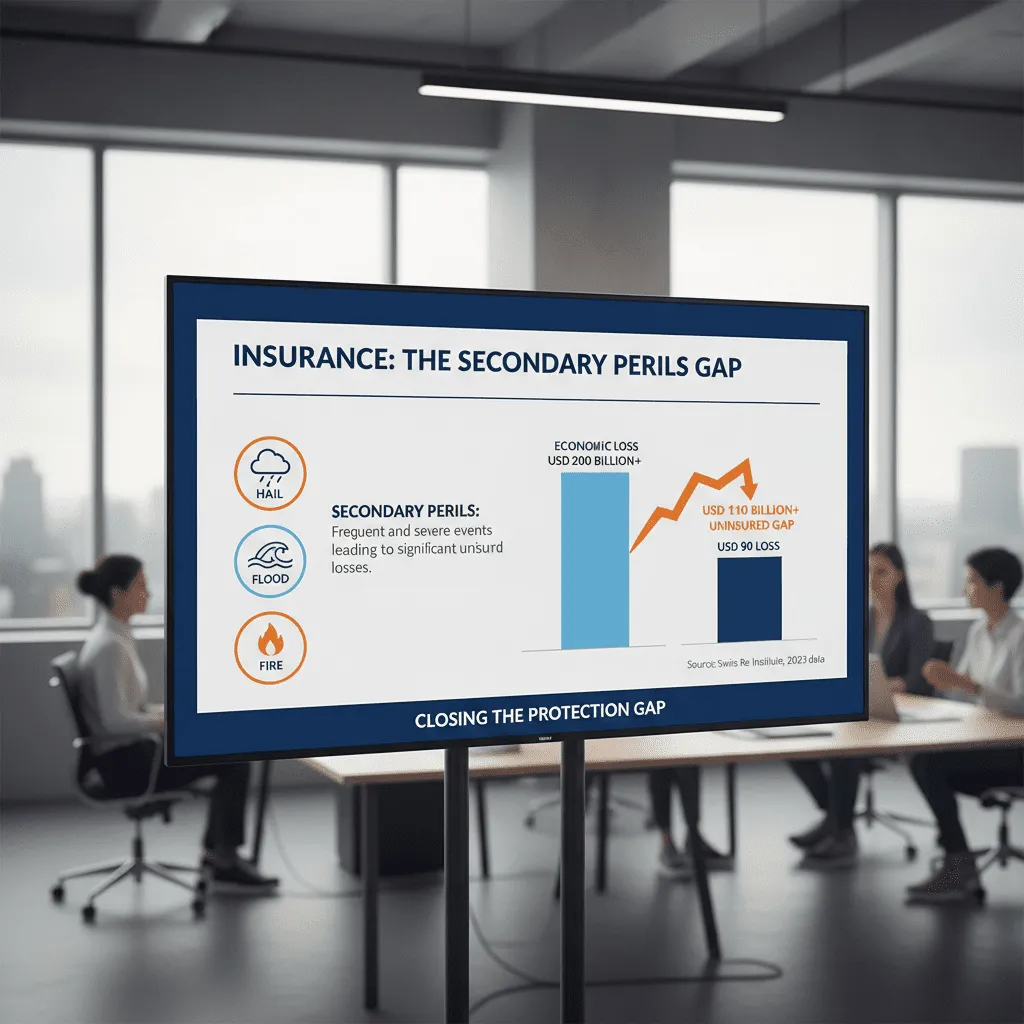

When we talk about risk, we can’t ignore the physical world. Climate change has altered the insurance landscape fundamentally. We are seeing a rise in what insurers call “secondary perils”—thunderstorms, hail, and floods—that are causing massive losses often excluded from standard policies.

— Jerome Haegeli, Group Chief Economist at Swiss Re

The Uninsured Gap

Many homeowners are shocked to learn that their expensive policy doesn’t cover flood damage or earth movement. If you live anywhere near water—or even if you don’t, given recent flash flood patterns—you need to review your exclusions. Relying on FEMA aid is a poor strategy; it is meant to keep you alive, not restore your lifestyle.

Actionable Step: Conduct a “peril audit.” specifically ask your broker: “What is excluded from this policy?” If flood or backup of sewer and drain is missing, buy the rider.

Pillar 4: The Legal & Legacy Lock

The final pillar is the one most people avoid because it forces us to confront mortality. However, a personal risk management plan is incomplete without addressing incapacity and death.

The Incapacitation Risk

Risk isn’t just about dying; it’s about being alive but unable to make decisions. Without a Durable Power of Attorney (financial) and a Medical Power of Attorney, your family may have to go to court to pay your mortgage or make medical decisions for you. This is a preventable legal nightmare.

Trust vs. Will

While a Will is essential, a Revocable Living Trust can be a superior risk management tool. A Trust allows your assets to pass to your heirs without the public, expensive, and time-consuming process of probate. It also provides privacy—Wills become public record; Trusts generally do not.

Conducting Your Annual “Risk Audit”

A risk plan isn’t a “set it and forget it” document. Life changes. You get married, you have kids, you buy a house, or you inherit money. I recommend an annual “Risk Audit” every January.

Interactive Risk Vulnerability Estimator

Use this simple tool to see where your current gaps might be.

Personal Risk Shield Scorecard

Check the boxes that apply to you to estimate your preparedness level.

If your score was lower than you hoped, don’t panic. Use it as a roadmap. Tackle one item per month. Start with the “Digital Door” (freezing credit costs nothing) and move toward the financial products.

Frequently Asked Questions

What is the difference between risk avoidance and risk reduction?

Great question. Risk Avoidance means eliminating the activity entirely (e.g., selling your car to avoid auto accidents). Risk Reduction means taking steps to minimize the likelihood or impact of the risk (e.g., driving a car with advanced safety features and carrying good insurance). A personal risk management plan focuses mostly on reduction and transfer.

How does inflation affect my risk management plan?

Inflation erodes the purchasing power of your coverage. If you bought a $500,000 life insurance policy ten years ago, that payout buys significantly less today. You need to review your coverage limits annually to ensure they keep pace with the rising cost of living and reconstruction costs for your home.

Is identity theft protection worth it in 2025?

While monitoring services are helpful, they are reactive—they tell you after a breach. According to the Federal Reserve’s 2025 report, 21% of adults experienced financial fraud in 2024. The best “protection” is proactive: freezing your credit and using strong cybersecurity hygiene. Paying for insurance that covers legal fees to restore your identity can be worth it, but avoid paying for simple monitoring you can do yourself.

Conclusion: From Paranoia to Preparedness

Building a personal risk management plan isn’t about living in fear. It’s actually the opposite. It’s about creating a perimeter of safety that allows you to live more freely.

When you know that a lawsuit won’t bankrupt you, that a hospital stay won’t stop your income, and that a cyber-attack won’t steal your identity, you have the mental bandwidth to focus on what matters: growing your career, enjoying your family, and building your legacy.

The data from the Federal Reserve, Swiss Re, and Allianz all point to a more volatile future. The “Polycrisis” is real. But by implementing the 4-Pillar Shield Framework we discussed, you are no longer a passive victim of circumstance. You are prepared.

Take the first step today. Download a password manager, call your insurance broker, or simply check your emergency fund balance. Your future self will thank you.