Smart Steps to Choose Your Initial Insurance Policy

First-Timer’s Guide: Smart Steps to Choose Your Initial Insurance Policy (2025 Edition)

I still remember sitting at my kitchen table, staring at an insurance quote on my laptop screen. It felt like trying to read ancient Greek. “Gap insurance”? “Liability limits”? “Deductibles”? I just wanted to drive my car legally without going broke. I ended up clicking “buy” on the first cheap option I saw.

That was a mistake.

Six months later, a minor fender bender revealed that “cheap” actually meant “barely covered,” costing me thousands out of pocket. I’m not alone in this confusion. Buying your first policy feels like learning a new language where the tuition fees are incredibly high. But making the wrong choice is getting even more expensive.

According to J.D. Power’s 2024 U.S. Auto Insurance Study, auto insurance premiums have risen 36% over the last decade, with a massive 11.2% jump in 2024 alone. If you go in blind, the algorithms will eat your wallet alive.

This isn’t just another generic overview. In my years covering personal finance, I’ve learned that insurance is a game of leverage. This guide is your roadmap to leveling the playing field. We’re going to bypass the jargon, look at the actual data, and walk through the exact steps—from assessing risk to timing your purchase—to ensure you get premium protection without the premium price tag.

Step 1: The “Must-Have” vs. “Nice-to-Have” Checklist

Before you even open a comparison site, you need to understand what you are actually protecting. The biggest trap first-timers fall into is either over-insuring a low-value asset or, more dangerously, under-insuring their financial future.

Assessing Your Real Risk

Ask yourself: If disaster strikes tomorrow, what can I afford to lose? If you are driving a 2005 Honda Civic worth $2,000, paying $1,000 a year for collision coverage doesn’t make mathematical sense. You are essentially pre-paying for the car twice over every few years.

This strategy is known as the “Collision Drop.” Take the case of Jenna Kardal. As reported by CBC News in 2025, Jenna lowered her premium to just $108/month by strategically dropping collision coverage on her older vehicle. The lesson? Don’t insure a depreciating asset as if it were gold.

The “Underinsurance” Trap

However, the pendulum swings the other way, especially with home and renters insurance. Inflation has driven up the cost of everything—from lumber to labor—yet many policies haven’t kept up.

🚨 The Inflation Gap

According to the Matic Mid-Year Premium Trends Report 2024, two-thirds of U.S. homes are underinsured. This means coverage amounts are failing to keep pace with inflation.

If your policy covers $20,000 in personal property, but replacing your clothes, laptop, furniture, and electronics would cost $35,000 at today’s prices, you are exposed. Don’t rely on the state minimums or the default settings on a quote generator. They are often designed to show you a low price, not to actually protect you.

Step 2: Decoding the Fine Print (Glossary for Beginners)

Insurance contracts are deliberately boring. They count on you zoning out. But there are two levers you can pull that dramatically change your price: the Deductible and the Limit.

Deductibles vs. Premiums: The Teeter-Totter

Think of this as a seesaw. When one goes up, the other goes down.

- Premium: The amount you pay every month (or year) just to have the policy.

- Deductible: The amount you must pay out of your own pocket before the insurance company pays a dime.

Many first-timers choose a $250 deductible because it feels safer. “If I crash, I only pay $250!” But that low deductible spikes your monthly premium. If you are a safe driver or a healthy individual, you are likely overpaying for a safety net you rarely use.

Let’s do the math. I’ve built a simple calculator below to help you find your “Sweet Spot.”

⚖️ Deductible Breakeven Calculator

Calculate how long you need to go claim-free to justify a higher deductible.

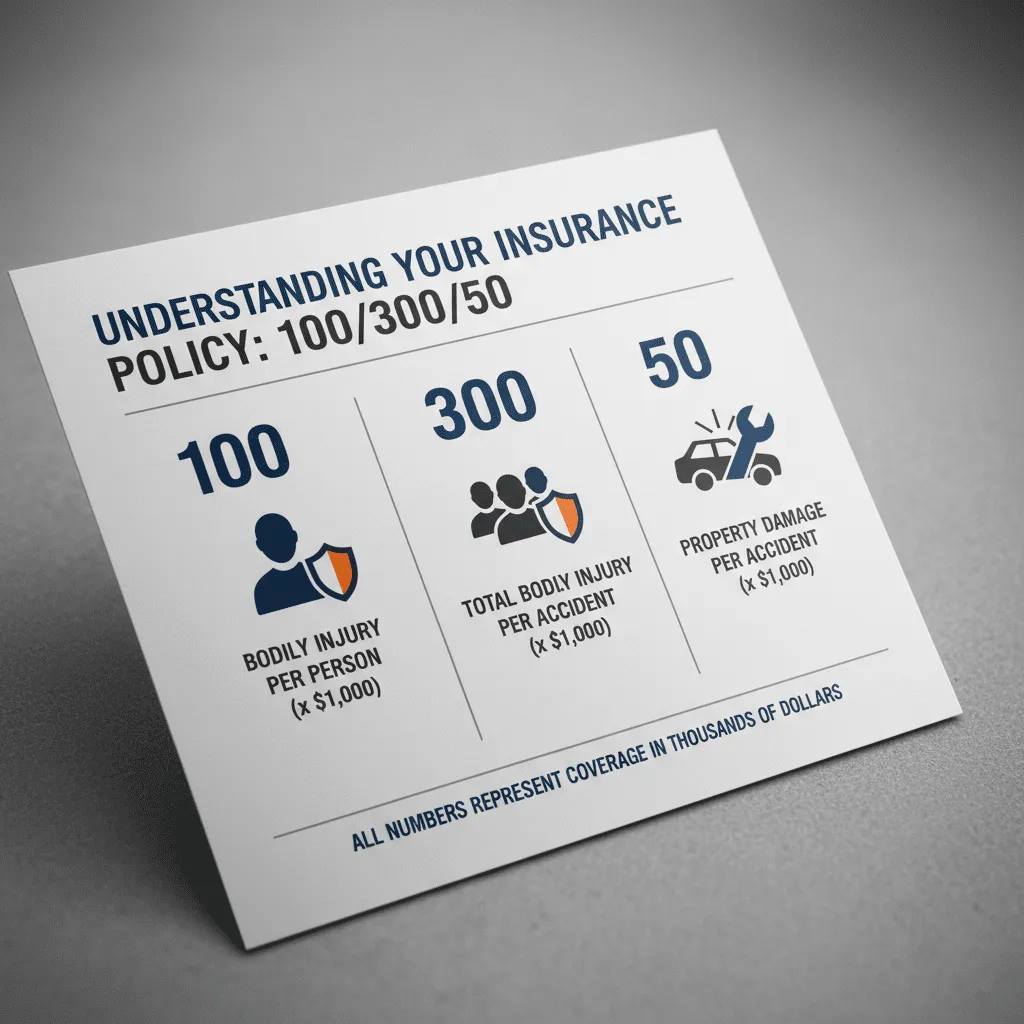

Liability Limits: Decoding “100/300/50”

You’ll see these numbers on auto quotes. They represent thousands of dollars.

- 100 ($100,000): Bodily injury limit per person.

- 300 ($300,000): Bodily injury limit per accident (total).

- 50 ($50,000): Property damage limit.

My advice: Avoid state minimums. If you cause a multi-car pileup and only have $25,000 in property coverage, the rest comes out of your future wages. It’s not worth the risk.

Step 3: Strategic Shopping (How to Beat the Algorithms)

Here is the thing most people don’t realize: Insurance pricing is dynamic. It changes based on when you buy and how you buy.

The “26-Day Rule”

Procrastination is expensive. If you wait until the day your current policy expires (or the day you buy the car) to get insurance, insurers view you as “high risk.” They assume you are disorganized.

According to extensive analysis by MoneySavingExpert in 2024, which looked at millions of quotes, the sweet spot is buying your policy roughly 26 days before it starts. In their data, buying on renewal day cost an average of £2,277, while buying weeks in advance dropped that to £906. While currency varies, the algorithm logic holds true globally: Plan ahead, save big.

The Credit Score Secret

In most U.S. states, your credit score is a major factor in your premium. It’s controversial, but insurers believe that people who manage debt well also manage driving risk well.

According to the TransUnion 2025 Insurance Trends Report, auto insurance shopping increased by 18% in early 2025 as consumers reacted to rate hikes. If your credit score has improved recently, you need to be part of that 18% shopping around. You might be eligible for a much lower rate simply because your FICO score jumped 20 points.

Step 4: Vertical-Specific Tips for First-Timers

Different types of insurance have different “gotchas.” Here is what you need to know for the big three.

Auto: The Telematics Trade-Off

You’ve probably seen ads for “Usage-Based Insurance” (UBI)—plugging a device into your car or using an app to track your driving. Is it worth it?

In my opinion, yes—if you are a safe driver. However, understand why premiums are high in the first place. It’s not just about how you drive; it’s about what you drive.

— Sherif Gemayel, CEO of Trufla Technology (2024)

Modern cars are computers on wheels. A minor bumper tap can damage sensors worth thousands. This is why J.D. Power reports premiums rising despite cleaner driving records. Telematics is one of the few ways to decouple your rate from the general population’s rising repair costs.

Renters: The “Laptop” Gap

Many young adults assume their landlord’s insurance covers the building and the stuff inside it. This is false. The landlord covers the walls; you cover your stuff.

The risks are real. The Triton Agency reports roughly 17,000 campus burglaries occur annually. Yet, the MoneyGeek Renters Insurance Analysis 2024 shows that while 45.5 million households rent, only 37% carry renters insurance. Considering the average cost is just ~$15/month (less than a streaming subscription), skipping this is a financial gamble you don’t need to take.

Health: HMO vs. PPO

Health insurance is arguably the most complex. A Corporate Insight Health Insurance Literacy Study from 2025 found that only 8% of consumers feel their knowledge of health insurance is “very high.”

When choosing, look beyond the premium:

- HMO (Health Maintenance Organization): Cheaper, but you generally must stick to their network and get referrals.

- PPO (Preferred Provider Organization): More expensive, but flexibility to see specialists without referrals.

Dr. Mark Fendrick, Director of Value-Based Insurance Design at the University of Michigan, noted in October 2024 that a “substantial minority of Americans, when given options, still do not pick the health plan that meets their clinical and financial needs.” Don’t just click renew or pick the cheapest. Calculate your total expected yearly cost (Premium + Deductible + Copays).

Step 5: Red Flags Before You Sign

You’ve found a quote, you’ve checked the deductible, and you’re ready to buy. Pause. Check for these two red flags.

1. “Fully Earned” Premiums

Some shady policies contain a clause stating the premium is “fully earned” upon purchase. This means if you cancel the policy after one month, they keep the money for the whole year. Always look for a pro-rated cancellation policy.

2. The Introductory Rate Bait-and-Switch

Just like cable companies, some insurers offer a “new customer discount” that vanishes after 6 months. Ask the agent specifically: “What will my rate be when this discount expires?”

Frequently Asked Questions

❓ Can I buy insurance without a credit score?

Yes. While most major carriers use credit-based insurance scores, some states (like California, Hawaii, and Massachusetts) ban this practice for auto insurance. Additionally, specific “no-credit-check” insurers exist, though they often charge higher premiums to offset the perceived risk.

❓ What is a “Binder” and do I need one?

An insurance binder is a temporary contract that proves you have coverage while the formal policy is being processed. If you are buying a car or closing on a house, the dealer or bank will require this document immediately. It usually lasts 30 days.

❓ Is bundling really cheaper?

Almost always. Combining renters and auto insurance can save you 5% to 15%. However, always check the individual prices first. Sometimes, two separate specialized companies are cheaper than one bundle from a generalist.

❓ Does checking quotes hurt my credit score?

No. Insurance quotes are “soft pulls.” They do not affect your credit score like applying for a credit card or mortgage (which are “hard pulls”) does.

Conclusion: It’s Wealth Protection, Not a Tax

It is easy to view insurance as an annoying tax on adulthood—money disappearing from your account every month with nothing tangible to show for it. But I challenge you to flip your perspective.

Insurance is wealth protection. It ensures that one bad day—a slippery road, a burst pipe, a medical emergency—doesn’t erase years of your hard work. There is a massive gap in coverage across the country right now. LIMRA’s 2024 Insurance Barometer Study shows that 102 million American adults live with a life insurance coverage gap, often because they overestimate the cost.

Don’t be part of that statistic. Use the 26-day rule. Calculate your deductible sweet spot. Read the fine print. As Breanne Armstrong from J.D. Power puts it, high premiums are painful, but they are offset by “high levels of trust that insurers will come through when they are needed.” Make sure you choose a partner, not just a policy.