What’s Your Risk Profile? Identifying Threats to Your Personal & Financial Health

What’s Your True Risk Profile? The 2025 Guide to Auditing Your Financial, Physical & Digital Safety

Ask the average investor about their “risk profile,” and they will almost invariably talk about the stock market. They’ll tell you they have a “high tolerance” because they didn’t sell during the last correction, or they are “conservative” because they hold bonds.

In my experience advising clients on comprehensive wealth management, this definition is dangerously narrow. It’s like checking the locks on your front door while leaving the back window wide open and the oven on.

Here is the reality of 2025: Your stock portfolio is likely not the biggest threat to your financial solvency. A 20% drop in the S&P 500 is painful, but a chronic illness diagnosis, a ransomware attack on your cloud storage, or a lawsuit exceeding your liability coverage can be terminal to your wealth.

This article is not about picking stocks. It is a Personal Risk Profile Assessment—a holistic audit designed to bridge the gap between financial health, physical longevity, and digital security. We will move beyond “risk tolerance” (how you feel) to “risk capacity” (what you can survive), backed by the latest data from the Federal Reserve, the CDC, and IBM Security.

Part 1: The Financial Fortress (Beyond Stocks)

Let’s start by dismantling a common myth in personal finance: the idea that volatility is the only risk. Real risk is the permanent loss of purchasing power or liquidity. To assess your profile, we need to look at three invisible killers: the confusion between tolerance and capacity, the erosion of inflation, and the liquidity trap.

Tolerance vs. Capacity: The Math vs. The Emotion

I often see high-net-worth individuals confuse risk tolerance with risk capacity. Tolerance is psychological—it’s how well you sleep at night when the market dips. Capacity is mathematical—it’s how much loss you can absorb before your financial plan fails.

In 2025, the gap between these two is widening. You might have the stomach for a high-risk crypto investment (tolerance), but if you are retiring in three years and have no pension (low capacity), that investment is objectively dangerous.

The Inflation Threat and Purchasing Power

The silent killer of risk capacity is inflation. It doesn’t look like a crash; it looks like a slow leak in a tire. Even as headline inflation stabilizes, the cumulative effect on purchasing power has left deep scars on the American psyche.

According to the Northwestern Mutual 2024 Planning & Progress Study, only 9% of Americans say their household income is outpacing inflation. More alarmingly, 33% feel financially insecure—the highest measure recorded in the study’s history.

If your assets are sitting in cash “to avoid risk,” you are actually accepting the certainty of a guaranteed loss in purchasing power. Your risk profile must account for the necessity of growth just to stand still.

The “Struggle of the Middle” and Liquidity

Liquidity—access to cash without penalties—is the ultimate risk buffer. Yet, recent data suggests that financial fragility is creeping up the income ladder. It’s not just about how much you have invested; it’s about what you can access in an emergency.

Data from the FINRA Investor Education Foundation’s National Financial Capability Study (Wave 6), released in July 2024, paints a concerning picture. The percentage of U.S. adults with three months of emergency savings dropped to 46% (down from 53% in 2021). Even more striking, 26% of adults now report spending more than their income—an all-time high.

“The ‘struggle of the middle’ signals that rising costs are creating financial strain across a broader segment of the population… specifically those earning $50k to $100k.”

Furthermore, the Federal Reserve’s report on Economic Well-Being of U.S. Households (May 2024) highlighted that 17% of all adults could not pay all their current month’s bills in full. If your personal risk profile doesn’t include a robust liquidity ratio (Cash / Monthly Expenses), you are running a high-risk operation regardless of your asset allocation strategy.

Part 2: The Biological Moat (Health is Wealth)

In my opinion, the greatest failure of modern financial planning is treating health and wealth as separate silos. They are inextricably linked. Your ability to earn an income is your greatest asset, and your body is the machine that generates it. A comprehensive risk profile must include a “Biological Audit.”

The $4.1 Trillion Reality

If you ignore your metabolic health, you are essentially shorting your own future. The economic impact of poor health is staggering. According to the Centers for Disease Control and Prevention (CDC), updated in May 2024, 90% of the nation’s $4.1 trillion in annual health care expenditures are for people with chronic and mental health conditions.

This isn’t just a national statistic; it’s a personal budget line item. A diagnosis of diabetes or heart disease transforms your retirement spending models instantly. You aren’t just losing health; you are losing the compound interest on the money you must now spend on care.

Productivity Loss: The Hidden Tax

It’s not just medical bills; it’s the inability to work at peak performance. Data from the Integrated Benefits Institute (late 2023) indicates that health-related productivity losses cost U.S. employers $530 billion annually. For the self-employed or high-income earners, “presenteeism” (working while sick and ineffective) is a direct threat to income stability.

Longevity Risk: Living Too Long?

Ironically, being too healthy presents its own financial risk: Longevity Risk. This is the risk of outliving your assets. If your biological age is significantly lower than your chronological age (a good thing!), your financial plan needs to account for a retirement that could last 35 or 40 years. Standard withdrawal rates of 4% may fail if you live to 105.

Part 3: The Digital Perimeter (Cyber Safety)

Ten years ago, a robbery meant someone breaking into your house. Today, it means someone breaking into your cloud. If you haven’t audited your digital footprint, your risk profile is incomplete.

The $4.88 Million Breach

We often assume cyber attacks only target massive corporations. However, individuals—especially those with assets—are prime targets. The IBM Security Cost of a Data Breach Report 2024, released in July, reveals that the global average cost of a data breach reached $4.88 million. While this is a corporate figure, the trickle-down effect to individuals is severe.

When your personal data is compromised, the costs include legal fees, credit freezing services, and the sheer time cost of reclaiming your identity. The Allianz Risk Barometer 2024 ranks cyber incidents as the top global risk (36%), surpassing business interruption.

“Cyber is the top risk… Hackers are increasingly targeting IT and physical supply chains, launching mass cyber-attacks, and finding new ways to extort money.”

The “Shadow Data” Problem

This is a term you need to know for 2025: Shadow Data. This refers to unmanaged data stored in unsecure locations—think of that old Dropbox account you haven’t checked since 2018 or the tax returns sitting in your “Sent” email folder.

According to the IBM report, 35% of breaches involved shadow data. This data is the most vulnerable because you’ve forgotten it exists. A personal risk assessment requires you to hunt down these “ghost” accounts and close them.

Identity Theft: The Statistics

The threat is accelerating. The Identity Theft Resource Center (ITRC) 2023 Annual Data Breach Report (published Jan 2024) noted that U.S. data compromises increased by 78% year-over-year. This isn’t a linear growth; it’s exponential.

How to Calculate Your “Total Risk Score”

Now that we’ve identified the threats, let’s conduct a simplified audit. I’ve developed this checklist based on the risk metrics discussed above. Be honest with yourself—no one else is grading this.

The 2025 Risk Audit Checklist

1. Financial Liquidity (Score 0-5)

- 5 points: 6+ months of expenses in High-Yield Savings.

- 3 points: 3 months of expenses.

- 0 points: Less than 3 months or credit card debt.

2. Biological Resilience (Score 0-5)

- 5 points: Annual physical complete, BMI/Metabolic markers in green zone, Critical Illness insurance in place.

- 3 points: Generally healthy but no recent bloodwork.

- 0 points: Managing chronic issues with no long-term care planning.

3. Digital Hygiene (Score 0-5)

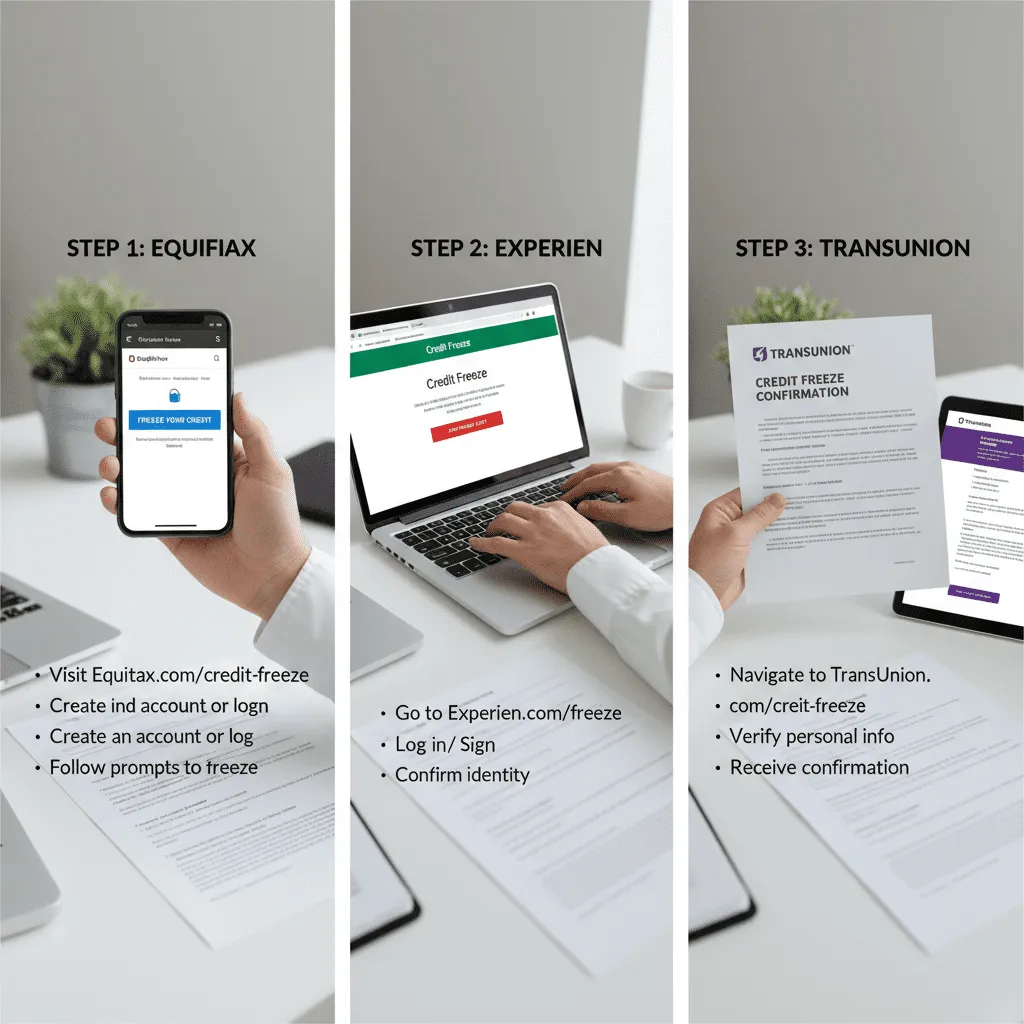

- 5 points: Use a Password Manager, 2FA on all financial accounts, credit frozen at all 3 bureaus.

- 3 points: Strong passwords but reused occasionally.

- 0 points: Use same password for email and banking; no 2FA.

Total Score:

- 12-15: Fortified. You are resilient.

- 8-11: Vulnerable. One bad event could destabilize you.

- 0-7: Critical Risk. Immediate action required.

Strategies to Mitigate Your Profile

If your score wasn’t what you hoped, don’t panic. Risk management is about mitigation, not elimination. Here is how you shore up your defenses.

1. Diversification (Assets & Income)

Diversification isn’t just buying international stocks. It’s about structural diversification. Do you have income streams that are uncorrelated? For example, if you work in Tech and your portfolio is 80% Tech stocks, your risk correlation is 1.0. If the sector crashes, you lose your job and your savings simultaneously. Build income streams (rentals, dividends, side businesses) that survive if your main industry falters.

2. Transferring Risk (Insurance)

You cannot save enough cash to cover a $2 million lawsuit or a $500,000 cancer treatment. You must transfer that risk to an insurance company.

The Checklist:

– Umbrella Policy: Covers liability beyond your home/auto limits. Cheap and essential.

– Disability Insurance (LTD): protects your income if you can’t work.

– Cyber Insurance: High-net-worth policies now include coverage for cyber extortion and identity restoration.

3. Prevention (The “Zero Trust” Model)

Adopt a “Zero Trust” mindset for your digital life. Assume your data is already out there. Freeze your credit at Equifax, Experian, and TransUnion. It’s free and it stops new lines of credit from being opened in your name. Use a hardware key (like YubiKey) for your primary email and financial accounts.

Frequently Asked Questions

What is the difference between risk tolerance and risk capacity?

Risk tolerance is psychological—how much market volatility you can handle without panic-selling. Risk capacity is financial—how much money you can afford to lose without jeopardizing your financial goals. You should always invest based on the lower of the two.

How does health affect my financial risk profile?

Poor health acts as a compound interest penalty. It increases immediate costs (deductibles, medications) and decreases future earnings (productivity loss, early retirement). As cited by the CDC, chronic disease drives the vast majority of healthcare spending, making health maintenance a critical financial strategy.

Is a 60/40 portfolio still safe in 2025?

The traditional 60/40 portfolio (60% stocks, 40% bonds) faced significant challenges in recent years due to stock and bond correlations. While still a solid baseline, modern risk profiles often require broader diversification into real assets, commodities, or inflation-protected securities to combat the erosion of purchasing power.

What is “Shadow Data” and why is it a risk?

Shadow Data refers to data stored outside of managed, secure IT environments. For individuals, this includes old accounts, unencrypted USB drives, or files in personal emails. The 2024 IBM report highlights that 35% of breaches involve this type of data, making it a critical vulnerability to audit.

Conclusion: Solvency vs. Insolvency

Risk isn’t about avoiding danger—it’s about managing it. The world of 2025 is complex, characterized by misinformation (cited by the WEF Global Risks Report 2024 as a top threat) and digital fragility.

By shifting your mindset from “investment returns” to “total life resilience,” you gain control. A true Personal Risk Profile Assessment reveals the cracks in the foundation before the earthquake hits. Whether it is boosting your liquidity, scheduling that overdue physical, or installing a password manager, the best time to mitigate your risk is today.

Don’t just watch the markets. Watch your life.