When (and How) to Re-evaluate Your Insurance Spending

Reviewing Your Policy: When (and How) to Re-evaluate Your Insurance Spending in 2025

Is your insurance policy protecting your life as it exists in 2025, or is it still guarding your wallet from 2019?

It’s a question most of us avoid. Insurance is complex, boring, and frankly, annoying to deal with. But here is the harsh reality I’ve seen unfolding rapidly over the last twelve months: the “set it and forget it” strategy is no longer just lazy—it is financially dangerous.

We are living through a historic disruption in the insurance market. According to the J.D. Power 2024 U.S. Insurance Shopping Study, auto insurance premiums rose by a staggering 22.2% year-over-year. Meanwhile, LIMRA data indicates that 102 million Americans are currently living with a life insurance coverage gap, leaving their families vulnerable.

In this guide, we aren’t just going to talk about how to save a few dollars (though we will cover that). We are going to build a financial defense strategy. We will explore exactly when to review insurance policy limits, how to navigate the threat of non-renewal, and why inflation may have quietly rendered your home insurance insufficient.

The “Big Three” Triggers for an Immediate Review

Traditionally, experts would tell you to review your insurance annually. That’s good advice, but it’s incomplete. In my experience, waiting for an arbitrary calendar date often means you’re reacting too late. Instead, you need to watch for two types of triggers: Internal Life Events and External Market Forces.

1. Life Events (The Usual Suspects)

These are the milestones that change your risk profile. Most people know to call their agent when they buy a house, but the nuance lies in the details:

- Marriage or Divorce: It’s not just about merging policies. You must audit your beneficiaries. I’ve seen too many cases where an ex-spouse received a life insurance payout simply because the policyholder forgot to update a form.

- New Child: This is the primary driver for life insurance. With LIMRA reporting that 42% of Americans say they need more coverage, a new baby is the moment to calculate that “Need-Gap.”

- Retirement: Your liability changes when you stop commuting, potentially lowering auto premiums. Conversely, your umbrella policy needs might increase as your assets peak.

2. Asset Changes

Did you renovate your kitchen this year? If you added $50,000 in value to your home but didn’t increase your dwelling coverage, you are self-insuring that renovation. The same applies to purchasing expensive jewelry or electronics that exceed the standard “special limits” of your homeowners policy.

3. Market Forces (The New Reality)

This is where 2025 differs from the past decade. Even if your life hasn’t changed, the world has. Inflation is the silent killer of coverage.

🚨 Inflation Alert: According to the Bureau of Labor Statistics, the “Motor Vehicle Insurance” CPI index increased 16.5% year-over-year as of August 2024. If your policy limits haven’t moved, your purchasing power in the event of a claim has effectively shrunk.

How to Re-evaluate Your Auto Policy (Actionable Steps)

Auto insurance is where consumers are feeling the most pain right now. With premiums up over 22%, loyalty to your carrier can be expensive. In fact, J.D. Power found that a record 49% of customers actively shopped for a new policy in 2024.

Here is how to attack your auto policy review:

The Deductible Math

One of the fastest ways to lower your premium is raising your deductible. Many people stick with a $250 or $500 deductible out of habit. However, raising that to $1,000 can result in significant annual savings—often around 10% to 15%.

But does the math work for you? Use this simple calculator I designed to check your “Breakeven Period.”

The “Loyalty Penalty”

Insurance companies use complex algorithms to predict how likely you are to switch. If you’ve been with the same carrier for five years, their data might suggest you are price-insensitive, leading to “price optimization”—a fancy term for charging you more. With TransUnion reporting a 19% increase in shopping activity in late 2024, the market is moving. You should too.

— Stephen Crewdson, Managing Director of Insurance Intelligence, J.D. Power

The Homeowners Insurance Crisis: A 2025 Survival Guide

If auto insurance prices are annoying, the state of homeowners insurance is alarming. We are seeing a convergence of climate risk and inflation that requires you to look at your policy immediately.

Replacement Cost vs. Market Value

This is the single biggest point of confusion I see. Your insurance shouldn’t cover what you paid for the house, nor what you can sell it for. It covers what it costs to rebuild it.

According to Consumer Reports, an estimated 67% of U.S. homes are underinsured. Why? Because the cost of lumber, labor, and roofing has skyrocketed. If your policy has a limit of $400,000 (set in 2020), but rebuilding your home in 2025 costs $550,000 due to inflation, you are on the hook for that $150,000 gap.

The “Non-Renewal” Threat

It is no longer guaranteed that your insurer will keep you. A 2024 Congressional Report revealed that insurers have dropped roughly 1.9 million home insurance contracts since 2018 due to climate risks. If you receive a non-renewal notice, do not panic, but act immediately. You may need to look into state-backed FAIR plans or surplus lines insurance.

The Bundling Strategy

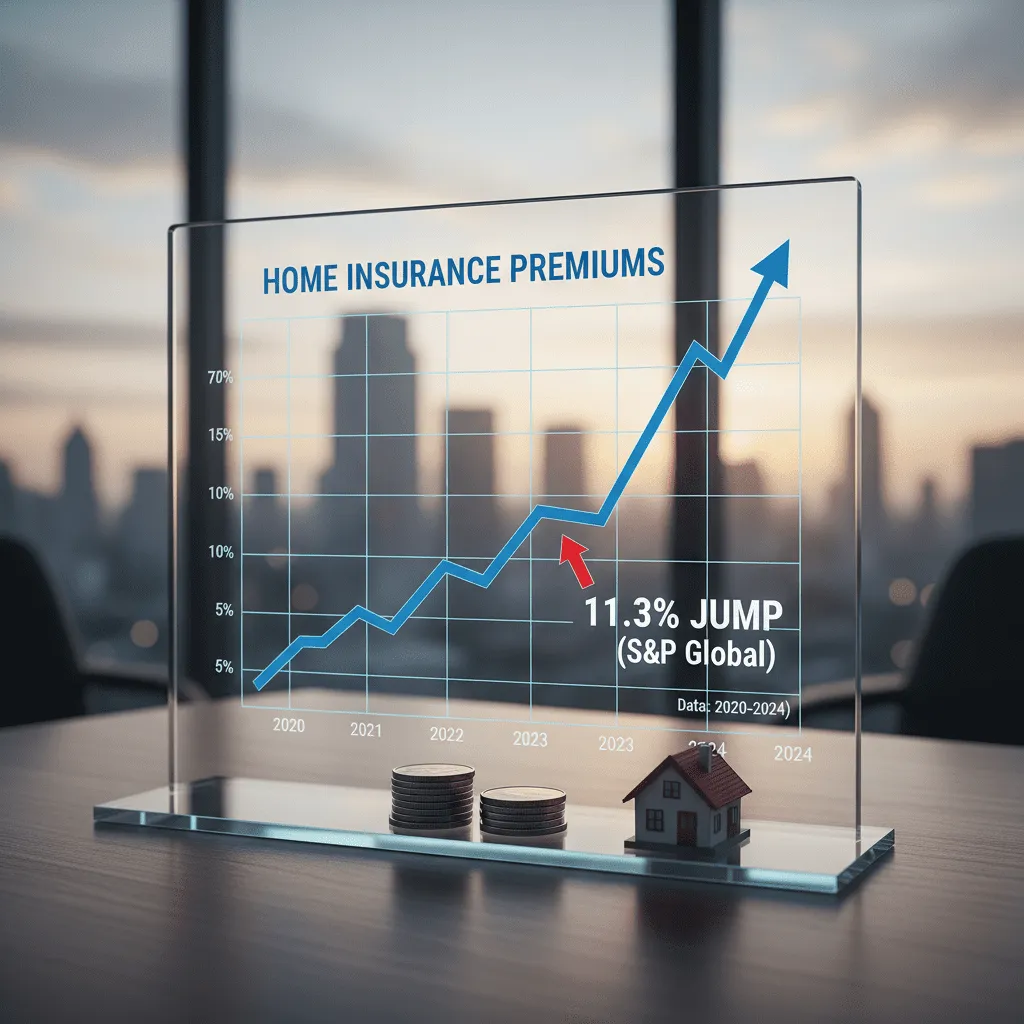

To combat these rate hikes (which S&P Global notes rose 11.3% on average), bundling remains your best defense. Analysis from Insurify indicates that bundling home and auto policies can unlock savings between 10% and 25%.

The Hidden Risks: Life and Health Re-evaluation

While property insurance protects what you own, life insurance protects who you love. Yet, it is often the most neglected area of personal finance.

The “Set and Forget” Trap

According to LIMRA, 72% of consumers overestimate the cost of life insurance, often believing it is three times more expensive than it actually is. This misconception prevents people from reviewing their coverage, leading to the massive “Need-Gap.”

If you bought a 20-year term policy ten years ago, ask yourself: Does the death benefit still cover the mortgage (which might be higher if you refinanced or moved) and college tuition (which has certainly risen)?

Beneficiary Audits

This is a five-minute task that can save years of legal heartache. Life events like divorce or remarriage do not automatically update your insurance contracts. You must manually change the beneficiary. I cannot tell you how many times “ex-spouses” have legally received death benefits because the policy owner simply forgot to fill out a form.

5-Minute Insurance Health Check Checklist

Ready to take action? You don’t need to spend all day on this. Grab your current declarations pages (“dec pages”) and run through this checklist:

- Check Auto Liability Limits: Are they at least 100/300/100? State minimums are rarely enough in 2025.

- Review Home Dwelling Coverage: Ask your agent to run a new “Replacement Cost Estimator” based on current local construction costs.

- Audit Deductibles: Can you afford to raise your auto deductible to $1,000 to save 10% on premiums?

- Verify Discounts: Are you getting credit for working from home (low mileage)? Did you install a security system?

- Check Beneficiaries: Ensure your life insurance and retirement accounts list the correct people.

Frequently Asked Questions

You should conduct a basic review annually, ideally around your renewal date. However, an immediate review is required during major life events (marriage, divorce, new home) or if you notice significant local price inflation in construction or auto repairs.

No. When you shop for insurance, carriers perform a “soft pull” on your credit report. This allows them to offer you a rate without impacting your credit score. It is not the same as applying for a loan or credit card.

Most insurers require you to carry coverage for at least 80% of your home’s replacement cost. If you drop below this (due to inflation or intentionally lowering limits), the insurer may not pay the full cost of repairing partial damages, leaving you with a massive bill.

Insurance is a shared risk pool. Rates are rising due to external factors: a 16.5% increase in vehicle repair costs, higher medical costs, and increased litigation. Even safe drivers are seeing rate hikes due to these systemic inflation pressures.

Conclusion: Don’t Wait for the Renewal Notice

Reviewing your policy isn’t about finding joy in paperwork; it’s about control. In an era where Insurify predicts average car insurance costs hitting over $2,100 and home insurers are shedding policies to manage climate risk, passivity is a liability.

You work hard for your assets. Don’t let a paperwork oversight or a failure to account for inflation jeopardize your financial future. Take thirty minutes this week to call your agent or log into your portal. Ask the hard questions about replacement costs and deductibles.

The best time to find out you are underinsured is today—not the day after the storm.