Why Bother with Insurance? Protecting Your Future, Explained Simply

Why Bother with Insurance? The Mathematics of Protecting Your Future (2025 Data)

Forget the sales pitch. Let’s look at the raw numbers, the hidden risks, and why “betting on yourself” is statistically likely to fail.

It feels like throwing money away. You send $100, $200, or $500 a month to a massive corporation for a disaster that hasn’t happened yet. If you’re skeptical, you have every right to be. When bills are tight and inflation is high, sending premiums into the void feels counterintuitive.

But here is the brutal truth about the modern economy: You are likely betting against the house, and the house always wins.

Why is insurance important? It isn’t about fear-mongering; it’s about leverage. It is a mathematical tool that allows you to trade a small, known loss (the premium) to avoid a catastrophic, unknown loss (financial ruin). In my years analyzing personal finance, I’ve seen savvy investors lose decades of wealth in a single afternoon because they skipped this step.

This guide isn’t here to sell you a policy. It’s here to show you the 2024-2025 data on why the “Protection Gap” is the single biggest threat to your financial freedom.

The “Why Bother” Equation: It’s Not About Fear, It’s About Math

Let’s strip away the emotion. Insurance is simply a risk transfer mechanism. You are paying a company to take a risk off your shoulders because you cannot mathematically afford to carry it yourself.

Most people operate under the “It won’t happen to me” fallacy. But financial fragility in the United States is more common than we like to admit. According to the Federal Reserve Board’s “Economic Well-Being of U.S. Households in 2023” report (released May 2024), 37% of U.S. adults could not cover a $400 emergency expense exclusively using cash or savings.

If nearly 40% of the country can’t handle a $400 car repair, how does anyone expect to handle a $50,000 medical bill or a lawsuit?

When you “bother” with insurance, you aren’t buying a product. You are buying financial resilience. You are ensuring that a bad Tuesday doesn’t turn into a bankruptcy filing on Friday.

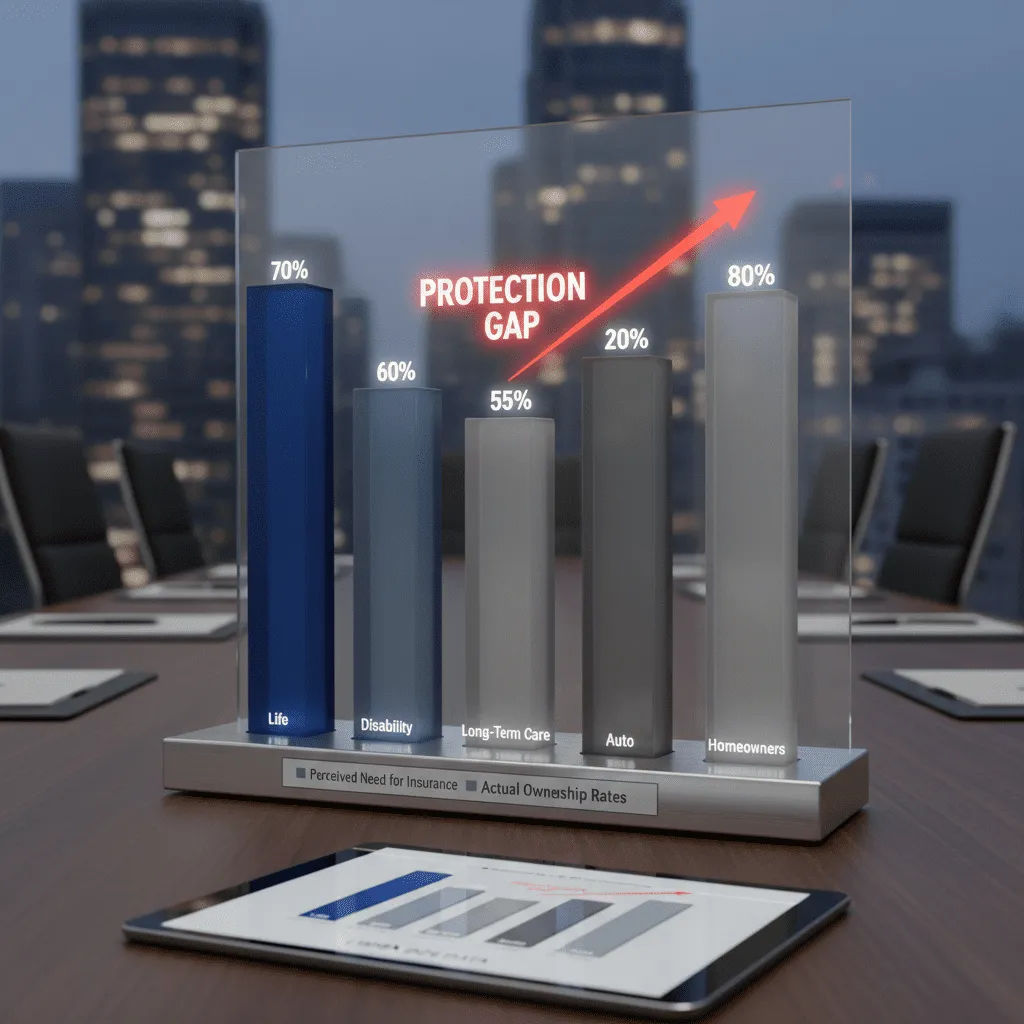

The Global “Protection Gap” (You Are Probably Underinsured)

There is a massive chasm between what people think they need and what they actually have. Economists call this the “Protection Gap,” and in 2024-2025, it has reached historic levels.

According to the Swiss Re Institute’s Sigma 3/2024 report (July 16, 2024), the global protection gap for natural catastrophes, mortality, and health reached a new high of USD 1.83 trillion in premium equivalent terms. This number represents the financial shock that households and businesses will have to absorb out of their own pockets because they didn’t have coverage.

The “Invincibility” Illusion

It’s even worse when we look at life insurance. We know we need it, but we delay it. Data from LIMRA’s “2024 Insurance Barometer Study” (May 2, 2024) reveals a startling statistic: 42% of Americans (102 million adults) acknowledge they need life insurance or more of it.

Despite this awareness, ownership has dropped. The same LIMRA report notes that life insurance ownership has fallen to 52%, down from 63% in 2011. This creates a dangerous paradox: we are more aware of the risks than ever, yet we are less protected.

Real-World Scenarios: When the “Bother” Pays Off

Statistics are dry. Let’s look at what this looks like in the real world. I want to contrast two scenarios—one where insurance worked, and one where the “fine print” caused a nightmare.

Scenario A: The Income Vanishing Act

Consider the Kazemier family (a case highlighted by the non-profit Life Happens). Tom, a father of two, died in a snowmobiling accident at age 45. It was sudden, tragic, and statistically unlikely. However, because Tom had “bothered” with term life insurance, the payout paid off the family mortgage and funded the children’s education.

The takeaway: Grief is debilitating. Insurance didn’t fix the grief, but it prevented the family from losing their home while they were grieving.

Scenario B: The “Hidden Rot” Nightmare

Not all insurance stories are fairy tales. A recent discussion in a verified homeowners community on Reddit highlighted a user who discovered extensive water damage behind their shower tiles. The insurance company denied the claim.

Why? The policy covered “sudden and accidental” damage (like a burst pipe), not “long-term seepage” (maintenance issues). This highlights a critical lesson: Insurance is for accidents, not maintenance. Understanding this distinction prevents the heartbreak of a denied claim. You still need an emergency fund for maintenance; insurance is for the catastrophes that exceed that fund.

The “Self-Insurance” Myth: Can You Just Save the Money Instead?

I hear this argument constantly from the “FIRE” (Financial Independence, Retire Early) community: “Why should I pay $30 a month for life insurance? I’ll just invest that $30 in the S&P 500 and self-insure.”

Let’s run the math. Suppose you need $500,000 coverage (a modest amount to replace income for a family).

Even if you invested that $100/month and got a generous 7% return, it would take you roughly 40+ years to reach $500,000. If you die in year 3, your family gets a few thousand dollars, not the half-million they need.

Self-insurance only works if you are already wealthy. For everyone else, insurance is the only way to buy instant estate value.

4 Types of Insurance That Are Non-Negotiable in 2025

You don’t need insurance for everything (pet insurance and extended warranties are often debatable), but these four are the pillars of a secure financial life.

1. Health Insurance (The Bankruptcy Shield)

Medical debt remains a leading cause of bankruptcy in the U.S. With rising healthcare costs, going uninsured is gambling with your entire net worth.

2. Auto Liability (Protecting Your Future Wages)

If you cause an accident and injure a surgeon, you aren’t just paying for their car; you could be sued for their lost wages. Liability coverage protects your future paycheck from being garnished for decades.

3. Disability Insurance (The Overlooked “Paycheck Protection”)

This is the one most people skip, yet it is statistically more necessary than life insurance for single people. According to the Social Security Administration (cited in 2024 industry reports), 1 in 4 of today’s 20-year-olds will become disabled before reaching retirement age. If you can’t work, your “money machine” stops. Disability insurance keeps the machine running.

4. Term Life Insurance (If Anyone Relies on You)

Note the word “Term.” As financial expert Dave Ramsey famously advises, “Insurance isn’t about fear—it’s about freedom.” Term insurance is affordable and purely for risk protection, unlike whole life policies which mix investing and insurance (often with high fees).

Cost Perception vs. Reality: It’s Cheaper Than You Think

One of the main reasons people avoid the “bother” of insurance is the perceived cost. We tend to overestimate how expensive protection is.

According to the 2024 LIMRA Insurance Barometer Study, 72% of consumers overestimate the cost of term life insurance. Many Millennials believe a policy costs three times more than it actually does.

How to “Bother” Less: Lowering Premiums Smartly

Recognizing the importance of insurance doesn’t mean you should overpay. In 2025, with inflation hurting wallets, you need to be strategic. Here is how I recommend optimizing your coverage without exposing yourself to risk:

- Raise Your Deductibles: This is the golden rule. If you have an emergency fund of $1,000, raise your auto deductible to $1,000. You will lower your monthly premiums significantly. You are taking on the small risk (the first $1,000) to protect against the big risk.

- Bundle Policies: Most carriers offer significant discounts (often 10-15%) if you keep your renters/homeowners and auto insurance under the same roof.

- Annual Reviews: Life changes. If you paid off your debt or your kids graduated college, you might need less life insurance. Don’t pay for coverage you no longer need.

Frequently Asked Questions

Is life insurance a waste of money if I don’t die during the term?

No. You are not paying for a payout; you are paying for the transfer of risk. Think of it like car insurance—you don’t hope to crash your car just to “get your money’s worth.” You pay for the peace of mind that if something happens, you are covered.

What is the 10-12x rule for insurance?

A common rule of thumb for life insurance is to buy a policy valued at 10 to 12 times your annual gross income. This amount, if invested by your beneficiaries, should theoretically replace your lost income for many years.

Why did my insurance rates go up in 2025?

Rates have risen due to inflation increasing the cost of repairs (cars and homes), higher medical costs, and an increase in severe weather events globally, as noted in the Swiss Re 2024 Sigma report.

Do I need disability insurance if I have a desk job?

Yes. Most disability claims are not caused by work accidents but by illnesses like cancer, heart disease, or musculoskeletal issues that can affect anyone, regardless of their job type.

Conclusion: Buying Freedom, Not Just Policies

So, why bother with insurance?

It’s not because you love paperwork. It’s not because you love spending money. You bother with insurance because it buys you the freedom to take risks in other parts of your life. When you know your baseline is secure—that your family won’t lose the house, that a lawsuit won’t garnish your wages, and that a hospital stay won’t bankrupt you—you can invest more aggressively, change careers, and sleep better at night.

In 2025, the economy is volatile. The “Protection Gap” is widening. Don’t be on the wrong side of the math. Take a weekend to review your coverage. It might be the most boring thing you do all year, but it’s also the most valuable.