Questions to Ask Before You Buy Insurance

Picking the Perfect Plan: 25 Critical Questions to Ask Before You Buy Insurance (2025 Edition)

Stop guessing. Start interrogating. The definitive guide to avoiding the “Coverage Gap” trap.

Here is the scary truth: You are likely paying for a false sense of security.

I’ve spent years analyzing policy documents that are thicker than phone books, and the pattern I see in 2025 is terrifying. According to a University of Colorado Boulder Study (Jan 2025), a staggering 74% of policyholders affected by the recent Marshall Fire were underinsured. They thought they were covered. They paid their premiums on time. But when the smoke cleared, many were short an average of $100,000 to rebuild.

That isn’t just a statistic. That’s a financial catastrophe waiting to happen to good people who simply didn’t know what to ask.

Buying insurance isn’t like buying a car; you can’t test drive a claim. You only find out if the “engine” works after the crash. And with Milliman Medical Index (June 2025) reporting that employer-sponsored health coverage costs have ballooned to $35,119 for an average family, the stakes have never been higher.

I wrote this guide to arm you. This isn’t a generic checklist. These are the “interrogation” questions—the specific, technical inquiries that agents pray you won’t ask. We’re going to cover everything from AI claims denials to the inflation traps in your home policy.

The “Golden Rule” Questions (Ask These for ANY Policy)

Before we dive into specific types of insurance, there are three universal questions you must ask regardless of whether you’re insuring a car, a house, or your life. These questions cut through the marketing fluff and get straight to the company’s reliability.

1. “What is the exact Claim Settlement Ratio for this product?”

An insurance policy is a promise. The Claim Settlement Ratio (CSR) tells you how often the company keeps that promise. You aren’t looking for “good”; you are looking for specific numbers.

According to data from the Association for Savings and Investment SA (ASISA) (2025), top-tier life insurers settled 95.6% of all death claims in 2024. If an agent hesitates to give you this number, or if the number is below 90%, run. You don’t want to be in the 10% when disaster strikes.

2. “Can you show me the ‘Exclusions’ page right now?”

Agents love to show you the “Benefits” page. It’s colorful and full of big numbers. But the “Exclusions” page is where they hide the bodies. In 2025, exclusions are getting trickier.

For example, does your policy exclude “secondary structures” or specific types of water damage? I’ve seen clients lose thousands because they assumed a “comprehensive” policy covered the shed in the backyard. It didn’t. Force the agent to walk you through what is not covered before you discuss what is.

3. “How does your company use AI in claims processing?”

This is a new question for 2025, and it might be the most important one. According to the Deloitte Center for Financial Services (Jan 2025), 76% of U.S. insurance executives say their organizations have implemented generative AI. While this speeds up processing, it also increases the risk of algorithmic denials.

Ask this follow-up: “If an AI denies my claim, what is the specific human review process?” If they can’t answer this, you risk facing a “computer says no” scenario with no recourse.

Health Insurance: Beyond the Premium Price Tag

Health insurance is currently the wildest frontier in personal finance. With the KFF Employer Health Benefits Survey (Oct 2025) showing premiums climbed another ~6% in 2025, we are paying more for less. Here is how to fight back.

4. “Is the network ‘Narrow’ or ‘Broad’ for 2025?”

In an effort to keep premiums theoretically lower, many insurers have quietly moved to “narrow networks.” This means your choice of hospitals and specialists is severely restricted. A plan might look cheap monthly, but if the only in-network hospital is 45 minutes away, is it really a plan?

5. “Are GLP-1 (weight loss) drugs covered or excluded?”

This is the single most common coverage dispute I’m seeing right now. Drugs like Ozempic and Wegovy are revolutionizing health, but insurers are terrified of the cost. Even if a doctor prescribes it, your plan might have a blanket exclusion.

Don’t assume medical necessity overrides policy exclusions. Ask to see the “Formulary Tier” for these specific drugs. If they are in Tier 4 or 5, your co-pay could be astronomical even if they are technically “covered.”

6. “What is my ‘True’ Out-of-Pocket Maximum?”

Most people know their deductible. Fewer know their Out-of-Pocket (OOP) max. Even fewer know that some plans don’t count co-pays toward that max. In a bad year, that distinction could cost you thousands.

Jane faced a denied claim for her mother’s treatment that threatened to wipe out her retirement. Why? A lack of clarity on “prior authorization.” She fought back, citing specific policy language, and won back $75,000. The lesson? Never accept the first “No,” and always ask about authorization requirements before treatment.

Auto Insurance: Detecting the “Cheap Quote” Traps

If you’re shopping for car insurance, you’ve probably noticed prices are skyrocketing. A lot of people are panic-shopping for the lowest number, but cheap insurance is often very expensive when you actually use it.

7. “Does this quote include ‘Diminishing Deductibles’?”

Good policies reward loyalty. A “diminishing deductible” feature lowers your deductible (often by $100) for every year you go without a claim. It’s a small feature that signals a carrier who wants to keep you, not just sign you.

8. “Will a ‘Not-At-Fault’ claim raise my rates?”

This is the surcharge trap. In some states and with some carriers, if you get hit by someone else, your rates still go up because you are statistically more likely to be in another accident. It feels unfair because it is. Ask specifically for the carrier’s “surcharge schedule.”

9. “What is the daily limit for rental reimbursement?”

Inflation has hit rental car prices hard. The old standard of $30/day won’t get you a compact car in most cities in 2025. You need at least $50-$60/day. If your car is in the shop for three weeks (common with supply chain delays for parts), a low limit means you’re paying hundreds out of pocket.

Pro Tip: The Digital Shift

According to the J.D. Power U.S. Insurance Digital Experience Study (May 2025), 47% of auto insurance buyers now purchase through digital channels. While convenient, this often leads to “under-selection” of coverage. If you buy online, double-check that you haven’t inadvertently selected state-minimum liability limits.

Homeowners Insurance: The Inflation Reality Check

This is where I see the most dangerous gaps. Your home has likely appreciated in value, and construction costs have soared. If your policy hasn’t kept up, you are in trouble.

10. “Is my ‘Rebuild Cost’ based on 2025 construction prices?”

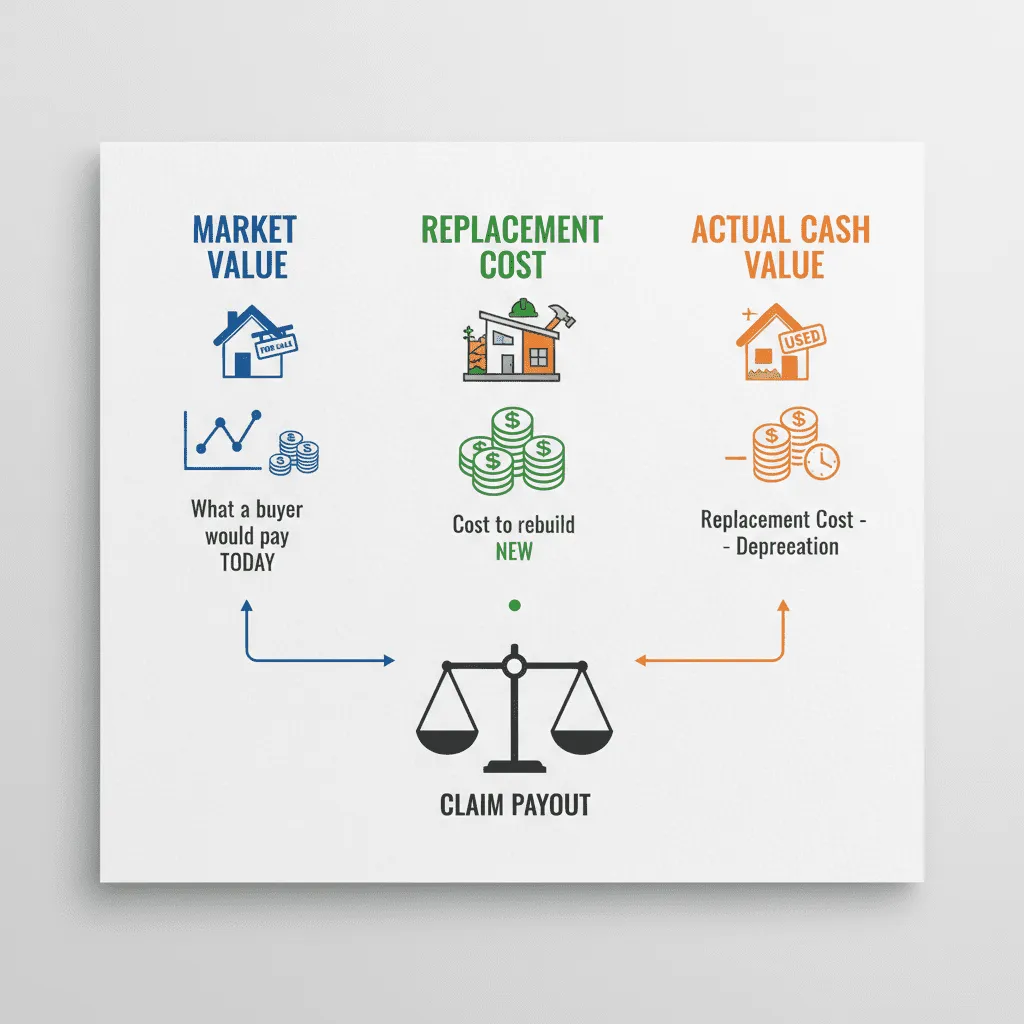

Forget “Market Value.” Market value includes the land. You need “Replacement Cost.” According to an Aviva Insurance Report (May 2024), 60% of homeowners have not increased their rebuild costs in the past three years despite rampant inflation. If your home burns down, you don’t want a check for what it cost to build in 2019.

11. “Are my detached structures covered at full replacement value?”

This is a massive blind spot. Do you have a nice shed? A detached garage? An Accessory Dwelling Unit (ADU) or “Granny Flat”?

Research from ZestyAI Property Risk Analysis (Dec 2024) reveals that 45% of U.S. properties have multiple structures, many of which are overlooked. Standard policies often cap “Other Structures” coverage at 10% of your main dwelling coverage. For a high-end ADU, that is rarely enough.

12. “Do I have ‘Ordinance or Law’ coverage?”

If your older home is damaged, you might be required by the city to upgrade the undamaged parts to current 2025 building codes (electrical, plumbing, etc.). Standard insurance pays to put it back how it was. “Ordinance or Law” pays for the mandatory upgrades. Without it, those upgrades come out of your pocket.

🧮 The Inflation Gap Estimator

Use this simple tool to see if your current coverage might be lagging behind inflation.

*This is a rough estimate based on average construction inflation rates. Consult a professional for an exact appraisal.

Life Insurance: Protecting Your Legacy

Life insurance isn’t just about paying for a funeral. It’s about asset protection. And in my experience, people often buy the wrong type because they ask the wrong questions.

13. “Is the death benefit adjustable?”

Life changes. You might get divorced, have more kids, or your estate tax liability might grow. A rigid policy is a bad policy. Ask if the policy allows you to decrease the face amount (to lower premiums) or increase it (with proof of insurability) without buying a whole new policy.

14. “Are there ‘Living Benefits’?”

We used to think life insurance only paid out if you died. Modern policies often include riders for critical illness or chronic care. If you have a massive stroke but survive, can you access 50% of the death benefit to pay for nursing care? This is a game-changer for retirement planning.

“Policyholders and their beneficiaries should be able to trust that their policies will pay when a life-changing event occurs.” — Gareth Friedlander, ASISA Life and Risk Board (Aug 2025) via FA News.

Red Flags: When to Walk Away

Not all agents are created equal. In my years in this industry, I’ve developed a “sixth sense” for bad advice. Here are two immediate red flags that should make you end the meeting.

- The “Quote Without Questions” Maneuver: If an agent gives you a price quote before asking about your assets, your commute, or your family medical history, they are selling you a commodity, not a protection plan. You cannot price risk without understanding it.

- The “Rating” Ignorance: Ask them, “What is the A.M. Best rating of this carrier?” If they don’t know, or if they say “ratings don’t matter,” walk away. A.M. Best rates the financial strength of insurers. You want an ‘A’ or better. A cheap policy from a ‘B’ rated company is a gamble that they won’t go bankrupt when a hurricane hits.

Save Big by Bundling

Don’t just stick with one company out of habit, but do consider loyalty where it pays. A 2025 report from Oyer, Macoviak & Associates indicates that bundling home and auto policies can save up to 30% (approx. $1,423/year) depending on the carrier. Always ask for the “multi-line” discount.

Frequently Asked Questions

Why did my car insurance go up 30% in 2025?

It’s not just you. This is due to “social inflation” (higher litigation costs), the rising cost of complex vehicle parts (sensors and cameras), and an increase in severe weather events damaging parked cars. Insurers are passing these costs directly to the consumer.

Is it better to buy insurance online or through an agent?

If you are single, rent an apartment, and drive a sedan, online is fine for speed. However, if you have complex assets—like a second home, a business, or teenage drivers—an agent is crucial to avoid the “underinsurance” gap we discussed earlier.

What happens if my insurance company goes bankrupt?

This is a valid fear. Every state has a “guaranty association” that steps in to pay claims up to a certain limit (usually $300k-$500k) if an insurer fails. This is why checking that A.M. Best rating is so critical—you don’t want to rely on the state safety net.

How do I know if I am underinsured?

If you haven’t updated your policy limits in 3 years, you are almost certainly underinsured. Use the calculator above, or better yet, hire an independent appraiser to give you a current replacement cost for your home.

Conclusion: The 15-Minute ‘Policy Audit’ Challenge

I know reading insurance policies is about as exciting as watching paint dry. But remember the Marshall Fire victims. Remember Jane, who saved $75,000 just by asking the right question.

I want you to take 15 minutes today. Not tomorrow. Today.

Pull out your “Declarations Page” (that’s the one-sheet summary of your policy). Look at your Out-of-Pocket Max. Look at your Dwelling Coverage. Then, call your agent and ask just one of the questions from this list that scared you the most.

If they can’t answer it, you know what to do. The perfect plan isn’t the cheapest one; it’s the one that actually pays you when your world falls apart.