Smart Ways to Slash Your Insurance Premiums Today

Paying Too Much? Smart Ways to Slash Your Insurance Premiums (2025 Guide)

There is a specific sinking feeling that comes with opening your insurance renewal envelope. In 2025, that feeling has turned into genuine shock for millions of Americans. If you felt like your bill jumped significantly this year, you aren’t imagining it. In fact, if your policy auto-renewed without a fight, you are almost certainly overpaying.

According to Bankrate’s February 2025 report, the national average cost for full coverage car insurance has hit a staggering $2,638 per year—a 12% jump from just last year. Homeowners aren’t safe either, with premiums projected to rise another 10-16% by year’s end.

I’ve spent the last decade analyzing the insurance market, and I’ve never seen a volatility spike quite like this. But here is the good news: volatility creates opportunity. While the “base rates” are up, the gap between what a lazy consumer pays and what a savvy consumer pays has never been wider.

This guide isn’t about stripping your coverage to the bone. It’s about using the latest 2024-2025 industry data to pull specific levers that can reduce your premiums by up to 35% today.

The 2025 Insurance Landscape: Why Rates Are Soaring

Before we fix your bill, we need to understand the enemy. Why are rates climbing when your driving record is clean? It feels personal, but it’s actually macroeconomic.

The primary driver isn’t just inflation; it’s the severity of claims. Modern cars are safer, but they are also computers on wheels. A minor fender bender that used to cost $500 now involves recalibrating sensors and replacing cameras.

The average repair cycle time for auto claims, which drives up rental car coverage costs significantly.

As Greg McBride, Chief Financial Analyst at Bankrate, noted in early 2024: “Auto insurance rates have been rising at a breakneck pace. And though the pace of increases will eventually slow, that doesn’t mean premiums are coming down.”

This means waiting for rates to drop naturally is a losing strategy. You have to force them down.

The “Big Three” High-Impact Adjustments

Most articles will tell you to “shop around.” While true, that’s advice for 1995. In 2025, the biggest savings come from structural changes to how you present your risk profile to insurers.

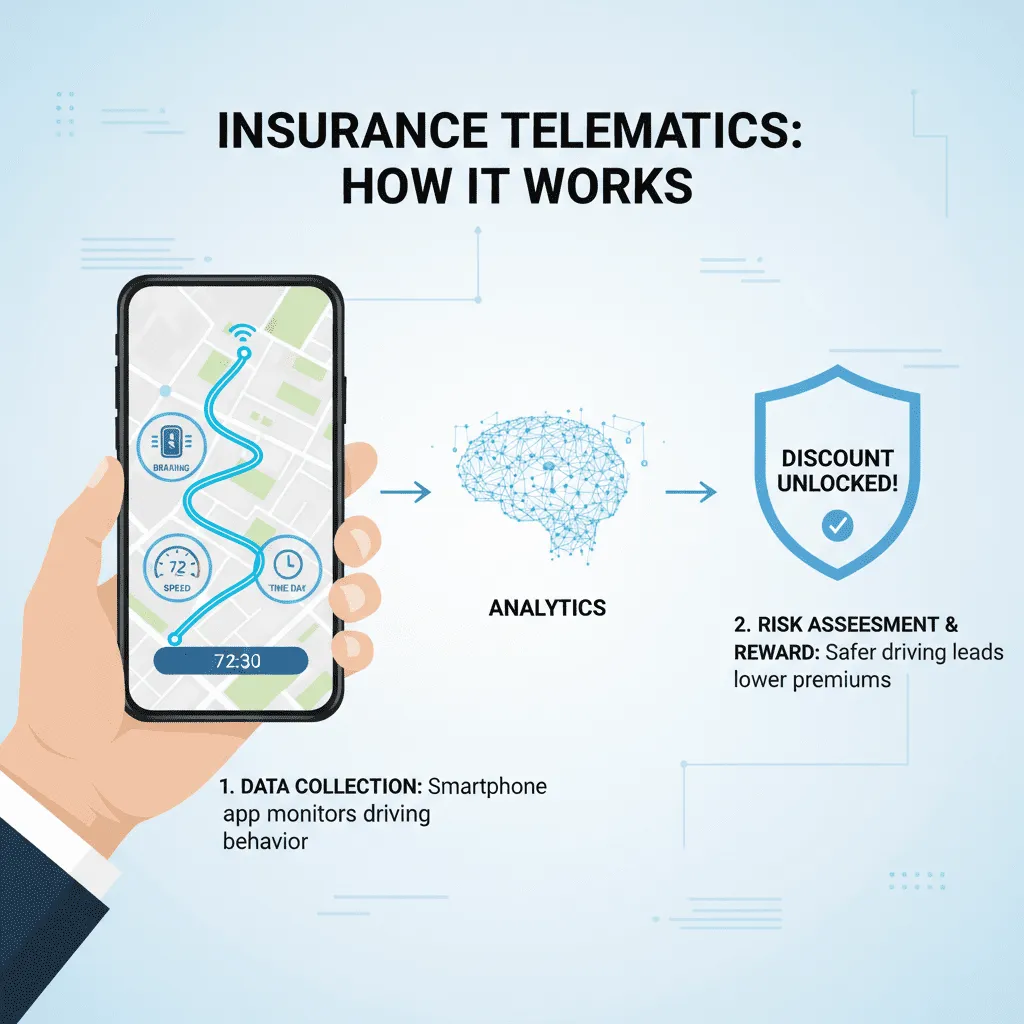

1. The Telematics Revolution (Usage-Based Insurance)

If you consider yourself a safe driver but you aren’t using a telematics program (like Progressive’s Snapshot or State Farm’s Drive Safe & Save), you are subsidizing the bad habits of others. It’s that simple.

The technology has matured. According to the 2024 Telematics Report by SambaSafety, 82% of commercial insurers now utilize telematics data. Why? because it works. Fleets using these systems see massive reductions in crash risks.

The Real Savings: We aren’t talking about a 5% “participation discount” anymore. Usage-based insurance (UBI) programs can lower premiums by 10% to 40% depending on your driving habits. If you work from home or avoid late-night driving, this is the single fastest way to slash your bill.

2. Strategic Bundling (The “Sticky” Discount)

Insurers love bundling because it makes you “sticky”—you’re less likely to switch if moving requires cancelling two policies instead of one. They pay handsomely for this loyalty.

According to an August 2024 analysis by Insure.com / Policygenius, bundling home and auto insurance saves customers an average of 11%. However, specific carriers are aggressive here, with some offering discounts up to 35%.

3. The Credit Score Factor (The Silent Premium Killer)

This is controversial, but the data is undeniable: in most states, your credit score impacts your premium more than your driving record. Insurers use an “insurance credit score” to predict the likelihood of you filing a claim.

The difference is astronomical. Data from The Zebra’s 2025 State of Insurance Report reveals that drivers with “Very Poor” credit scores pay 273% more than those with “Exceptional” credit. That is a difference of roughly $4,581 per year.

The “One Tier” Strategy: You don’t need perfect credit to see savings. Improving your score by just one tier—for example, moving from “Poor” to “Fair”—can lower your insurance rate by an average of 54%. If you are working on your finances, let your insurer know the moment your score crosses a threshold (e.g., crossing from 640 to 670).

Tactical Policy Tweaks (Low Hanging Fruit)

Once you’ve addressed the structural issues, it’s time to look at the fine print. These tweaks take 15 minutes on the phone but can save hundreds annually.

Optimizing Deductibles: The Break-Even Math

Many drivers stick with a $500 deductible out of habit. In 2025, with premiums so high, raising that to $1,000 is often the smartest financial move.

The Logic: If raising your deductible saves you $150 per year, and the difference in deductible is $500, your “break-even” period is roughly 3.3 years. If you don’t crash every 3 years, you come out ahead.

Savings Calculator: Is a Higher Deductible Worth It?

Use this tool to see how long you need to go claim-free to justify a higher deductible.

Dropping “Zombie” Coverage

Zombie coverage refers to add-ons that are dead weight.

- Rental Reimbursement: If you have a second car or work from home, do you really need to pay for a rental car add-on?

- Roadside Assistance: Check your credit cards or AAA membership. You are likely paying for this twice.

- Collision on Old Cars: If your car is worth less than $3,000, the premiums for collision coverage (plus the deductible) often exceed the payout you’d receive in a total loss.

Lifestyle Changes That Pay Dividends

Your lifestyle dictates your risk. If your life has changed, your premium should too.

Defensive Driving Courses

This isn’t just for teenagers. Many states mandate discounts for completing an accredited safety course. For instance, according to Washington State regulations, completing a defensive driving course guarantees a mandatory 10% discount on auto premiums for certain demographics.

Low Mileage Verification

If you transitioned to remote work in 2023 or 2024 and haven’t updated your insurer, you are overpaying. The average American drives 13,500 miles. If you drive 5,000, you fall into a different risk tier. Call your agent and ask for a “low mileage verification” form.

Homeowner Specific Strategies

With home insurance premiums rising 24% over the last three years, homeowners need aggressive strategies.

Fortifying Your Home

Insurers reward resilience. In hurricane-prone areas, a wind mitigation inspection can uncover discounts for roof geometry and hurricane straps. Furthermore, professionally monitored security systems often yield a 5-10% discount on the dwelling portion of your policy.

The “Claims-Free” Discount

Home insurance is for catastrophes, not maintenance. Filing small claims for a $800 fence repair can disqualify you from “claims-free” discounts that are often worth 20% of the policy. Before filing a home claim, always ask: “Is this payout worth losing my claims-free status for the next 5 years?”

The Trust Factor: Don’t Just Buy “Cheap”

I have to add a critical warning here. In the race to save money, don’t sacrifice reliability. J.D. Power’s 2024 U.S. Auto Insurance Study reveals that while price is a pain point, customer satisfaction hinges on trust.

Breanne Armstrong, Director of Global Insurance Intelligence at J.D. Power, notes: “Auto insurers are in a tough position… insurers are still losing money, despite passing along huge price increases.”

If you switch to a bottom-tier carrier to save $10 a month, but they deny your claim when you’re rear-ended, you haven’t saved money—you’ve bought a liability. Always check the insurer’s “Complaint Ratio” on the NAIC (National Association of Insurance Commissioners) website before switching.

FAQ: Your Premium Questions Answered

Will car insurance rates go down in 2025?

It is unlikely rates will drop significantly. While the rate of increase may slow, Bankrate predicts stabilization rather than reduction due to persistently high repair costs and labor shortages. The best way to lower your rate is to actively manage your policy rather than waiting for the market to correct.

Does shopping around really affect my credit score?

No. When you shop for insurance, carriers perform a “soft pull” on your credit. This does not impact your credit score. You can get quotes from 10 different companies without hurting your credit rating.

Is accident forgiveness worth the extra cost?

If you have a clean record, accident forgiveness is essentially an insurance policy for your insurance policy. If the cost is less than $50/year, it’s often worth it. One at-fault accident can raise premiums by 40-50% for 3-5 years, so the “forgiveness” pays for itself in the event of a single mishap.

Conclusion: Your Action Plan

The days of “set it and forget it” insurance are over. In this high-inflation environment, passivity is a tax. To combat the 12% auto and 24% home insurance hikes, you must be proactive.

Here is your checklist for this week:

- Call your current agent. Ask specifically: “When will my credit tier be re-evaluated?” and “Do you offer a telematics discount?”

- Check your deductible. If you have $5,000 in savings, raise your deductible to $1,000 immediately.

- Get competing quotes. Use an aggregator tool to compare at least three other carriers.

- Review your mileage. If you drive less than 7,500 miles a year, ensure your policy reflects that.

You have the power to lower your premiums. It just takes a little knowledge and about 30 minutes of your time. Start today, and stop paying more than your fair share.