Balancing Insurance Cost with Quality Coverage

Is Cheaper Always Better? The Hidden Costs of “Budget” Insurance Coverage

Saving $30 a month sounds like a victory until a denied claim costs you $30,000. It’s a scenario I’ve seen play out far too often in my years analyzing financial risk: a policyholder believes they are protected, only to discover their “budget-friendly” policy is actually a hollow shell when disaster strikes.

In 2024 alone, the global insurance protection gap hit a staggering $1.83 trillion. This figure, reported by the Swiss Re Institute in their Sigma 3/2024 Report, proves that millions of people are technically “insured” but financially exposed. They have a piece of paper, but they don’t have protection.

We are living through a massive shift in the insurance landscape. Prices are climbing—Bankrate’s February 2025 data shows full coverage auto insurance now averages $2,638 per year. It is tempting to slash coverage to keep that number down. But is cheaper always better? Or is it a financial time bomb waiting to go off?

In this guide, we are going to move beyond the premium price tag. We will learn to calculate the True Cost of Risk using 2025 market data, analyzing the tradeoffs in Auto, Home, and Life insurance backed by verified satisfaction data and expert financial insights.

The “Premium Illusion”: Why Low Prices Can Be Deceptive

There is a psychological trap in insurance shopping known as the “Premium Illusion.” We tend to focus entirely on the monthly deduction from our bank account, ignoring the mathematics of risk that dictate that price. The reality is that actuarial science doesn’t give free lunches. If a premium is significantly lower than the market average, something has been removed from the equation.

The Mathematics of Risk: Premium vs. Deductible vs. Coverage Limits

Every insurance policy is a balancing act between three levers: Premium (what you pay now), Deductible (what you pay later), and Limits (the maximum the insurer will pay). Cheap insurance usually manipulates these levers in dangerous ways.

For example, raising a deductible from $500 to $2,000 might save you $200 a year. But ask yourself: do you have $2,000 sitting in an emergency fund right now? If not, that “savings” is actually a debt you haven’t paid yet.

The “Hollow Policy” Trap: What State Minimums Actually Leave Unpaid

The most dangerous form of cheap insurance is the “State Minimum” liability policy. In many states, the minimum liability coverage for property damage is as low as $5,000 or $10,000.

Think about the cars you see on the road today. If you are at fault in an accident and total a Tesla or a new Ford F-150, that $10,000 limit won’t even cover the bumper and headlights. You are personally liable for the rest. If you have savings, a house, or a job, you can be sued for the difference.

According to Bankrate’s “True Cost of Auto Insurance Report” (Feb 2025), Americans now spend 3.39% of their median household income on car insurance alone. This pressure drives many to minimum limits, exposing them to bankruptcy risks.

Inflation Impact: Why “Cheap” Policies Are Failing in 2025

Inflation hasn’t just hit the grocery store; it has decimated the repair industry. “Budget” policies written with 2020 limits are woefully inadequate for 2025 prices.

According to the J.D. Power 2024 U.S. Auto Claims Satisfaction Study, average auto repair costs rose 26% over the past two years. If your policy limits haven’t increased by that same margin, your coverage has effectively shrunk.

Auto Insurance: The 23-Day Wait and Other Budget Pitfalls

When you buy a premium policy, you aren’t just buying repairs; you are buying speed and convenience. When you buy a budget policy, you are often buying a bureaucratic nightmare. I’ve seen clients switch to “no-name” carriers to save money, only to find themselves stranded without a vehicle for weeks.

Claims Velocity: Cheap Carriers vs. Premium Carriers

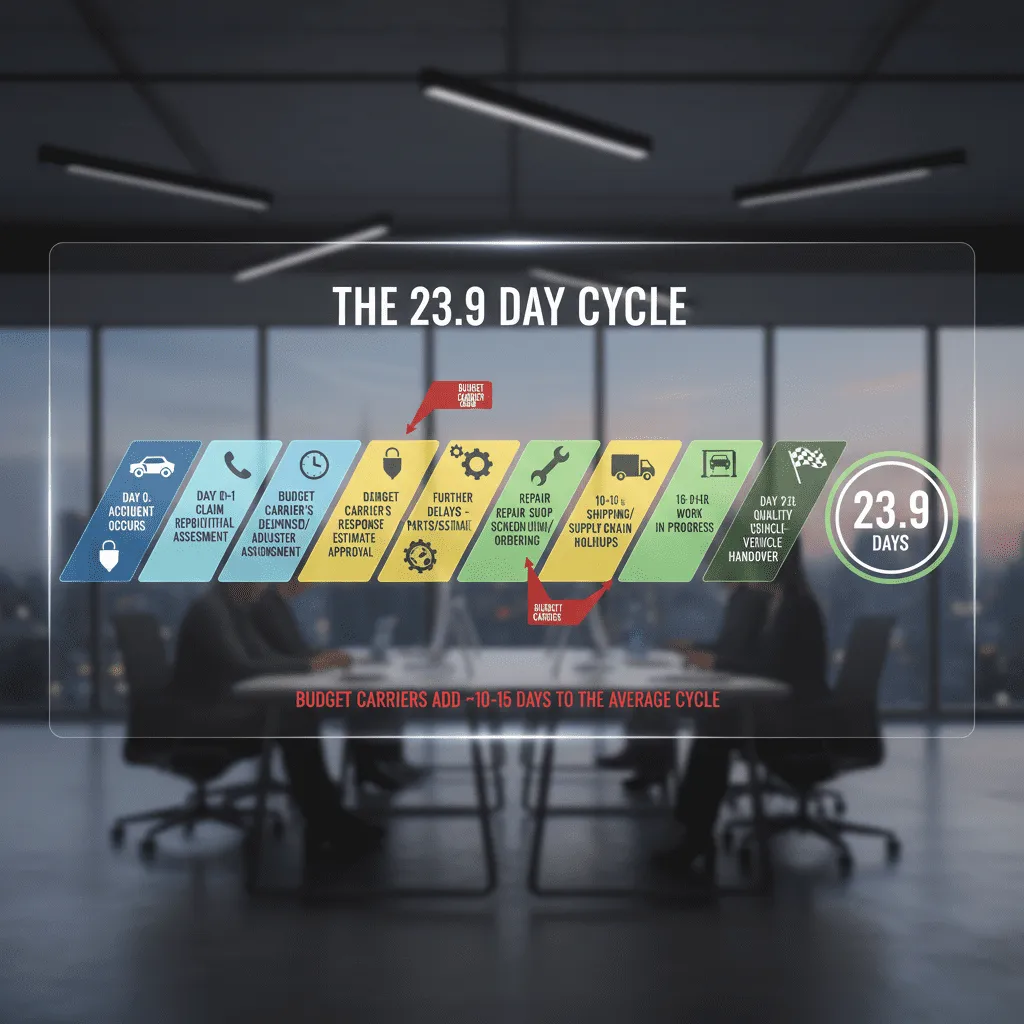

The metric that matters most isn’t price—it’s “Cycle Time.” This is the time between filing a claim and getting your keys back.

According to the J.D. Power 2024 U.S. Property Claims Satisfaction Study, the average property claim repair cycle time hit 23.9 days in 2024. That is over six days longer than in 2022. Budget carriers often lack the direct repair networks and staffing to speed this process up.

The Real Cost: If your cheap policy doesn’t include “Loss of Use” (rental car) coverage—which is often the first thing cut to lower premiums—a 24-day repair cycle could cost you $1,200 out of pocket for a rental. That single event wipes out three years of premium savings.

OEM vs. Aftermarket Parts: The Quality Compromise

Cheaper policies almost universally dictate the use of “Aftermarket” or “Recycled” parts rather than Original Equipment Manufacturer (OEM) parts. While aftermarket parts can be fine, they can also lead to fitment issues, voided warranties, and lower resale value for your vehicle.

The Uninsured Motorist Reality

Cheap insurance often skips Uninsured/Underinsured Motorist (UM/UIM) coverage. This is a gamble I never recommend. If you are hit by one of the 14% of drivers who have no insurance, or the millions carrying state minimums, your own policy is the only thing standing between you and financial ruin.

Homeowners Insurance: When “Good Enough” Costs Families Everything

If a car accident is a financial setback, a home disaster can be a financial fatality. The stakes here are infinitely higher, yet the race for the lowest premium is just as intense.

ACV vs. Replacement Cost: The Single Biggest Bankruptcy Risk

This is the most critical distinction in property insurance.

- Replacement Cost Value (RCV): Pays what it costs to rebuild your roof today.

- Actual Cash Value (ACV): Pays what your roof is worth after depreciation.

Many budget policies quietly switch roof coverage to ACV once the roof is 10 years old. If a storm destroys your 15-year-old roof that costs $20,000 to replace, an ACV policy might only pay you $5,000 because of depreciation. You are left with a $15,000 bill.

The 2024/2025 Climate Shift

Insurers are reeling from weather events. Data cited in the 2024 Property Claims Study indicates there were 28 catastrophic weather events in the U.S. in 2023/24 that each caused over $1 billion in damage.

Cheap carriers are responding by fleeing high-risk zones or increasing deductibles to percentage-based models (e.g., 2% or 5% of the home’s value). On a $400,000 home, a 5% hurricane deductible is $20,000. Ask yourself: Is saving $500 a year worth a $20,000 deductible?

Evaluating Carrier Quality: Metrics That Matter More Than Price

So, how do you find quality without overpaying? You need to look at the metrics that industry insiders use. Don’t just look at the shiny TV commercials; look at the financial and satisfaction health of the company.

Financial Strength Ratings (AM Best)

Will the company be there when you file? The AM Best Financial Strength Rating is the gold standard. I advise clients to never go below an “A” rating. In early 2025, AM Best maintained a “Stable Outlook” for the commercial segment, but smaller regional carriers (often the cheapest ones) face higher solvency risks.

The J.D. Power “Trust Index”

Trust is quantifiable. According to the J.D. Power 2024 U.S. Auto Insurance Study, overall satisfaction scores are 426 points higher among customers who have high trust in their insurer compared to those with low trust.

Budget carriers typically score lower on this index because they invest less in customer service infrastructure. When you pay less, you are often cutting the salary of the person who is supposed to answer the phone when you are stranded on the highway.

Customer Service Digital Experience

In 2025, if your insurer doesn’t have a functional app, you are at a disadvantage. Customers using digital tools for claims report faster cycles (15 days) versus non-digital (28 days), according to J.D. Power data. Premium carriers invest heavily in these tools; budget carriers often rely on outdated call centers.

Strategic Balancing: How to Save Without Sacrificing Protection

You don’t have to buy the most expensive policy to get quality. You just need to be smart about where you save money.

The “Smart Deductible” Strategy

Instead of cutting coverage limits (which is risky), raise your deductible (which is manageable). Moving from a $500 to a $1,000 deductible can drop your premium significantly. Use those savings to build an emergency fund that covers the difference.

True Cost Calculator

Use this simple tool to estimate if a lower premium is actually worth the risk of a higher deductible or rental car costs.

Risk vs. Savings Calculator

Bundling and Loyalty: Verified Discounts

Insurers love stability. According to the J.D. Power 2024 U.S. Insurance Shopping Study, while shopping is surging (49% of customers shopped in 2024), loyalty discounts remain one of the safest ways to reduce costs without cutting coverage. Bundling home and auto can save 15-20% with top-tier carriers.

Telematics and UBI

If you are a safe driver, stop paying for the mistakes of others. Telematics (Usage-Based Insurance) allows you to trade privacy for price. By letting the insurer track your driving, you can earn discounts of 30% or more based on actual data, not just demographic averages.

FAQ: Common Questions on Insurance Value

Is cheap car insurance bad?

Not inherently, but “cheap” often correlates with slow claims service and strict payout ratios. Always check the carrier’s NAIC Complaint Index. If the index is above 1.0, they receive more complaints than average.

Why is my insurance quote so low?

A significantly lower quote usually indicates stripped coverage. Check if they have removed “Loss of Use,” lowered liability limits to state minimums, or increased your deductible. Also, verify if they are rating you on an “Actual Cash Value” basis for property.

What happens if I am underinsured in an accident?

If damages exceed your policy limits, you are personally responsible for the difference. This can lead to wage garnishment, lawsuits, and the seizure of assets like your home or savings. This is why the global protection gap of $1.83 trillion, as noted by Swiss Re, is such a critical economic issue.

Who are the worst insurance companies for claims?

While we cannot name and shame specific brands here, generally, companies with J.D. Power claims satisfaction scores below 850 (on a 1,000-point scale) are considered underperformers. Look for carriers with consistent scores above the segment average.

Conclusion: Don’t Just Compare Prices—Compare Promises

The allure of a low monthly payment is powerful, especially when inflation is squeezing every other part of your budget. But insurance is one of the few products where you don’t know the quality of what you bought until the worst day of your life occurs.

The data from 2024 and 2025 is clear: rising repair costs, longer cycle times, and increasing weather severity mean that “budget” policies are becoming riskier than ever. The J.D. Power study revealing that insurers lose 5 cents on every dollar of premium highlights the strain the industry is under—and struggling carriers are more likely to fight your claim.

My advice is simple:

- Start with the coverage you need (Replacement Cost, adequate Liability limits).

- Raise your deductibles to the highest amount you can afford to pay in an emergency.

- Then, and only then, shop for the lowest price on that specific package.

Don’t let a $30 monthly saving cost you your financial future. Close the protection gap in your own life before the next storm hits.