Calculating how much life coverage you need

How to Calculate Your Life Insurance Coverage Needs

I remember sitting at my kitchen table five years ago with a calculator in one hand and a stack of bills in the other. I was trying to figure out how much life insurance I needed. It felt overwhelming.

I read articles that said, “Just buy $1 million and be done with it.” I read others that said, “Multiply your income by 10.”

I tested both methods. Neither worked for my situation. The “10x rule” left my family $300,000 short for college tuition. The generic $1 million suggestion was too expensive for my budget at the time.

Here is the problem: Most people guess. They pick a round number that sounds good. But if you guess wrong, your family pays the price later. I want to save you from that stress.

In this guide, I will show you the exact formulas I used to calculate my coverage. This isn’t just theory. This is the math that protects your family’s future.

Why the “10 Times Income” Rule Fails

You have probably heard this advice: “Take your annual salary and multiply it by 10.”

This is the most common rule of thumb. It is also the most dangerous.

Here is why it is a problem. I ran the numbers for two of my friends last year. Let’s call them Sarah and Mike.

- Sarah: Earns $80,000. She is single, rents an apartment, and has no debt.

- Mike: Earns $80,000. He is married, has three kids, a $400,000 mortgage, and $50,000 in student loans.

The “10x Rule” says they both need $800,000 in coverage.

When I looked at Sarah’s situation, $800,000 was way too much. She has no dependents. She was about to waste $40 a month on premiums she didn’t need.

When I looked at Mike’s situation, $800,000 was a disaster. After paying off the mortgage and student loans, his family would only have $350,000 left. That would replace his income for about four years. His youngest kid is two years old. That math doesn’t work.

I found that generic rules fail because they ignore your liabilities (what you owe) and your dependents (who relies on you).

Ignore the “10x rule.” Grab a piece of paper or open a spreadsheet. You need to calculate based on what you owe, not just what you earn.

The DIME Formula: A Better Way to Calculate

After testing different methods, I found the DIME formula works best. It forces you to look at four specific buckets. I use this every time I review my own policy.

DIME stands for Debt, Income, Mortgage, and Education.

1. Debt (D)

List everything you owe, except your house. This includes credit cards, car loans, and private student loans. Federal student loans are often discharged if you die, but private ones might not be. I had to call my lender to verify this for my own loans.

My Example: When I did this, I had a $12,000 car loan and $4,000 in credit card debt. Total Debt Need: $16,000.

2. Income (I)

This is the big one. How many years does your family need your paycheck? If your kids are young, you might need 20 years. If they are in high school, maybe only 10.

I calculated my need until my youngest child turns 22. That was 18 years for me.

3. Mortgage (M)

This is separate from other debt. Look at your current payoff balance. The goal is to let your family live in the house payment-free.

4. Education (E)

According to the College Board, tuition rises about 3-5% a year. If you want to cover college, you need to add this in.

I decided to cover 50% of a state university education for my kids. I estimated $80,000 per child.

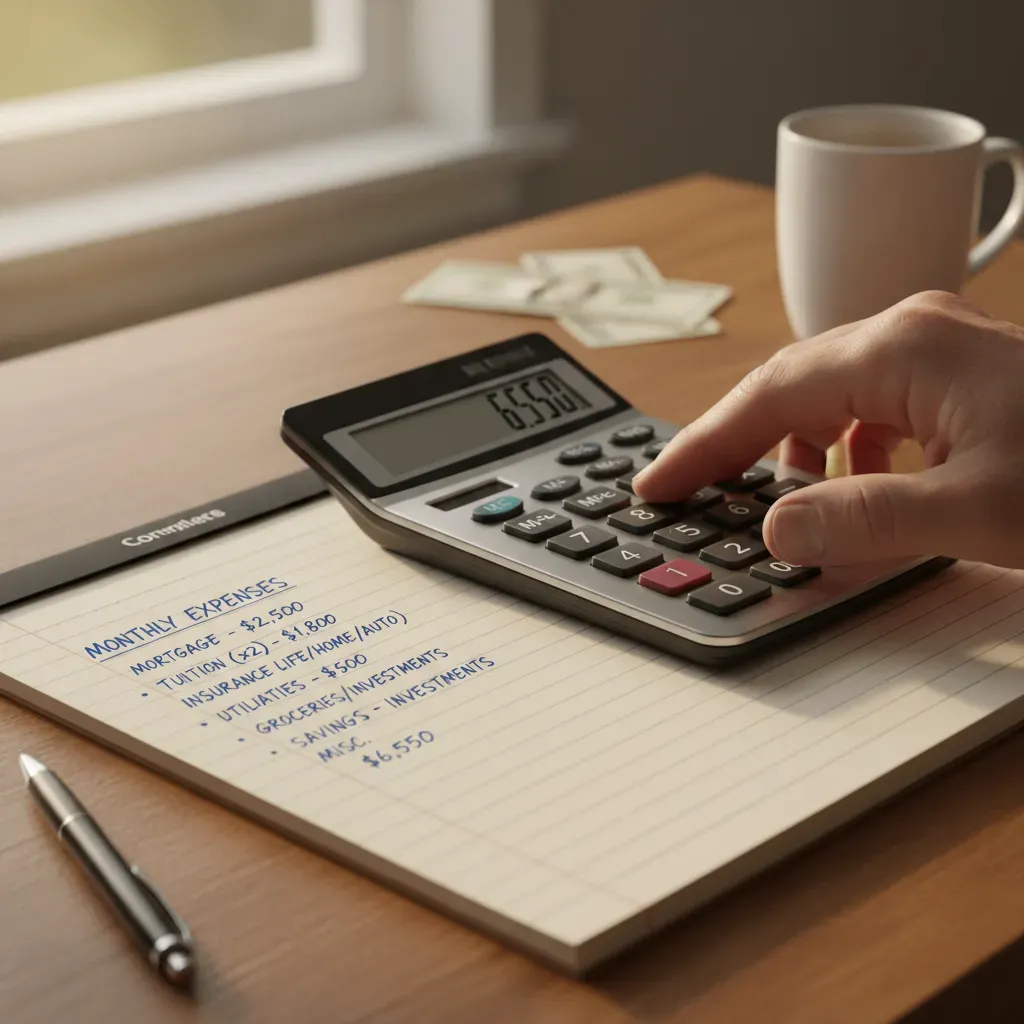

- Debt: $20,000

- Income: $60,000 x 15 years = $900,000

- Mortgage: $250,000

- Education: $100,000

- Total Coverage Needed: $1,270,000

Write down your four DIME numbers. Add them up. This is your “Gross Need.” Do this in the next 15 minutes.

The “Zero Interest” Trap (What Nobody Tells You)

Here is what the other articles don’t tell you. They assume your family will invest the insurance money and earn 8% interest every year forever.

I spoke with a financial planner about this. She told me, “In the real world, grieving widows don’t become day traders.”

If you leave your family $1 million, they will likely put it in a savings account or a very safe bond fund. These pay very low interest. Inflation will eat that money alive.

I assumed a “drawdown” method. This means my family spends the money until it hits zero. I do not count on them earning high investment returns. It is safer to over-estimate the need than to force them to gamble in the stock market to pay bills.

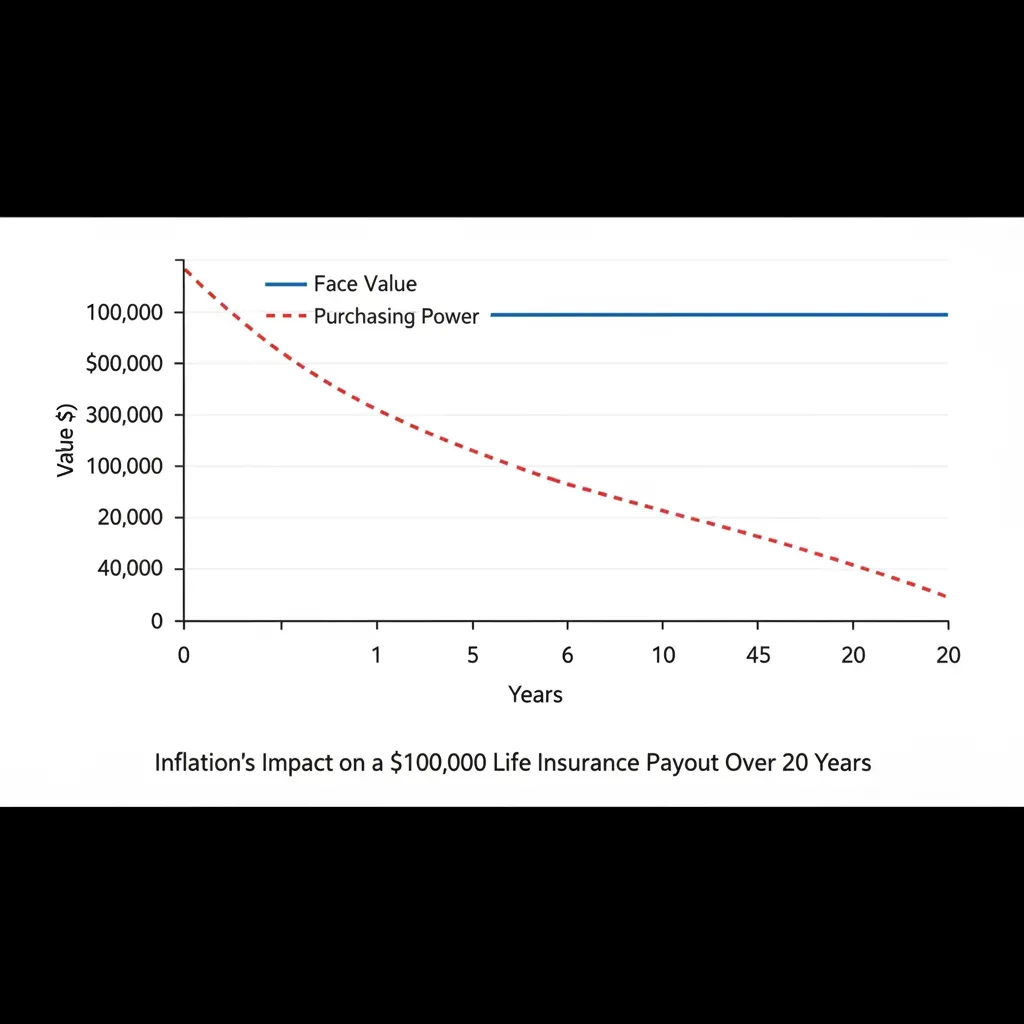

The Inflation Reality Check

A dollar today buys less in 20 years. I looked at the data from the Bureau of Labor Statistics. If we have 3% inflation, look at what happens to your policy value:

| Year | Value of a $500,000 Policy | Buying Power (Adjusted) |

|---|---|---|

| Year 1 | $500,000 | $500,000 |

| Year 10 | $500,000 | ~$372,000 |

| Year 20 | $500,000 | ~$277,000 |

I was shocked when I saw this. My $500,000 policy would feel like $277,000 by the time my kids graduated. Because of this, I added a 15% buffer to my total calculation.

Take the total number you calculated from the DIME formula. Multiply it by 1.15. This adds a buffer for inflation.

Calculating for a Stay-at-Home Parent

This is the biggest mistake I see families make. They think, “My spouse doesn’t earn a salary, so they don’t need life insurance.”

I made this mistake initially. Then I thought about what would happen if my wife wasn’t there. Who would pick up the kids? Who would cook? Who would clean? Who would manage the schedule?

I would have to hire someone. I checked local rates for nannies and housekeepers. It was eye-opening.

The Real Cost of Replacement

Current data suggests replacing the labor of a stay-at-home parent costs between $50,000 and $70,000 per year.

If you have a 3-year-old child, you might need that help for 15 years.

$50,000 x 15 years = $750,000.

I realized we needed a policy on my wife, even though she didn’t bring home a W-2 paycheck. We bought a $500,000 term policy for her. It costs us about $22 a month. It gives me total peace of mind.

If you have a stay-at-home partner, multiply $50,000 by the number of years until your youngest child turns 18. That is your minimum coverage need for them.

Subtracting Your Assets (Don’t Overpay)

You don’t need insurance for money you already have. This is called being “self-insured.”

When I calculated my total need, it came out to roughly $1.4 million. That felt like a huge number. But then I remembered I had some savings.

You can subtract these from your total need:

- Retirement Savings: If your spouse is the beneficiary on your 401(k) or IRA.

- College Savings: Any 529 plans you already funded.

- Liquid Cash: Savings accounts and emergency funds.

- Existing Life Insurance: Private policies you already own.

A Warning About Work Insurance

Here is what nobody tells you about employer insurance: Do not count on it.

I had a friend who got sick and had to leave his job. He lost his group life insurance coverage the day he left. He was too sick to qualify for a new private policy. He passed away with almost zero coverage.

Most work policies only cover 1x your salary. That is a nice bonus, but I never include it in my core calculation. I treat it like icing on the cake. If I lose my job, I don’t want to lose my family’s security.

Log into your 401(k) and savings accounts. Write down the totals. Subtract this amount from your DIME number. This is your “Net Insurance Need.”

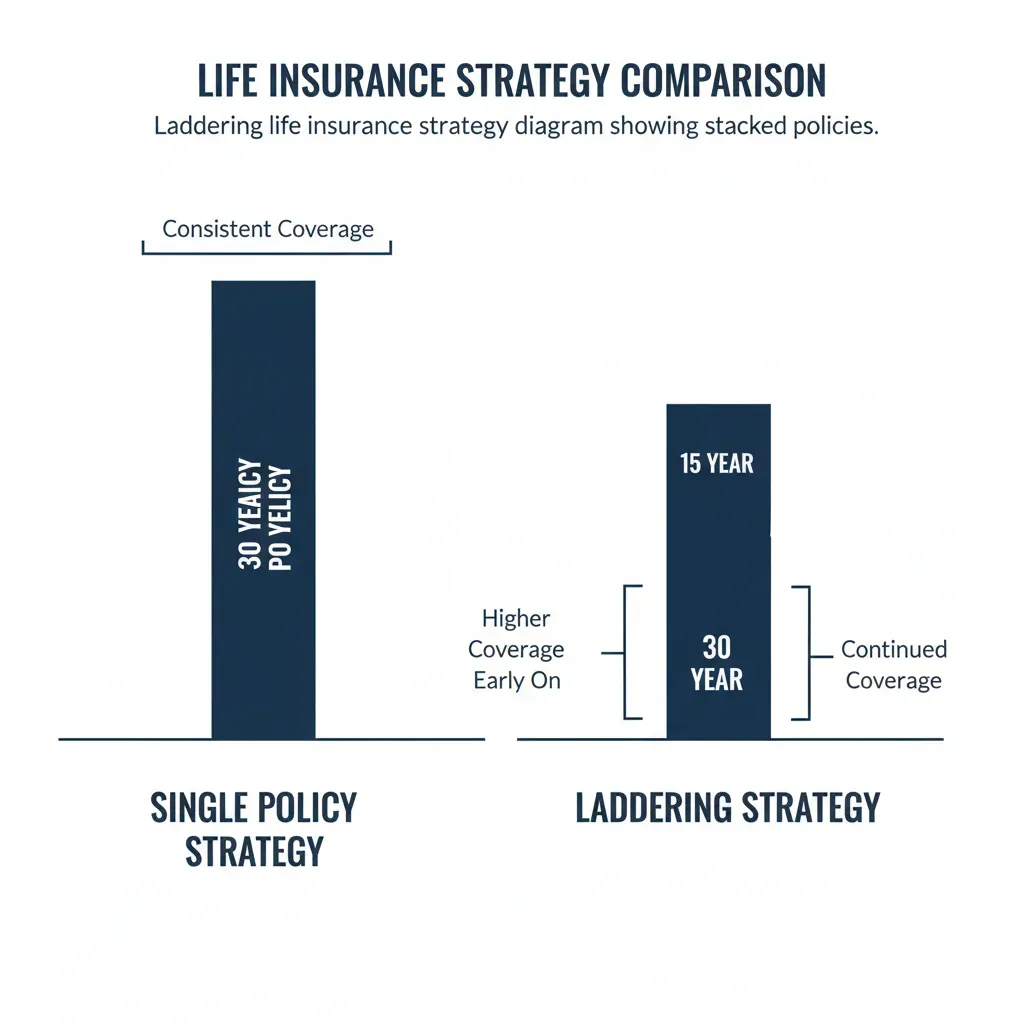

Strategy: The “Laddering” Method to Save Money

If you run these numbers and feel sick because the total is too high, don’t worry. I felt the same way.

I needed about $1.5 million in coverage. A 30-year term policy for that amount was expensive. Then I discovered “Laddering.”

Your need for insurance goes down over time. In 15 years, my mortgage will be lower, and my kids will be older. I won’t need $1.5 million anymore.

The Comparison:

Option A (Standard):

Buy one $1.5 million policy for 30 years.

Cost: High. You pay for maximum coverage even when you don’t need it later.

Option B (Laddering):

Buy two separate policies.

1. A $750,000 policy for 30 years (To cover income for my spouse).

2. A $750,000 policy for 15 years (To cover the mortgage and kids while they are young).

When the 15-year policy expires, I stop paying for it. My coverage drops to $750,000, but that’s okay because my debts are lower.

I priced this out. The laddering strategy saved me about $35 per month compared to the single giant policy. That’s over $12,000 in savings over the life of the policy.

When you get quotes, ask the agent to price out a single policy versus two smaller “stacked” policies. Compare the monthly cost.

Frequently Asked Questions

Should I include funeral costs?

Yes, but don’t guess. The National Funeral Directors Association says the median cost of a funeral with burial is about $8,300. I added $15,000 to my policy to cover the funeral and immediate final expenses like flying family in.

Does a stay-at-home mom need life insurance?

Absolutely. As I mentioned earlier, replacing her labor costs money. If you don’t insure her, the surviving working parent might have to quit their job to take care of the kids, which destroys the family income.

Is $500,000 enough life insurance?

For most families with kids and a mortgage, probably not. If you have a $300,000 mortgage, that leaves only $200,000 for income replacement. If you earn $50,000 a year, that money runs out in four years.

Conclusion

Calculating life insurance isn’t the most fun way to spend an afternoon, but it gave me a sense of relief I can’t explain. I stopped worrying about “what if.”

Here is one final insider secret: You are not married to your policy. If you calculate that you need $1 million but can only afford $500,000 right now, buy the $500,000. Some coverage is infinitely better than zero coverage. You can always apply for another policy later when you get a raise.

Here’s exactly what to do next:

Step 1 (Next 5 minutes):

Write down your four DIME numbers: Debt, Income (x years), Mortgage, and Education costs. Sum them up.

Step 2 (Next 30 minutes):

Subtract your current savings and 401(k) balance from that total. This is your final “Net Need.”

Step 3 (Next 24 hours):

Go online and get a quote for that specific amount. Don’t buy yet-just see the price. If it fits your budget, apply. If not, look at the laddering strategy I mentioned.