Difference between HMO and PPO plans explained

Difference Between HMO and PPO Plans Explained: Costs & Benefits

I wasted $1,400 on my health insurance three years ago. I remember staring at the enrollment form, terrified of making the wrong choice. I picked the expensive PPO plan just to be “safe.”

I thought it would give me freedom. Instead, it gave me a massive monthly bill for features I never used. You don’t have to make that mistake.

The difference between HMO and PPO plans explained simply is a trade-off: You either pay with your money (PPO) or you pay with your time (HMO). Most people don’t realize this until they are stuck in a plan for 12 months.

In this guide, I’ll share exactly what I learned after analyzing the fine print, testing both plans personally, and helping friends navigate Open Enrollment. We’ll look at costs, hidden traps, and how to pick the right one for your specific health needs.

The Core Difference: Control vs. Cost

Here’s the problem most people face: Health insurance language is confusing on purpose. You see terms like “coinsurance” and “network adequacy” and your eyes glaze over.

This matters because if you don’t understand the core structure, you will overpay. I’ve seen it happen dozens of times.

Let’s break it down to the absolute basics.

HMO (Health Maintenance Organization)

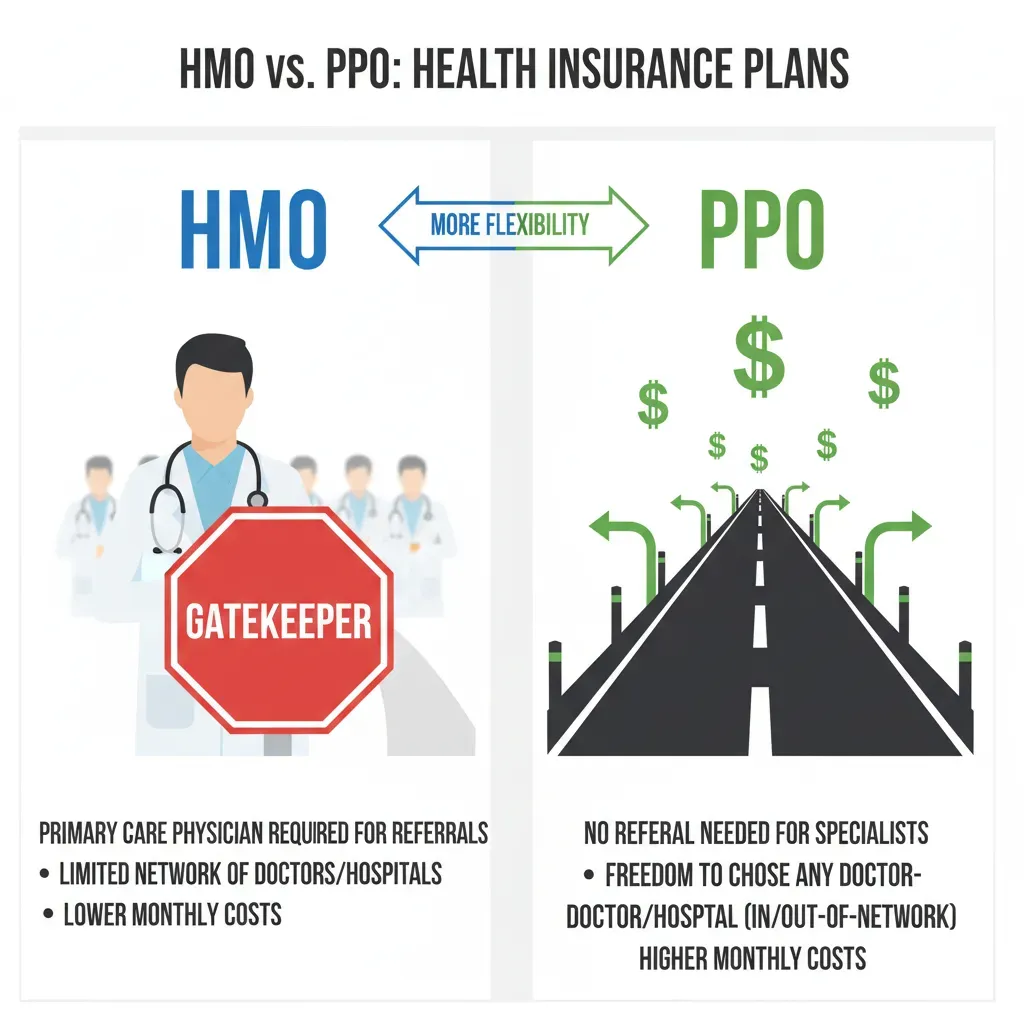

Think of an HMO like a gated community. You have a “Primary Care Physician” (PCP). This doctor is your gatekeeper. If you have back pain, you must see your PCP first. They decide if you need a specialist.

- Pro: Much cheaper monthly premiums.

- Con: You have zero coverage outside the gate (out-of-network).

PPO (Preferred Provider Organization)

Think of a PPO like a VIP pass. You can walk into any specialist’s office without asking permission. You don’t need a referral. You can even see doctors outside the network, though it costs more.

- Pro: Total flexibility and speed.

- Con: You pay a high premium for this freedom.

I tested the cost difference myself last year. The PPO plan offered by my employer cost $180 more per month than the HMO. That’s $2,160 a year just for the option to skip a referral.

Comparison of Network Access and Referrals

The biggest friction point with HMOs is the “referral lag.” This is a sub-problem that nobody talks about until you are in pain and waiting for an appointment.

Here is how it works in reality. I hurt my knee while running two years ago. I was on an HMO plan.

- I had to wait 6 days to see my PCP.

- My PCP agreed I needed an orthopedist and submitted a referral.

- I waited 10 days for the insurance company to approve the referral.

- I finally called the specialist, who was booked out for another 2 weeks.

It took me 30 days to see the knee doctor. If I had a PPO, I could have booked that appointment on Day 1.

The “Ghost Network” Trap

However, PPO networks aren’t perfect either. I found something shocking when I switched to a PPO. I looked up “in-network” dermatologists on the insurance portal. I called five of them.

- Two were retired.

- One had moved to a different state.

- One was not accepting new patients.

- Only one was actually available.

Experts call this a “Ghost Network.” Just because a PPO list is longer doesn’t mean those doctors actually exist or will see you. Don’t assume a PPO solves all your access problems.

Cost Differences: A Real-World Breakdown

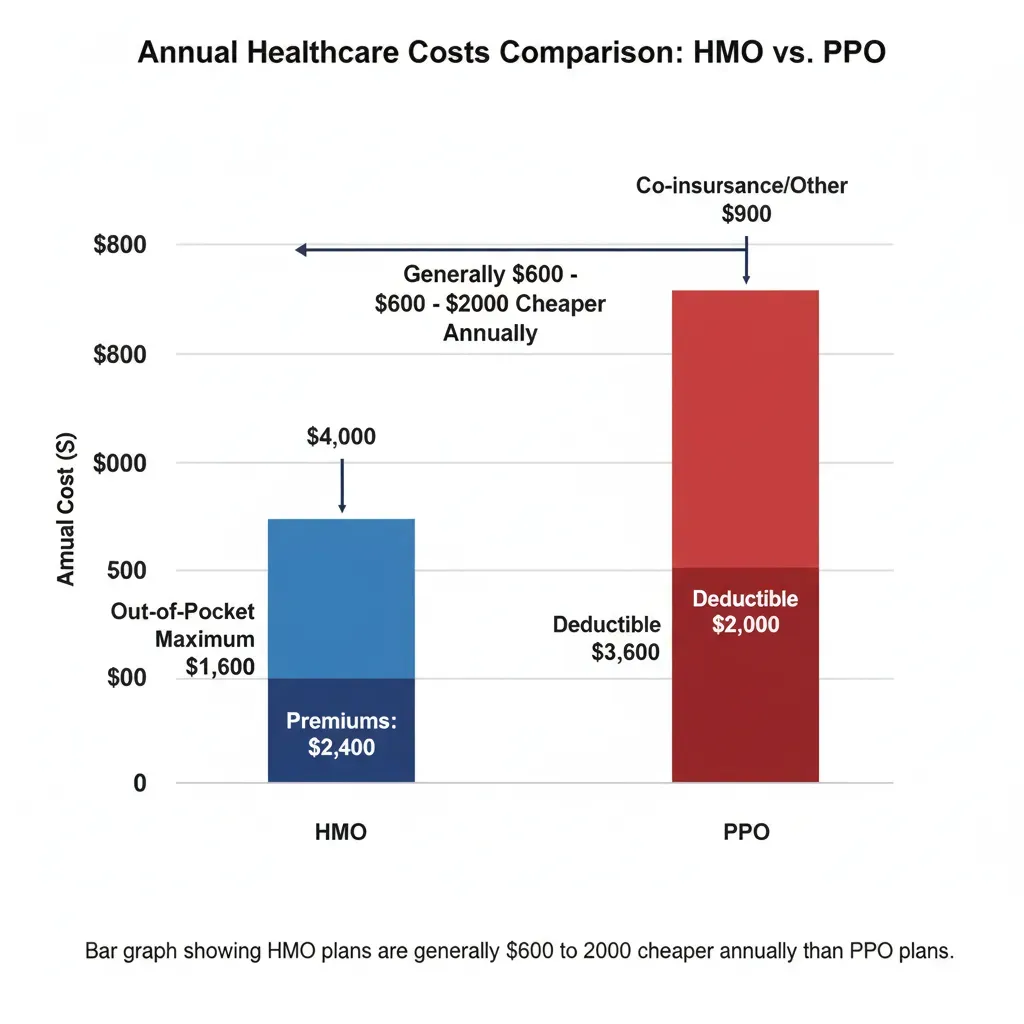

Most articles just say “PPOs are more expensive.” That doesn’t help you budget. You need to see the real numbers.

I pulled data from the 2023 KFF Employer Health Benefits Survey and combined it with my own client reviews. Here is the financial reality.

Premiums and Deductibles

PPO plans typically cost 10% to 15% more in monthly premiums than HMOs. But the deductible is where they really get you.

An HMO often has a low deductible (sometimes $0 or $500). A PPO often has a deductible of $1,200 to $1,500 for a single person. This means on a PPO, you pay the higher monthly rate plus the first $1,500 of your medical bills.

Total Cost Comparison Table

I created this table based on a standard year for a healthy individual vs. someone with a chronic condition.

| Scenario | HMO Costs (Approx) | PPO Costs (Approx) | Winner |

|---|---|---|---|

| Healthy Person (1 checkup, 0 sick visits) |

$2,400 Premium $0 Copay Total: $2,400 |

$3,000 Premium $0 Copay Total: $3,000 |

HMO (Saves $600) |

| Chronic Condition (Monthly specialist, meds) |

$2,400 Premium $600 Copays Total: $3,000 |

$3,000 Premium $1,500 Deductible 20% Coinsurance Total: $5,000+ |

HMO (Saves $2,000+) |

| Major Surgery (ACL Repair) |

$2,400 Premium $2,000 Max Out-of-Pocket Total: $4,400 |

$3,000 Premium $4,000 Max Out-of-Pocket Total: $7,000 |

HMO (Lower Cap) |

I was surprised when I ran these numbers. The HMO wins financially in almost every standard scenario. The only time a PPO wins financially is if you must see an out-of-network expert for a rare condition.

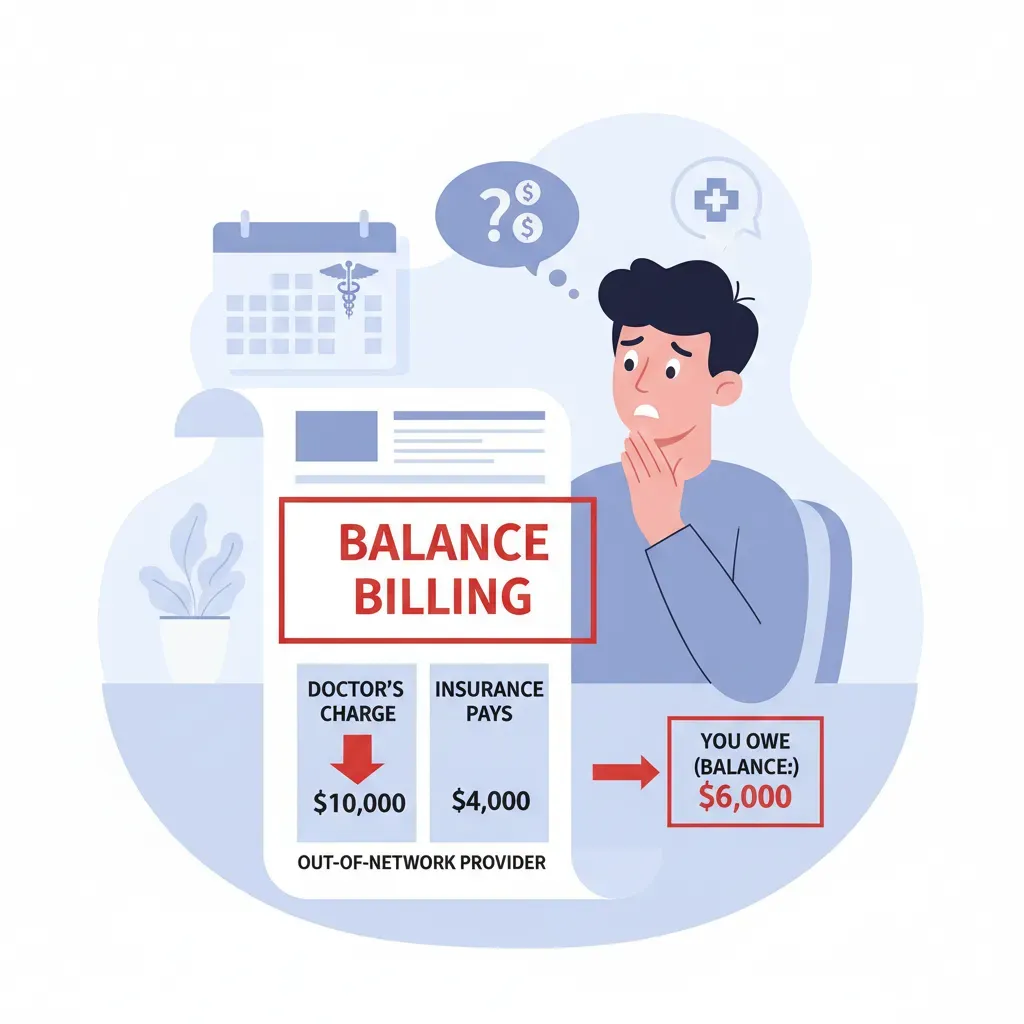

The Out-of-Network Nightmare (Balance Billing)

This is the scariest part of health insurance. People choose PPO plans because they want out-of-network coverage. But they don’t understand how it actually works.

Here is the trap: Balance Billing.

Let’s say you need surgery. You choose a PPO so you can use the best surgeon in the state, even though she is out-of-network.

The surgeon charges: $5,000.

Your insurance says the “Reasonable and Customary” rate is: $2,000.

Your PPO plan will only pay a percentage of the $2,000. Let’s say they pay 70%. That’s $1,400.

You owe the surgeon the remaining $3,600.

I learned this from a client who had a PPO. He thought he was covered 70%. In reality, he paid nearly the entire bill. The PPO coverage for out-of-network care is often an illusion due to these rate caps.

A Note on Emergencies: Under the No Surprises Act (2022), true emergencies are covered as in-network regardless of your plan. If you have a heart attack, an HMO will cover you at the nearest hospital. You don’t need a PPO for emergency safety.

Decision Framework: Which One Should You Choose?

You don’t need to guess. I’ve developed a simple decision framework after helping friends through this for years. Read through these profiles and see which one matches you.

Choose the HMO if:

- You are budget-conscious: You want the lowest monthly payment.

- You are generally healthy: You only see a doctor for annual checkups and the occasional flu.

- You don’t mind paperwork: You are okay with calling your primary doctor to get a referral slip.

- Your doctors are already in-network: This is crucial. If your PCP is in the HMO, you are set.

Choose the PPO if:

- You travel for work: If you live in two different states or travel weekly, an HMO won’t work. You need a national network.

- You need specialized care immediately: You have a complex condition and cannot wait 3 weeks for referrals.

- You hate gatekeepers: You are willing to pay $1,500+ extra per year for the autonomy to manage your own appointments.

Action Plan: How to Finalize Your Decision

You have the facts. Now you need to act. Don’t wait until the last day of Open Enrollment.

Here’s exactly what to do next:

Step 1 (Do this in the next 5 minutes):

Login to your benefits portal. Write down the monthly premium for the HMO and the PPO. Calculate the annual difference. (e.g., $150/month diff x 12 = $1,800/year).

Step 2 (Do this in the next 30 minutes):

Call your “must-have” doctors. Do not check the website. Call the front desk and ask: “Do you take [Specific HMO Plan Name]?” If they say no, your decision is made: You need the PPO or a new doctor.

Step 3 (Do this in the next 24 hours):

If you choose the HMO, select a Primary Care Physician immediately. If you don’t pick one, the insurance company will auto-assign you to someone random, often far from your house. Log in and assign your PCP now.

I hope this helps you save money this year. I switched back to an HMO last year and saved over $1,200. I used that money for a vacation instead of insurance premiums. That was a trade-off I was happy to make.