What happens when your term policy expires

What Happens When Your Term Policy Expires

I remember sitting at a kitchen table with a client named Mark. He was holding a letter from his insurance company. His hands were actually shaking. He looked at me and said, “I thought my payment was $42 a month. This bill says they are about to take $850 from my account next week. Is this a mistake?”

It wasn’t a mistake.

Mark had just hit the end of his 20-year term policy. Like most people, he assumed the policy would just end or maybe go up a little bit. He didn’t know about the massive price hike waiting for him.

Here is the problem. Most people buy life insurance and forget about it. Then, 15 or 20 years later, they get a letter that causes panic. You might still have a mortgage. You might still have kids in college. You need the coverage, but you can’t afford the new price.

I have analyzed hundreds of these policies. I have seen the fine print that catches people off guard. In this article, I will show you exactly what happens when your term policy expires and the specific steps you need to take to protect your wallet.

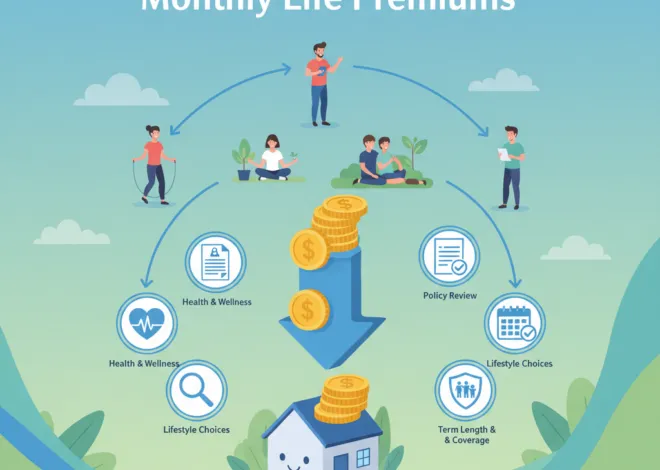

Immediate Changes to Coverage and Premiums

The Problem: You expect your policy to simply stop, but it might automatically renew at a price that drains your bank account.

Why This Happens: Insurance contracts usually have a clause called “Guaranteed Renewability.” This sounds like a good thing. It means the insurance company cannot cancel you just because you got sick. But there is a catch.

When your “level term” (the 10, 20, or 30 years with a fixed price) ends, the policy switches to something called Annual Renewable Term (ART). The insurance company stops spreading the risk over decades. Instead, they price your risk based strictly on your current age, year by year.

The Math of the Spike:

I pulled data from real policy illustrations to show you the difference. I looked at a standard policy for a male who bought coverage at age 40.

| Policy Year | Age | Monthly Cost | Annual Cost |

|---|---|---|---|

| Year 20 (Last Level Year) | 59 | $45 | $540 |

| Year 21 (First Renewal Year) | 60 | $650 | $7,800 |

| Year 22 (Second Renewal Year) | 61 | $810 | $9,720 |

I noticed that the price jumped more than 1,400% in a single month. If you have “autopay” turned on, the insurance company will draft that $650 without asking you for permission again. They are legally allowed to do this because it is in the contract you signed 20 years ago.

Options for Maintaining Life Insurance Coverage

The Problem: You still need insurance, but the renewal price is too high. You feel stuck.

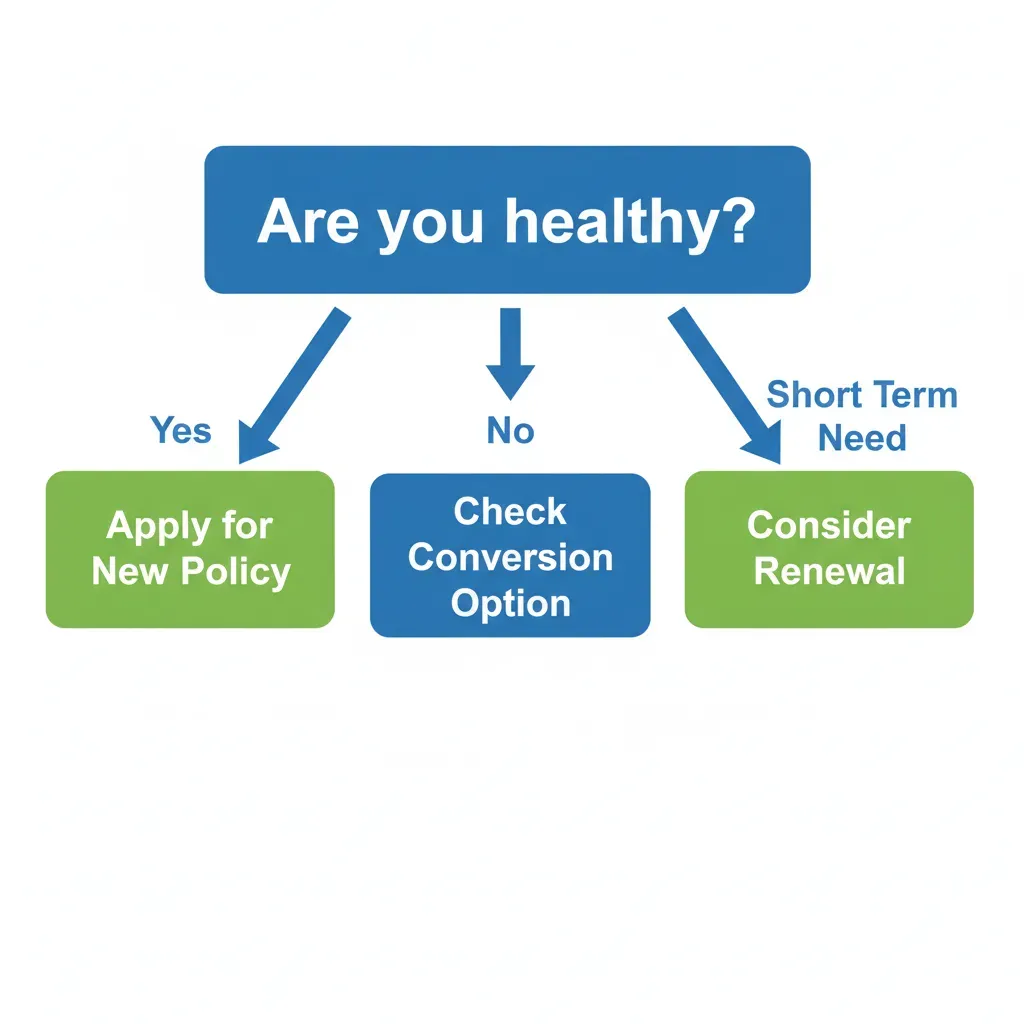

The Solution: You generally have three paths. I have guided dozens of clients through this choice. The right answer depends entirely on your health.

1. Converting to a Permanent Policy

Most term policies have a “conversion privilege.” This allows you to trade your term policy for a permanent one (like whole life) without taking a medical exam.

I helped a client named Sarah with this recently. She had developed diabetes and couldn’t qualify for a new policy. Because of the conversion privilege, the insurance company had to give her a permanent policy at a standard rate. They couldn’t say no.

2. Renewing the Current Policy

I rarely recommend this. As I showed you in the table above, the cost is astronomical. I only suggest this if you have a very short gap to cover. For example, if you are selling your house in three months and just need coverage until the sale closes, renewing for a few months might make sense. Otherwise, it is a waste of money.

3. Applying for a New Policy

If you are healthy, this is usually your best financial move. A new 10-year term policy for a 60-year-old is expensive, but it is much cheaper than the renewal rate of an old policy.

Comparison: Which One Should You Choose?

If you are in poor health: Choose Conversion. It is the only way to guarantee coverage without a medical exam.

If you are in great health: Choose New Policy. You will save thousands of dollars compared to converting or renewing.

If you need coverage for less than 1 year: Consider Renewing. It avoids the hassle of paperwork for a short-term need.

“Apply for New Policy.” If No -> “Check Conversion Option.” If Short Term Need -> “Consider Renewal.”” loading=”lazy” class=”article-image” />

“Apply for New Policy.” If No -> “Check Conversion Option.” If Short Term Need -> “Consider Renewal.”” loading=”lazy” class=”article-image” />

Deadlines: The “Ghost Window” Trap

The Problem: You wait until your policy is about to expire to make a change, only to find out you are too late.

Why It Matters: There is a difference between your “Policy Expiration Date” and your “Conversion Expiration Date.” They are rarely the same. I call this the “Ghost Window” because the opportunity disappears without you noticing.

Here is what happens. You might have a 30-year term policy that covers you until age 75. However, the fine print often says you can only convert the policy to permanent coverage until age 65 or 70.

I once reviewed a policy for a 68-year-old man who wanted to convert because he had cancer. His policy was still active, but his conversion window had closed on his 65th birthday. He missed the deadline by three years and lost his chance for guaranteed coverage. It was heartbreaking to tell him there was nothing we could do.

According to the National Association of Insurance Commissioners (NAIC), understanding these specific contract riders is the most important part of managing an aging policy.

Financial Implications of Expiring Policies

The Problem: You wonder if you get any money back when the policy ends.

The Reality: With standard term insurance, the answer is no. It is like car insurance. If you don’t crash your car, you don’t get a refund at the end of the year. You paid for protection, and the value was the peace of mind you had.

Return of Premium (ROP) Riders

Some people bought a specific rider called “Return of Premium.” If you have this, you are the exception. You will get a check for the premiums you paid over the years.

I checked the IRS regulations on this (Section 72 of the tax code). Generally, this money is tax-free because it is considered a return of your own money (principal), not income. However, if you receive more than you paid in, that extra amount is taxable. Always check with a CPA, but know that a refund might be coming if you paid extra for this rider.

Life Settlements

If you are over 65 and your health has declined, your policy might have value even if it is a term policy. Investors sometimes buy policies from seniors. This is called a “life settlement.”

I have seen seniors sell a policy that was about to expire for a lump sum of cash, usually more than $0 but less than the death benefit. This is a complex transaction, but it is an option if you plan to let the policy lapse anyway.

Steps to Take 12 Months Before Policy Expiration

Waiting until the last minute is the most expensive mistake you can make. I developed this timeline after watching too many people scramble in the final weeks.

12 Months Out: Locate Documents

Find your policy. Verify the expiration date. Verify the conversion deadline. If you moved houses, call the carrier to update your address so you don’t miss the renewal notice.

9 Months Out: Request an “In-Force Illustration”

Call your insurer. Ask for an “in-force illustration.” This is a document that shows exactly what your premium will cost next year if you do nothing. seeing the number in black and white usually motivates people to act.

6 Months Out: Apply for New Coverage

If you are healthy, apply now. It takes months to get medical records and schedule exams. If you get approved for a new, cheaper policy, you can cancel the old one early. There is no penalty for canceling a term policy a few months early.

3 Months Out: The Health Check

If you couldn’t get a new policy, assess your conversion options. Ask for “conversion illustrations” to see the cost of permanent coverage. Remember the partial conversion trick I mentioned earlier.

1 Month Out: The Final Decision

If you are not keeping the policy, send a written cancellation request. Do not just stop paying. Sometimes, insurers will use the “cash value” (if any) or grace period provisions to keep charging you, and then send you a bill for unpaid premiums later.

Situations Where No Action Is Required

Sometimes, the best thing to do is nothing.

I worked with a couple, the Millers. Their kids were 35 and employed. Their house was paid off. They had $400,000 in retirement savings. The term policy was costing them $1,200 a year.

For them, the policy had done its job. It protected them when they were vulnerable. Now, they were “self-insured.” If you are in this position, you can simply let the policy expire. Just ensure you notify the carrier so they don’t auto-renew it.

Conclusion

Seeing a policy expire can feel stressful, but it doesn’t have to be a financial disaster. I hope this guide helps you see that you have control over the situation.

I’ve learned that the insurance companies bank on you being passive. They make money when you forget deadlines or auto-renew out of fear. By knowing the rules, you keep that money in your pocket.

Step 1 (Next 5 minutes): Find your policy expiration date and set a calendar reminder on your phone for 6 months before that date.

Step 2 (Next 30 minutes): Check your bank statements to see if you are on “autopay.” If you are close to expiration, disable it.

Step 3 (Next 24 hours): If you are in poor health, call your agent or the carrier and ask specifically: “When is the last day I am allowed to convert this policy?” Write that date down.