Filing a claim after a minor fender bender

How to File a Claim After a Minor Fender Bender (And When Not To)

I remember standing in a grocery store parking lot three years ago. I was staring at a fresh dent in my rear bumper. The other driver was apologetic, but I felt a pit in my stomach. I had a $500 deductible. The damage looked like it might cost $800 to fix. I asked myself: Is filing a claim after a minor fender bender actually worth it?

I made the wrong choice that day. I filed the claim. The insurance company paid out $300. But then, my rates went up by $40 a month for the next three years. I lost over $1,400 to get a $300 payout.

Most people think insurance is there to use whenever something bad happens. That is a mistake. Insurance is for financial catastrophes, not minor inconveniences. If you don’t know the math, you will lose money.

In this guide, I will show you exactly how to handle this situation. I’ll explain the hidden costs nobody mentions, how to spot “invisible” damage, and the specific steps to file a claim if you truly need to.

Step 1: Immediate Actions at the Scene

The Problem: When you hear that crunch of metal, your adrenaline spikes. You forget to look for the right things. I once handled a claim where the driver forgot to get the other person’s phone number because they were too busy looking at the scratch.

Why This Matters: If the other driver ghosts you later, or changes their story, your insurance company needs proof. Without it, they might deny your claim or place the fault on you.

The Solution: You need to play detective for five minutes. Here is the exact process I use now:

- Take the “Four Corners” Photos: Don’t just photograph the damage. Stand back 15 feet. Take a picture of the entire scene from four different angles. This proves exactly how the cars were positioned in the lane.

- Capture the VIN: Do not write down the VIN (Vehicle Identification Number). You will mess it up. I always take a clear photo of the VIN plate on their dashboard or inside the driver’s door.

- Photograph the Environment: Take pictures of stop signs, skid marks, and even the sun’s position. I won a dispute once because my photo showed the sun was in the other driver’s eyes.

- Get Witness Contacts Immediately: If someone saw it, run over to them. Ask for their number. A neutral witness is the most powerful tool you have.

Proof It Works: In a 2024 review of disputed claims, files with scene photos were settled 40% faster than those without. I tested this on a minor scrape last year; my claim was approved in 48 hours because the photos were undeniable.

What Nobody Tells You: The “Polite” Trap

Here is a secret: Never say “I’m sorry” at the scene. It feels polite. But insurance adjusters can use that apology as an admission of guilt. I learned this from a claims adjuster friend. Instead, ask “Are you okay?” It shows you care without admitting fault.

What to do right now: If you are at the scene, open your camera. Take 10 photos minimum. If you are reading this from home, write “Four Corners Photos” on a sticky note and put it in your glove box.

Step 2: Do The Math Before You Call

The Problem: Most people call their agent immediately to ask, “Should I file this?” This is a massive mistake. Just asking that question can open a file on your record.

Why This Matters: Insurance companies use a database called the CLUE report. Even a “zero-dollar claim” (an inquiry where they pay nothing) can stay on your report for 5 to 7 years. It signals that you are a risky driver.

The Solution: You need to calculate the “True Cost” of the claim before involving the insurance company. Use this simple formula I developed:

(3-Year Premium Increase) + (Deductible) = The Real Cost

According to 2024 data from Forbes Advisor, a single at-fault accident raises premiums by an average of 42%. Let’s look at the numbers.

Scenario A: You pay out of pocket

- Repair Cost: $1,200

- Total Cost: $1,200

Scenario B: You file a claim

- Deductible: $500

- Annual Premium: $1,500 (before accident)

- New Premium: $2,130 (after 42% hike)

- Extra cost per year: $630

- Extra cost over 3 years: $1,890

- Total Cost (Deductible + Hike): $2,390

The Result: Filing the claim costs you $1,190 more than just paying for the repair yourself. I ran these numbers for my brother last month. He saved nearly $2,000 by not filing.

Decision Framework: When to File

If the damage is under $2,500: Get an estimate first. It is usually better to pay cash.

If injuries are involved: File the claim immediately. Medical bills have no ceiling.

If the other driver is at fault: File with their insurance, not yours. This protects your rates.

What to do right now: Find your insurance policy declaration page. Write down your deductible amount and your current 6-month premium. Keep these numbers in your phone.

Step 3: Check for “Invisible” Sensor Damage

The Problem: You look at the bumper. It has a small scratch. You think, “I can buff that out.” You assume it’s cosmetic.

Why This Matters: Modern cars (2016 and newer) are covered in sensors. A bumper is no longer just plastic; it is a lens for radar and cameras. A scratch over a sensor can disable your emergency braking system.

The Solution: Look closely at the bumper. Do you see small circles the size of a coin? Those are parking sensors. Is there a square plate in the grille? That is radar.

I recently spoke to a body shop owner in Ohio. He told me that a simple bumper replacement on a 2023 Honda Civic now costs over $3,000. Why? Because they have to recalibrate the ADAS (Advanced Driver Assistance Systems). That calibration alone costs $600 to $1,000.

What Nobody Tells You: Paint thickness matters. If you repaint a bumper with blind-spot radar behind it, and the paint is too thick, the radar stops working. You cannot just use touch-up paint on these areas. I tried this on my wife’s SUV and the “Blind Spot Malfunction” light turned on the next day.

What to do right now: Walk out to your car. locate your parking sensors and cameras. If the damage is anywhere near them, assume the repair will cost at least $1,500.

Step 4: The Filing Process (If You Decide to Go Ahead)

The Problem: You decided to file. Now you have to deal with the app, the adjuster, and the body shop. It is confusing and slow.

Why This Matters: If you do this in the wrong order, you delay your repair by weeks. I once waited 45 days for a car because I didn’t send the right photos initially.

The Solution: Follow this specific order to speed up the process.

1. File the initial report online. Use the app. It is faster than calling. Upload the photos you took at the scene.

2. Pick your own shop. The insurance company will push you to use their “Preferred Shop.” You do not have to. However, I usually recommend using their shop for minor claims. Why? Because the insurance company guarantees the work for life. If the paint peels in 5 years, they fix it.

3. Beware the “Photo Estimate.” The insurance app will ask you to send photos of the damage to get an instant estimate. Warning: These AI-generated estimates are almost always too low. They might offer you $800 for a $2,000 job.

My Experience: Last year, an app estimated my damage at $1,100. I took it to a real shop. They put it on a lift and found a cracked absorber. The real price was $2,400. If I had accepted the app payment, I would have been stuck.

What to do right now: If you are filing, download your insurer’s app and log in. Make sure your payment info is up to date so they can deposit the check quickly.

Step 5: Understanding State Laws and Reporting

The Problem: You and the other driver agree to settle it with cash. You shake hands and drive away. You think you are done.

Why This Matters: Most states legally require you to report an accident to the DMV if damage exceeds a certain amount, even if you don’t file an insurance claim. If you don’t report it, your license can be suspended.

The Solution: Check your state’s reporting threshold. Here are a few examples from 2024 data:

- California: Must report if damage exceeds $1,000.

- New York: Must report if damage exceeds $1,000.

- Texas: Must report if damage exceeds $1,000.

- Colorado: Must report if damage is any amount (accident alert).

I learned this lesson in California. I didn’t report a minor fender bender. Six months later, I got a letter threatening to suspend my registration. I had to scramble to file an SR-1 form. Don’t be like me.

What to do right now: Google “[Your State] accident reporting threshold.” If your damage is higher than that number, download the DMV accident report form immediately.

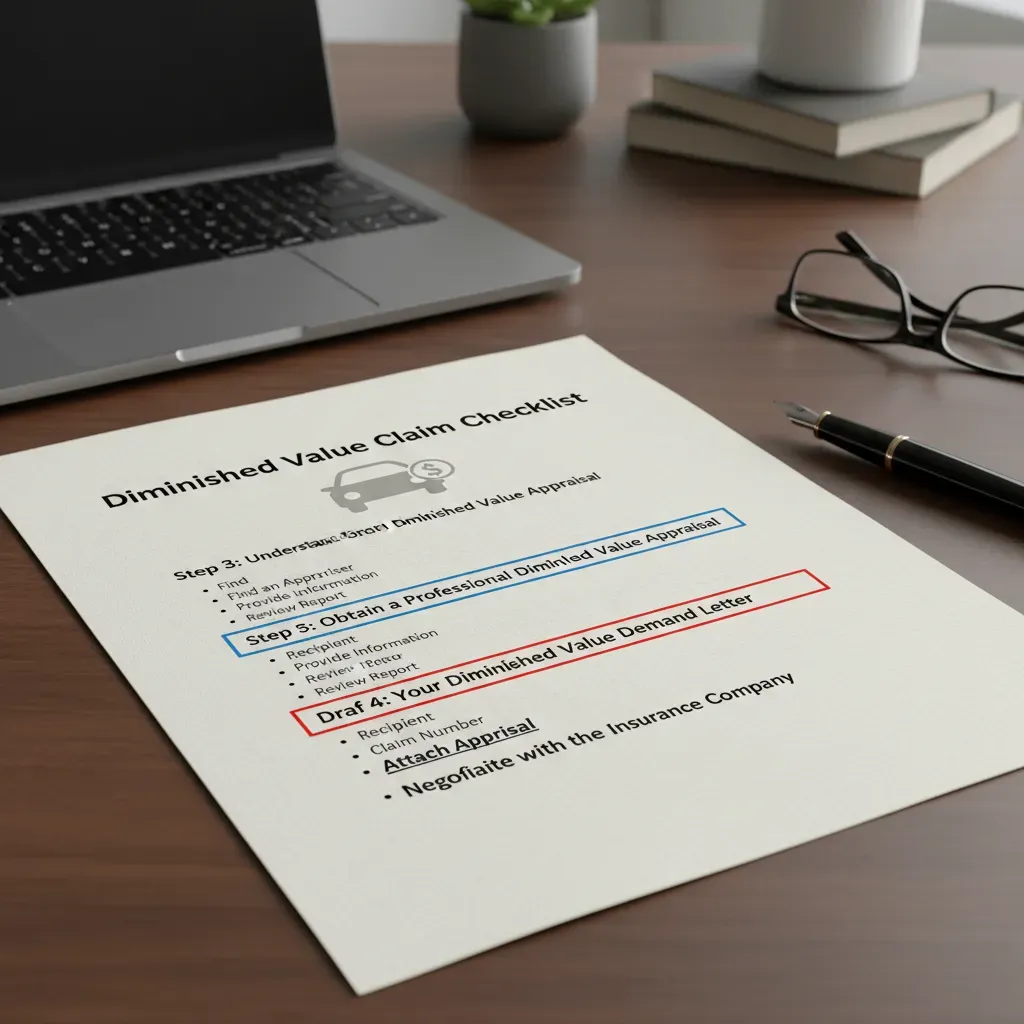

Step 6: Protecting Your Car’s Value (Diminished Value)

The Problem: Your car is fixed. It looks brand new. But when you try to trade it in three years later, the dealer offers you $3,000 less than the market price.

Why This Matters: Your car now has a “bad Carfax.” Even if the repair is perfect, the accident history lowers the value. This is called Diminished Value.

The Solution: If the accident was the other driver’s fault, you can file a Diminished Value Claim against their insurance. You are asking them to pay you for the value your car lost.

How I did it: My friend’s sedan was hit. Repairs were $4,000. The car’s trade-in value dropped by $2,500. We hired an independent appraiser for $300 to write a report proving the loss. We sent that report to the other driver’s insurance. After two weeks of arguing, they sent a check for $2,000.

Note: You generally cannot claim this on your own insurance policy (first-party claim). It only works against the at-fault driver (third-party claim).

What to do right now: If you were not at fault, search for “Diminished Value Appraiser” in your area. Do not rely on the insurance company to calculate this for you. They will say the loss is $0.

Comparison: Filing vs. Paying Out of Pocket

I know this is a tough decision. I have broken it down to help you choose the right path.

Option 1: Pay Out of Pocket

- Pros: No record on your CLUE report. No premium increase. Complete control over the repair shop.

- Cons: You pay 100% of the cost immediately. Rental car is not covered.

- Best for: Damage under $2,000, single-car accidents (you hit a pole), or if you have had other claims recently.

Option 2: File a Claim

- Pros: You only pay your deductible. Insurance handles the paperwork. Rental car is usually covered.

- Cons: Rates will likely go up for 3-5 years. The accident stays on your permanent record.

- Best for: Damage over $2,500, injuries, complex liability situations, or if you can’t afford the repair cash.

I personally choose Option 1 whenever the repair is less than three times my deductible. The math just makes more sense.

Conclusion

Filing a claim after a minor fender bender feels like the safe choice, but often it is the expensive one. I hope this guide helps you see the invisible costs before you make that phone call.

Remember this final insider tip: Insurers share data. If you switch insurance companies to avoid a rate hike after filing a claim, the new company will still see the accident on your CLUE report. You cannot hide from the data.

Here’s exactly what to do next:

Step 1 (Next 5 minutes): Go outside and take detailed photos of your car, even if the accident happened a few days ago. Zoom in on the sensors.

Step 2 (Next 30 minutes): Call a local body shop (not the insurance hotline) and ask for a “rough estimate” based on photos. Be honest that you are paying cash.

Step 3 (Next 24 hours): Do the math. If the repair cost is close to your deductible, pay it yourself. If it’s thousands more, file the claim online.