Steps to convert term life to whole life

Steps to Convert Term Life to Whole Life Insurance

I remember sitting across from a client named Mark a few years ago. He was 64 years old. He had a $1 million term life policy that he bought when he was 44. He felt safe because his policy documents said the term didn’t expire until he was 74.

But when I looked at the fine print, my stomach dropped.

Mark had developed Type 2 diabetes and high blood pressure in his 50s. He couldn’t qualify for a new policy. His only option was to convert his existing policy. But there was a catch. His “conversion privilege” expired at age 65-not 74.

If he had waited six more months, he would have lost the ability to keep his coverage forever.

I see this happen constantly. People think they have time, but the rules are tricky.

The problem is simple: Most people wait too long or get scared away by high prices because they don’t know how to negotiate the conversion.

In this guide, I will walk you through the specific steps to convert term life to whole life insurance. I’ll share the shortcuts I’ve learned over 15 years, including how to lower the cost and avoid a medical exam completely.

1. Verify the Conversion Rider in Your Policy

The Problem: Most people assume their right to convert lasts as long as the policy does. This is rarely true.

Why It Matters: If you miss the conversion deadline by even one day, the insurance company will require a new medical exam. If your health has changed, you could be denied.

The Solution: You need to find the specific “Conversion Expiration Date.” It is almost always different from your policy expiration date.

I recently reviewed a 30-year term policy for a client. The term ended in 2040. But the conversion rider ended in 2030 (at age 70). He had 10 fewer years than he thought.

What Nobody Tells You:

Watch out for the “first 10 years” rule. I’ve seen many 20-year term policies that only allow you to convert during the first 10 years. If you try to convert in year 11, you’re out of luck. Check this immediately.

What to do right now:

Go find your original policy paperwork. Look for a section titled “Conversion Privilege” or “Right to Convert.” If you can’t find it, call customer service and ask this exact question: “What is the exact date my conversion privilege expires?” Write that date on your calendar.

2. Request a “Conversion Illustration”

The Problem: When you call to ask about permanent coverage, agents often try to sell you a brand new policy instead of converting your old one.

Why It Matters: Agents usually make a large commission on new policies (sometimes 90-100% of the first year’s premium). They make very little on conversions (often 5% or less). If you apply for a new policy, you have to take a medical exam. If you fail that exam, it goes on your permanent record (MIB report).

The Solution: Be firm. Tell the agent you want to exercise your conversion option. Do not agree to a new medical exam if your health has declined.

I once had a client with a history of cancer. An agent tried to convince him to apply for a new policy to “save money.” It was bad advice. We stuck to the conversion. He kept his “Preferred” health rating from 15 years ago, even though he was now a cancer survivor.

Comparison: Conversion vs. New Policy

| Feature | Converting Old Policy | Buying New Policy |

|---|---|---|

| Medical Exam | None (Guaranteed) | Required (Blood/Urine) |

| Health Rating | Based on past health | Based on current health |

| Cost | Higher (usually) | Lower (if healthy) |

| Speed | 2-3 weeks | 6-10 weeks |

Decision Framework:

If you are in perfect health: Shop for a new policy first. It might be cheaper.

If you have any health issues: Convert your current policy. It locks in your old health rating.

Your next step:

Email your carrier. Subject line: “Request for Conversion Illustration.” Body: “Please send me illustrations for converting my term policy to whole life. I want to see options for the full amount and for $100,000.”

3. Choose Between Full or Partial Conversion

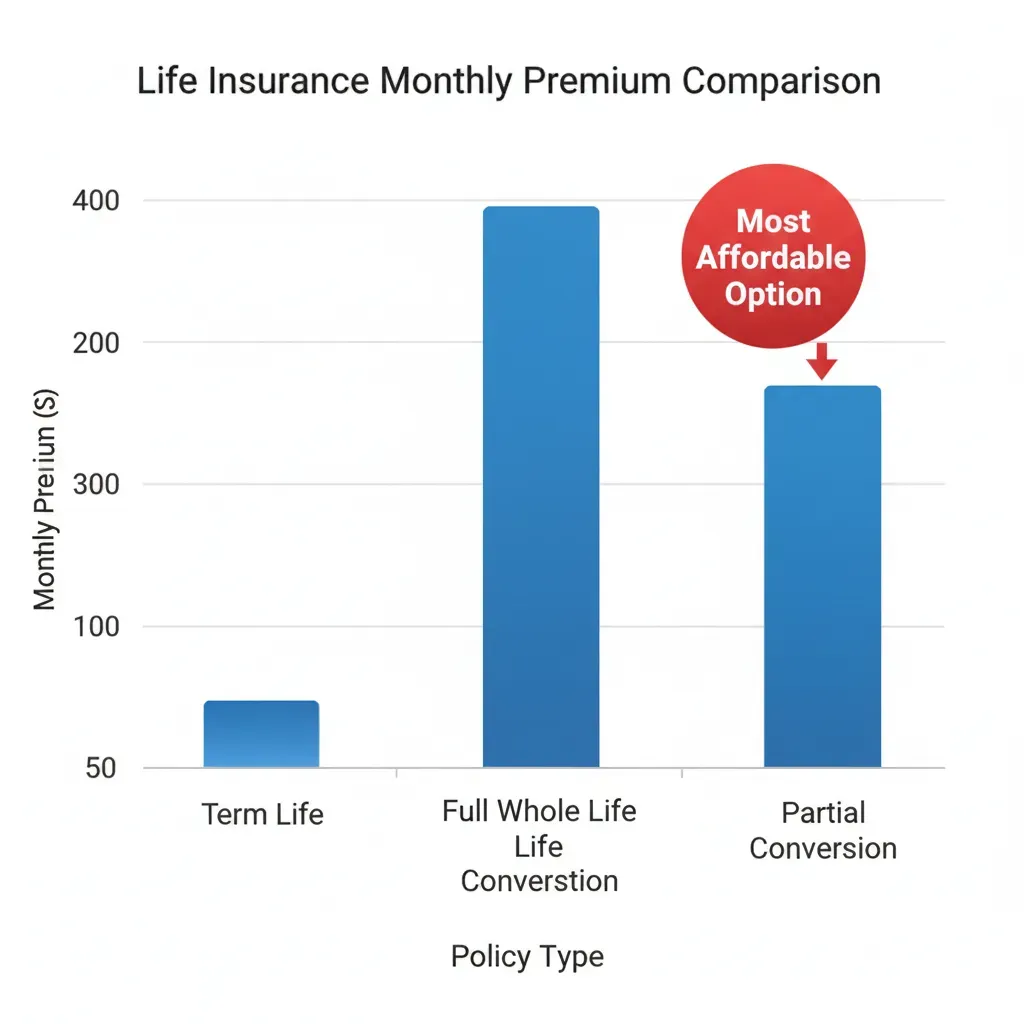

The Problem: Sticker shock. You are paying $50 a month for term life. The quote for whole life comes back at $600 a month. You panic and do nothing.

Why It Matters: Whole life insurance builds cash value and lasts forever. That costs money. According to Forbes Advisor (2024), whole life premiums can be 5 to 10 times higher than term. If you think it’s “all or nothing,” you will likely drop the coverage entirely.

The Solution: Use a “Partial Conversion.” You don’t have to convert the whole thing. You can convert just a slice of it.

I helped a young father named David with this recently. He had a $1 million term policy. He wanted permanent coverage but couldn’t afford $900/month.

Here is exactly what we did:

- We converted $100,000 to whole life (Cost: $120/month).

- We kept $900,000 as term insurance (Cost: $45/month).

- Total cost: $165/month.

This gave him a permanent death benefit for final expenses, but kept his family protected with the large term policy for the next 15 years. It was affordable and safe.

What Nobody Tells You:

You can “ladder” your conversions. You can convert $50,000 today, another $50,000 in three years, and another chunk five years later. As long as you finish before the deadline (usually age 65 or 70), you can split it up to match your rising income.

Try this today:

Look at your budget. Determine the maximum monthly amount you can pay. Ask the agent to “solve for premium.” Tell them, “I can afford $200 a month. How much permanent death benefit does that buy me?”

4. Select Your Premium Calculation Method

The Problem: Most people don’t know there are two ways to calculate the price. They just accept the first number they see.

Why It Matters: The method you choose changes your cash flow immediately.

The Solution: You need to decide between “Attained Age” and “Original Age.”

Option A: Attained Age (Most Common)

The insurance company calculates your new premium based on your current age. If you are 50, you pay the rate for a 50-year-old.

- Pros: No upfront cost. You just start paying the new monthly bill.

- Cons: The monthly bill is higher because you are older.

Option B: Original Age (The “Time Machine” Method)

The company calculates the premium based on the age you were when you bought the term policy. If you bought it at 30, you pay the rates of a 30-year-old forever.

- Pros: Much lower monthly payments. Higher immediate cash value.

- Cons: You have to pay a “lump sum” to catch up. You must pay the difference in premiums between what you paid (term) and what you should have paid (whole life) for all those years, plus interest.

I ran the numbers for a client last year. To get the “Original Age” rate, he had to write a check for $24,000. For most people, this isn’t realistic. But if you have cash sitting in a low-interest savings account, this can instantly create equity in the policy.

What to do right now:

Ask your agent for an “Original Age Conversion quote.” It costs nothing to look. If the lump sum is too high, stick with Attained Age.

5. Check for “Conversion Credits”

The Problem: You are leaving free money on the table. Carriers often have incentives they don’t advertise.

Why It Matters: A conversion credit can save you hundreds or even thousands of dollars in the first year.

The Solution: Ask specifically about a “term conversion credit.”

Here is how it works: Some carriers will take the term premiums you paid in the last 12 months and apply them as a discount to your new whole life policy.

Real Example:

I worked with a woman converting a policy with New York Life. She had paid about $800 in term premiums that year. When she converted, the company credited that $800 toward her new whole life premium. It effectively made her first two months of the new policy free.

Insider Truth:

This credit usually only applies if you convert in the first few years of the policy (often years 1-5). If you are at the end of your term, this credit might not exist. But you must ask. I have seen agents forget to apply this credit, costing the client money.

Your next step:

Send a text to your agent: “Does this carrier offer a conversion credit for premiums I paid this year?”

6. Submit the Paperwork (No Exam Required)

The Problem: Anxiety about the application. People worry they will accidentally say something that triggers a medical review.

Why It Matters: The main benefit of conversion is the “guaranteed insurability.” You want to protect that.

The Solution: Fill out the specific “Conversion Application.” It is much shorter than a regular application.

When you fill this out, pay attention to the “Health Questions” section. In a true conversion application, there should not be health questions. If the form asks about your weight, smoking status, or cancer history, stop. You might be filling out the wrong form.

My Experience:

I once caught a mistake where a carrier sent a “Reinstatement Application” instead of a “Conversion Application.” The Reinstatement form asked about heart conditions. If my client had signed it, he would have been denied. I called the carrier, got the correct form (which had zero health questions), and the policy was issued in two weeks.

What Nobody Tells You:

Your “contestability period” might not reset.

Every new life insurance policy has a 2-year period where they can deny claims for suicide or material misrepresentation. However, when you convert, many companies count the time you already served. If you’ve had the term policy for 5 years, your new whole life policy is often “incontestable” from Day 1. This is a massive safety feature.

What to do right now:

Review the application. If you see medical questions, call your agent immediately and ask why. Do not sign until you confirm it is a conversion application.

Factors That Competitors Often Overlook

The “Group Term” Trap

If you have life insurance through your job (Group Term), the rules are brutal. Usually, if you leave your job, you only have 31 days to convert that policy to an individual whole life plan.

I’ve seen dozens of people miss this window because they were busy moving or starting a new job. If you miss that 31-day window, the coverage is gone forever. Mark your calendar the day you hand in your resignation.

The “Unrated” Advantage

If you were a smoker when you bought your term policy, but you quit 3 years ago, do not just convert.

Why? Because a conversion keeps your old health rating. You will be converting to a “Smoker” whole life policy, which is incredibly expensive.

The Better Path: Apply for a new policy first with a medical exam to prove you are smoke-free. You could save 50% or more. Only convert if you fail the new exam.

Conclusion

Converting term life to whole life is one of the most powerful financial moves you can make if your health has declined. It feels expensive at first, but it guarantees a payout to your family.

I have never met a widow who complained that the premiums were too high. I have only met widows who wished their spouse hadn’t let the policy lapse.

Here’s exactly what to do next:

Step 1 (Next 5 minutes):

Log into your insurance portal or find your paper contract. Locate the “Conversion Expiration Date.” It is likely age 65 or 70. Write it down.

Step 2 (Next 30 minutes):

Email your agent. Ask for a “Conversion Illustration” for a partial amount ($50k or $100k) and the full amount. This gives you budget options.

Step 3 (Next 24 hours):

Check your bank account. Determine exactly how much monthly cash flow you can allocate to this. Do not stretch yourself too thin-a lapsed whole life policy is a waste of money.