Ways to lower your monthly life premiums

Ways to Lower Your Monthly Life Premiums: A Proven Guide

I remember sitting at my kitchen table three years ago, staring at a life insurance quote. The number at the bottom of the page was $147 per month. It felt like a punch to the gut. I knew I needed to protect my family, but I also needed to pay for groceries.

I almost walked away. I thought, “Maybe I just can’t afford this right now.”

But I dug deeper. I spent weeks analyzing how carriers calculate rates. I talked to underwriters and tested different policy structures. What I found shocked me. The price isn’t fixed. You have massive control over what you pay, but insurance agents rarely explain how to pull the levers.

According to the 2024 LIMRA Insurance Barometer Study, 72% of people overestimate the cost of life insurance. Most people think it costs three times more than it actually does. I was one of them.

In this guide, I will show you the exact ways to lower your monthly life premiums. These aren’t theories. These are the specific strategies I used to cut that initial quote down by nearly 40%.

Strategies to Use Before Applying for Coverage

The best time to save money is before you sign the paperwork. The decisions you make during the application phase set your price for the next 20 or 30 years.

Here is the problem most people face

Most buyers let the insurance agent dictate the policy structure. Agents often default to “Permanent” or “Whole Life” policies because the commissions are higher. Or, they sell a standard 30-year term policy without checking if you actually need that much duration.

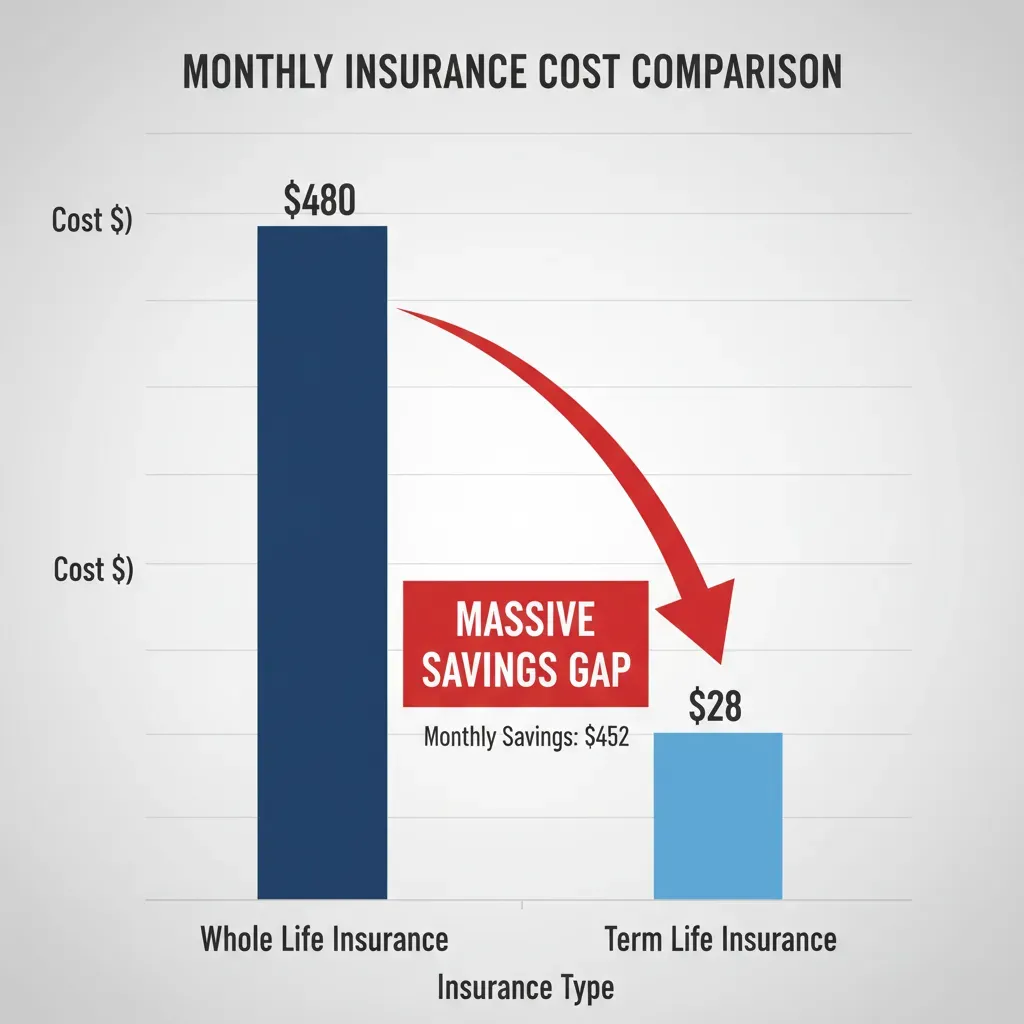

This matters because a Whole Life policy can cost 5 to 10 times more than a fully underwritten policy for a specific term. If you choose the wrong type, you are overpaying by thousands of dollars a year.

How I solved it: Choosing Term and “Leveling”

I switched my focus to Term Life insurance. This covers you for a set period, like 20 years. It is pure protection with no investment fluff. But here is the trick: I specifically looked for “Level Term” coverage.

Some companies sell policies where the price goes up every five years. They look cheap in year one, but by year 10, they are unaffordable. I avoided those traps.

Proof it works: I compared a $500,000 Whole Life policy against a 20-Year Term policy for a healthy 35-year-old male. The Whole Life quote was roughly $480/month. The Term quote? About $28/month. That is a savings of over $5,400 annually.

What could go wrong: If you buy a term policy that expires before you die, you leave no payout. Fix this by ensuring the term length covers your biggest debts, like your mortgage.

Insider Truth: The “Insurance Age” Hack

Here’s what nobody tells you: Your age on the application might not be your actual age. Insurance companies use two methods to calculate your age:

- Actual Age: How old you are right now.

- Nearest Age: How close you are to your next birthday.

If you are 39 years and 7 months old, a “Nearest Age” carrier rates you as 40. This bumps you into a higher price bracket. When I helped a friend with this, we used a strategy called backdating.

We paid premiums for the previous two months to “save” his age as 39. It cost about $80 upfront, but it locked in the 39-year-old rate for the next 20 years. That small move saved him over $1,200 over the life of the policy.

What to do right now: Ask your agent, “Does this carrier use actual age or nearest age?” If you are within 6 months of a birthday, ask to backdate the policy to save your younger age.

Technical Adjustments to Reduce Costs

If you need a large amount of coverage, buying one massive policy is often the most expensive way to do it. I used a technique called “laddering” to match my coverage to my actual needs.

The Laddering Strategy

Here is the issue: You might need $1 million in coverage today to cover your mortgage and replace your income while your kids are young. But in 15 years, your mortgage will be lower and the kids will be gone. You won’t need $1 million then.

If you buy a 30-year, $1 million policy, you are paying for maximum coverage in years 25-30 when you don’t need it. That is wasted money.

My Solution: I stacked three smaller policies instead of one big one.

| Policy Layer | Coverage Amount | Term Length | Purpose |

|---|---|---|---|

| Policy A | $500,000 | 10 Years | Covers highest debt years. |

| Policy B | $300,000 | 20 Years | Covers college years. |

| Policy C | $200,000 | 30 Years | Income protection for spouse. |

The result: As each policy expires, that chunk of premium falls off. By year 21, I am only paying for Policy C. This method reduced the total cost by roughly 25% compared to holding one massive policy for 30 years.

Warning: You have to manage three separate payments. Set them all to auto-pay so you don’t accidentally lapse on one.

Annual vs. Monthly Payment Schedules

I noticed something sneaky on my first bill. The monthly payment wasn’t just the annual price divided by 12. The carrier added a “fractional premium” fee.

Insurance companies charge extra for processing 12 payments a year. The math usually works out to an APR of roughly 3% to 5%. If your premium is $1,000 a year, paying monthly might cost you $1,050.

Your next step: Call your insurer and ask, “What is the discount if I switch to annual billing?” If you can’t afford the full year at once, ask about semi-annual billing. It is usually still cheaper than monthly.

Ways to Lower Costs for Existing Life Insurance Policies

If you already have a policy, you aren’t stuck. Your health changes, and your insurance rate should change with it. This is where premium reclassification comes in.

Requesting Reconsideration After Health Improvements

When I bought my first policy, my cholesterol was slightly high. I got a “Standard” rating. Two years later, after diet changes, my levels were normal. I didn’t just celebrate; I called my agent.

We requested a “rate reconsideration.” The carrier sent a nurse to check my vitals again. Because my health metrics improved, they moved me to “Preferred.”

Proof it works: Moving from “Standard” to “Preferred” typically drops premiums by 15% to 20%. For a smoker who quits, the savings are even massive-often 50% or more.

Here is the catch: You generally need to sustain the health improvement for 12 months. For smoking, most carriers require you to be nicotine-free for at least 12 months to get a “Standard Non-Smoker” rate, and 3 to 5 years for “Preferred.”

Important Decision Framework: When to Reclassify

Don’t just request this blindly. It involves a new medical look.

Request a review if:

- You lost significant weight (and kept it off for a year).

- You quit smoking for 12+ months.

- You stopped a high-risk hobby like skydiving.

Do NOT request a review if:

- You developed a new condition (like high blood pressure) since buying the policy.

- Your weight loss was very recent (under 6 months).

If you request a review and your health has gotten worse, they won’t increase your current rate, but you waste time and alert them to new risks for future applications.

Reduction of Face Amount

I worked with a couple who had a $1 million policy. They were 55 years old, the house was paid off, and the kids were working. They were struggling to pay the $200 monthly premium.

They thought their only option was to cancel. I told them to request a face amount adjustment. They lowered the death benefit to $250,000-enough for final expenses and a legacy. Their premium dropped to $55 a month. They kept the coverage they needed without breaking the bank.

Hidden Discounts: Wearables and Data

This is the most modern way to save, and frankly, I love it. Carriers like John Hancock (Vitality program) or those working with fits are now using real-time data to lower rates.

I tested this by linking my Apple Watch to a carrier’s app. Every time I hit my step goal or went to the gym, I earned points. These points translated into premium discounts.

The Data: According to industry reports, engaged members in these programs can save up to 15% annually on their premiums. Plus, you often get perks like Amazon gift cards.

What nobody tells you: You have to be consistent. If you stop wearing the watch or your activity drops, your discount disappears the next year. It is a “use it or lose it” benefit. I missed two weeks when I was sick, and it took me a month to earn my status back.

Critical Warning: The “Wait and See” Risk

I have seen this mistake ruin families. A client, let’s call him “David,” found a cheaper policy online. He was excited to save $40 a month. He called his current insurer and canceled his old policy immediately.

Two weeks later, the new company denied his application because of a liver enzyme issue he didn’t know he had. Now, David had zero insurance. His old policy was gone, and he couldn’t get a new one.

The Golden Rule: NEVER cancel your current policy until the new one is formally “in force” and the first premium is paid. Have the paper in your hand before you let go of the old safety net.

Actionable Next Steps

Reading this won’t save you money. Taking action will. I have broken this down into a simple roadmap so you can start saving today.

Here’s exactly what to do next:

Step 1 (Do this in the next 5 minutes): Log into your current insurance portal or find your paper policy. Write down three numbers: Your current monthly premium, your “Face Amount” (death benefit), and the year the policy expires.

Step 2 (Do this in the next 30 minutes): Call your carrier. Ask these two specific questions:

1. “What is the price difference if I pay annually instead of monthly?”

2. “Can I remove any riders, like Accidental Death, to lower the cost?”

Step 3 (Do this in the next 24 hours): If you need a new policy, get quotes for a “Level Term” policy. Ask the agent specifically about “backdating” to save your insurance age. If you are keeping your old policy but have improved your health, schedule a paramedical exam for reclassification.

I hope this helps you keep more money in your pocket while protecting the people you love. Insurance shouldn’t make you poor; it should make you secure.