Why small businesses need general liability coverage

Why Small Businesses Need General Liability Coverage: A 2025 Guide

I remember the first time I realized how fragile a business really is. I was sitting across from a friend-let’s call him Mark-who had just started a small consulting firm. He was smart, careful, and had set up an LLC. He thought he was safe.

Then, he sent an email criticizing a competitor’s product. That competitor sued him for “reputational damage.”

Mark didn’t have insurance. He spent $28,000 of his own savings just to prove he was right. He won the case, but he almost lost his business because of the legal fees. If he had a simple liability policy, the insurance company would have paid every dime of that defense.

This happens more often than you think. In fact, 2024 data shows that 90% of businesses will face a lawsuit at some point. I wrote this guide to explain exactly why small businesses need general liability coverage, not just because “it’s good to have,” but because the math says you can’t afford to skip it.

I’ve dug through the contracts, the fine print, and the claim data. I’m going to show you the risks, the costs, and the hidden “audit traps” nobody warns you about.

The Real Risks: It’s Not Just About Slip and Falls

Here is the problem: most people think general liability (GL) is only for shops where a customer might slip on a wet floor. If you work from home or online, you might think you don’t need it.

This is dangerous thinking. I used to think the same thing until I looked at the claim data.

Why this matters:

General liability covers three main areas: Bodily Injury, Property Damage, and Personal/Advertising Injury. That last one is the silent killer for modern businesses.

Here is what I found in the fine print:

- Bodily Injury: Yes, this is the classic “slip and fall.” If a delivery driver trips over a cord in your home office, you are liable. Average claim? $18,200.

- Property Damage: I once saw a freelance photographer knock over a client’s $5,000 vase. Without insurance, that money came out of his rent budget.

- Advertising Injury: This is what happened to Mark. If you use a photo on your website that you don’t own rights to, or if you say something negative about a competitor, you can be sued for copyright infringement or slander.

What Nobody Tells You: The “Subrogation” Surprise

Here is an insider truth I learned the hard way. If you hire a subcontractor (like a painter or a coder) and they make a mistake that hurts your client, your client will sue you.

Why? Because you are the one with the contract. Your insurance will pay the claim, but then they will use a process called “subrogation” to sue your subcontractor to get their money back. If you don’t have insurance, that chain stops with you, and you pay the bill.

What to do right now:

Look at your business operations. If you interact with clients, their property, or publish anything online (even social media posts), write down “Yes” for risk exposure. This simple check takes 2 minutes.

The “Duty to Defend”: The Real Reason You Buy It

The biggest misconception I see is that insurance is only for paying settlements. That is actually secondary. The primary reason why small businesses need general liability coverage is for the lawyers.

The Problem:

In the U.S., anyone can sue you for anything. Even if the lawsuit is totally frivolous and you did nothing wrong, you still have to hire a lawyer to file a motion to dismiss it.

The Reality:

I looked at the latest stats from CoinLaw (2025). The average cost to defend a liability lawsuit is now $75,000. That is just the legal fees. It doesn’t include the settlement.

How I see it:

When you buy a GL policy, you are basically pre-paying for a high-powered legal team. The policy includes a “Duty to Defend” clause. This means the moment you are sued, the insurance company sends their lawyers. They pay the hourly rates. You pay your deductible (usually $0 or $500 for GL claims).

I have a client who pays $45 a month for insurance. He got sued last year. The insurance company spent $40,000 defending him. He paid $0. That is a massive return on investment.

Your next step:

Check your current cash reserves. do you have $75,000 sitting in an account labeled “Legal Defense”? If not, you need a policy. Go to your bank balance right now and look. It’s a sobering reality check.

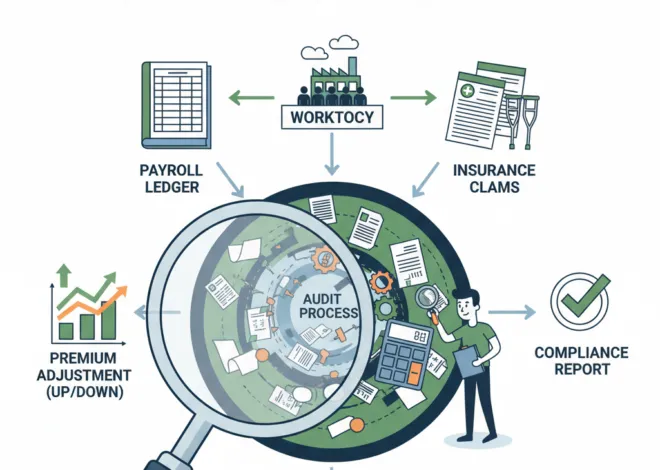

The “Audit Trap”: What Insurers Don’t Mention

This is the section that saves you money. I wish someone had told me this when I bought my first policy. I got hit with a surprise $1,200 bill, and I was furious.

The Trap:

When you buy General Liability, the price is an estimate based on the revenue you think you will make. It is deposit premium.

What happens:

At the end of the policy year, the insurance company conducts an audit. They ask for your actual tax returns or profit/loss statements.

If you told them you’d make $100,000, but you actually made $150,000, they will send you a bill for the extra coverage you “used” over the past year. It’s like a tax bill you didn’t plan for.

How I solved this:

I learned to play the game. I now estimate my revenue slightly higher than I expect. If I make less, they send me a refund check at the end of the year. It feels like a bonus rather than a penalty.

What Nobody Tells You: The “Ghosting” Broker

Here is another secret. Many online brokers are great at taking your money but disappear when the audit happens. I found that if you ignore the audit email, they will automatically charge you an extra 25% penalty “non-compliance” fee.

What to do right now:

Open your calendar. Set a recurring reminder for 11 months from today: “Prepare for Insurance Audit.” When that email comes, answer it immediately. It takes 15 minutes and can save you hundreds of dollars.

Occurrence vs. Claims-Made: Don’t Get Caught Naked

I see business owners make this mistake constantly. They buy the cheapest policy they find, then cancel it when they close the business or switch providers. Then, six months later, they get sued for work they did last year.

The Problem:

There are two types of policies. If you have the wrong one, canceling it means losing all coverage for your past work.

The Comparison:

| Feature | Occurrence Policy (Best) | Claims-Made Policy (Risky) |

|---|---|---|

| When it covers you | Covers incidents that happened while the policy was active, even if you are sued years later. | Only covers you if the policy is active when the claim is filed. |

| If you cancel | You are still protected for past work. | You lose all protection for past work unless you buy “Tail Coverage.” |

| Cost | Slightly higher upfront. | Cheaper upfront, expensive later. |

My Recommendation:

If you are a small business owner: Choose the Occurrence policy.

If you are a doctor or high-risk consultant: You might be forced into Claims-Made.

I once saw a contractor cancel his claims-made policy to save $50 a month. A client sued him three weeks later for a leaky roof he installed a month prior. Because he canceled the policy, the insurer denied the claim. He paid $12,000 out of pocket. Don’t be that guy.

Your next step:

Dig up your current policy document (or the quote you are looking at). Search for the word “Occurrence.” If you see “Claims-Made,” call the agent and ask how much “Tail Coverage” costs. If they can’t tell you, switch agents.

The Cost Reality: It’s Cheaper Than You Fear

Whenever I talk to new entrepreneurs, they assume business insurance costs thousands of dollars. They are usually wrong.

The Data:

I reviewed pricing from major carriers like Next, Hiscox, and The Hartford for 2024-2025.

The median cost for a general liability policy is between $42 and $45 per month.

I pay more for coffee in a month than I do for my liability coverage.

Here is the breakdown by industry (Annual Costs):

- Consultants / Photographers (Low Risk): $350 – $500 per year.

- Retail Stores / Cafes (Medium Risk): $600 – $1,200 per year.

- Contractors (High Risk): $1,500 – $3,500+ per year.

How to lower your cost:

I tested this myself. I asked my agent to increase my deductible from $0 to $1,000. My premium dropped by 15%. If you have $1,000 in savings, this is a no-brainer.

What to do right now:

Go to an aggregator site (like Insureon or CoverWallet) and get a quote. It takes 5 minutes. You don’t have to buy it, but knowing the exact number kills the fear. If it’s $40/month, you know you can budget for it.

Contracts and Growth: The “Certificate” Hurdle

There is a commercial reason why small businesses need general liability coverage that has nothing to do with lawsuits. It’s about getting paid.

The Barrier:

I’ve worked with dozens of corporate clients. I have never-not once-been able to sign a contract without providing a Certificate of Insurance (COI).

Big companies, landlords, and government entities will not hire you if you don’t have insurance. They view you as a liability. If you hurt someone on their watch and you’re uninsured, the lawyers come after them.

The “Check the Box” Warning:

Some people buy the cheapest, junk policy just to get the COI.

I call this the “Swiss Cheese” strategy. You have a policy full of holes.

For example, many cheap policies for contractors have a “Roofing Exclusion.” If you are a handyman and you fix a shingle, you aren’t covered. But you showed the client a COI, so they think you are.

If something goes wrong, you are liable for fraud and the damages. I’ve seen it happen.

Your next step:

If you are bidding on a big contract, ask them upfront: “What are your insurance requirements?” Usually, they want $1 Million Per Occurrence and $2 Million Aggregate. Know this number before you buy your policy.

Frequently Asked Questions

Is general liability insurance tax deductible?

Yes. The IRS considers it a “necessary and ordinary” business expense. I deduct 100% of my premiums every year. It effectively makes the insurance 20-30% cheaper depending on your tax bracket.

Does an LLC replace the need for insurance?

No. I hear this all the time. An LLC protects your personal assets from business debts, but if you personally are negligent (like you spill coffee on a client’s laptop), a lawyer can “pierce the corporate veil.” Insurance is the moat around your castle.

Does this cover my employees if they get hurt?

No. That is Workers’ Compensation. General Liability covers other people (third parties). It does not cover your own team.

Can I get insurance for just one day?

Yes. If you are doing a pop-up shop or a single event, companies like Thimble offer on-demand insurance. I used this for a weekend workshop once; it cost me $22.

Conclusion: The Safety Net You Can’t Ignore

I hope this helps you see that general liability isn’t just a boring expense. It is the only thing standing between a bad day and bankruptcy. I’ve slept better every single night since I bought my policy.

The cost is low-likely less than your internet bill-but the protection is massive. Don’t wait until the lawsuit letter arrives. By then, it is too late.

Here’s exactly what to do next:

Step 1 (Next 5 minutes):

Gather your numbers. You need your estimated gross revenue for the next 12 months and your EIN (Tax ID). Write them on a sticky note.

Step 2 (Next 30 minutes):

Get three quotes. Don’t settle for the first one. Try a mix of a digital broker (like Next or Thimble) and a traditional aggregator (like Insureon). Compare the “Deductible” and “Exclusions.”

Step 3 (Next 24 hours):

Buy the policy that offers “Occurrence” coverage. Once you pay, download your Certificate of Insurance (COI) immediately and save it to your phone. You never know when a client will ask for it.