Protecting your home office with business insurance

Protecting Your Home Office with Business Insurance: A Real-World Guide

I remember the panic I felt three years ago. I was working from my home office when a power surge fried my main desktop computer. I thought, “No problem, I have homeowners insurance.” I called my agent, confident I would get a check for the $2,400 replacement cost.

I was wrong.

Because I used that computer primarily for “business pursuits,” my claim was denied. I paid for the new machine out of pocket. That expensive mistake taught me a lesson I want to share with you: standard home insurance is rarely enough for a home-based business.

The Small Business Administration (SBA) reports that 50% of all small businesses are home-based. Yet, Forbes Advisor found that 60% of us don’t have the right insurance. We assume we are safe, but we aren’t.

In this guide, I will show you exactly how to fix this. I’ll explain the costs, the specific policies you need, and the traps that catch most people off guard.

The Problem: Why Homeowners Insurance Isn’t Enough

Here is the issue most people face: they believe their home policy covers everything inside their house. It doesn’t.

This matters because insurance companies draw a hard line between “personal” and “commercial” use. If you make money using a piece of equipment, it’s commercial. If you meet a client in your living room, that’s commercial activity.

The “Business Pursuits” Exclusion

Most homeowners policies have a clause called “Business Pursuits.” I read through my old policy after my claim denial, and there it was in black and white. This clause effectively removes liability coverage for anything related to your business.

If a delivery driver slips on your porch while dropping off a business package, your personal policy might not pay. If a client trips over a rug in your office, you could be personally liable for their medical bills.

The $2,500 Equipment Limit

According to the Insurance Information Institute (III), standard policies usually cap business property coverage at $2,500. That might sound like a lot, but do the math with me.

I did an inventory of my office recently:

- Laptop: $1,800

- Dual Monitors: $600

- Printer/Scanner: $400

- Standing Desk: $500

- Inventory in the closet: $3,000

Total Value: $6,300.

If a fire burned down my office, a standard policy would pay me $2,500. I would lose $3,800 instantly. And that limit often drops to $500 if the theft happens away from home.

Here is what nobody tells you:

The “Void” Risk. If your insurer finds out you are running a business they consider “risky” (like candle making with open flames or a daycare with kids) and you didn’t tell them, they can void your entire homeowners policy. They won’t just deny the business claim; they could deny a claim for a kitchen fire that had nothing to do with your business.

What to do right now: Go find your current home insurance policy declaration page. Look for “Limits of Liability” and see what the limit is for “Business Personal Property.” If it’s $2,500 or less, you have a gap.

The 3 Ways to Insure Your Home Business

I spent weeks researching this to find the best balance between cost and protection. You generally have three options. Here is how I break them down based on my experience.

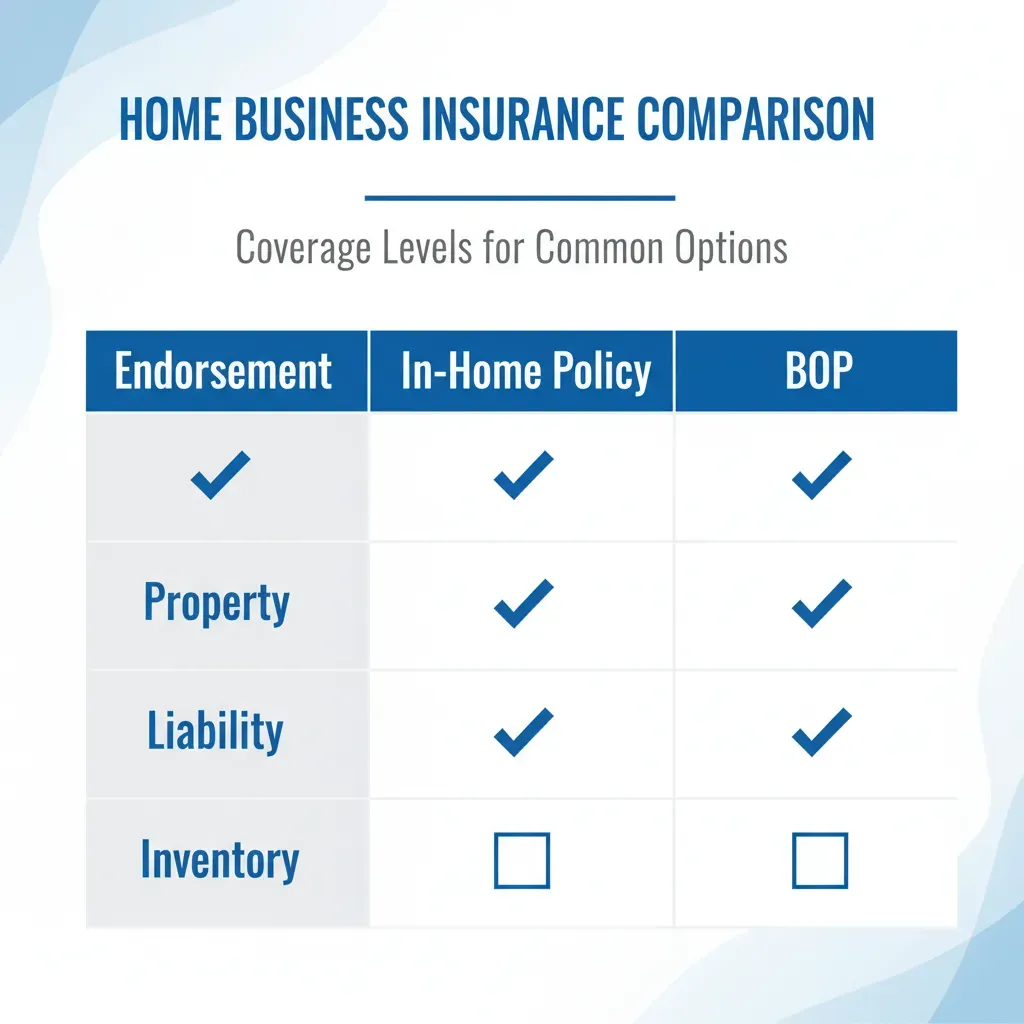

Option 1: Homeowners Policy Endorsement (The “Rider”)

This is the simplest fix. You ask your current insurer to add a “rider” to your existing policy. It increases your coverage limit for business equipment.

- Best for: Freelance writers, graphic designers, or coders with no inventory and no visitors.

- Cost: Very low. Usually $25 to $50 per year.

- My experience: I started here. I paid $35 a year to bump my equipment coverage to $5,000.

- The Catch: It rarely covers liability. If a client sues you, this won’t help.

Option 2: In-Home Business Policy

This is a standalone policy. It is separate from your homeowners insurance but specifically built for home-based work.

- Best for: Consultants, tutors, or creators who have some equipment and maybe an occasional visitor.

- Cost: $250 to $500 per year.

- The Benefit: It usually includes general liability (for injuries) and higher property limits (up to $10,000).

Option 3: Business Owner’s Policy (BOP)

This is the heavy hitter. It bundles General Liability and Commercial Property insurance into one package.

- Best for: Sellers with inventory (Etsy/Amazon), businesses with employees, or anyone with high liability risk.

- Cost: $500 to $1,500+ per year.

- My experience: As my business grew, I switched to this. The peace of mind was worth the extra $40 a month.

Decision Framework: Which one should you pick?

Don’t guess. Use this simple rule of thumb I developed:

Choose the Endorsement if: You have less than $5,000 in gear, no inventory, and zero clients coming to your house.

Choose the In-Home Policy if: You have clients visit occasionally, or you need to protect up to $10,000 in equipment.

Choose the BOP if: You sell physical products, have employees, or your contracts require you to carry liability insurance.

Your next step: If you are a freelancer, call your current agent today and ask, “Can I add a business property endorsement for $5,000?” It takes ten minutes.

Specific Risks You Are Probably Ignoring

Protecting your home office with business insurance isn’t just about theft or fire. There are invisible risks that cost much more.

The “Data Breach” Nightmare

I used to think hackers only targeted big companies. Then I saw the data. Cyber insurance premiums for small businesses rose 20% in 2023 according to Marsh McLennan. Why? Because hackers know home-based businesses have weaker security.

If you store client credit card numbers or personal data on your home server and you get hacked, you are responsible. You have to pay for credit monitoring for your clients and legal fees. A standard home policy pays $0 for this. A BOP usually includes “Cyber Liability” coverage.

The “Car” Gap

This is a huge blind spot. I talk to photographers who leave $5,000 worth of cameras in their car. If that car is broken into, your auto insurance covers the broken window, not the cameras. Your home insurance might cover $500 of the cameras (remember the off-premises limit).

The Solution: You need “Inland Marine” coverage (sometimes called a “Floater”). It sounds like boat insurance, but it actually covers movable property. I added this for my expensive laptop that travels with me. It costs me about $12 a month.

Inventory: The Silent Killer of Cash Flow

If you sell handmade goods, your raw materials are money. If a pipe bursts and ruins your stock, you can’t sell, and you can’t make money. Business Interruption Insurance (included in most BOPs) covers this lost income. Standard home insurance does not.

What nobody tells you: Document your inventory before the disaster. I take a video of my office and storage closet on the 1st of every month. It takes three minutes. If I ever have to file a claim, I have video proof of exactly what I owned.

Real Costs and How to Lower Them

I know what you’re thinking: “I can’t afford another monthly bill.”

I felt the same way. But let’s look at the real numbers. When I finally bought a proper Business Owner’s Policy, it cost me $640 for the year. That is roughly $53 a month.

However, that’s not the real cost.

The Tax Deduction Secret

Because this insurance is for your business, it is generally 100% tax-deductible on your Schedule C (if you are in the US). If you are in a 25% tax bracket, that $640 policy actually costs you closer to $480.

According to IRS Publication 587, direct expenses for your business (like a business insurance policy) are fully deductible. Even if you use a home endorsement, the portion of your home insurance premium that applies to your home office space can often be deducted.

Factors That Spike Your Price

I tested quotes for three different “businesses” to see how the price changed. Here is what I found:

- Industry Risk: A graphic designer paid $300/year. A personal trainer (high injury risk) paid $750/year.

- Location: Being in a flood zone or high-crime area increased the property portion of the premium by about 20%.

- Revenue: If you make over $100,000, premiums go up slightly because your liability exposure is higher.

Try this today: Go to a comparison site like CoverWallet or Simply Business. Enter your details. You can get a quote in about 15 minutes without talking to a human. This gives you a baseline price to negotiate with.

The “Hybrid” Employee Trap

This section is for you if you are employed by a company but work from home.

Many remote workers assume their company covers them. In my experience talking to HR departments, this is a 50/50 bet. If the company provided the laptop, they usually insure it. But if you use your monitor, your desk, and your printer, and a power surge destroys them, the company rarely pays.

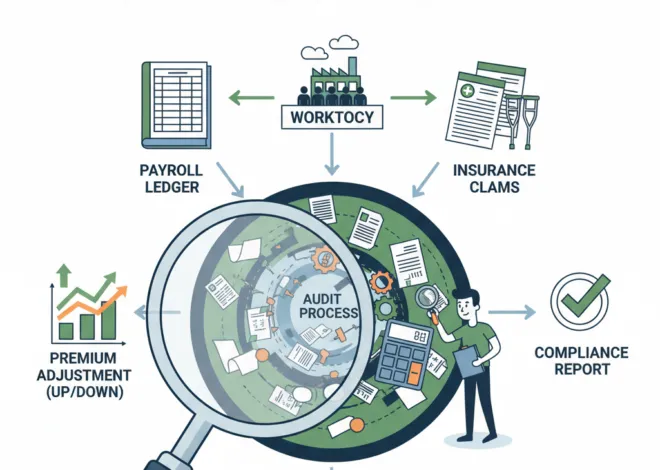

The “Workers Comp” Gray Area: If you trip over your dog while walking to your desk, is that a workplace injury? It’s complicated. I’ve seen claims denied because the employee was “on a break” in their own kitchen.

What to do right now: Send a simple email to your HR rep: “Does the company insurance cover my personal equipment if it is damaged while I am working? And what is the protocol if I am injured in my home office?” Get the answer in writing.

Common Mistakes I Made (So You Don’t Have To)

I want to save you some headaches. Here are two mistakes I made when I first started protecting my home office.

Mistake 1: Undervaluing My Stuff

I estimated my equipment was worth $3,000. When I actually sat down with a spreadsheet and looked up current prices on Amazon, the replacement cost was over $6,000. I was underinsured by 50%.

The Fix: Do not guess. Check current retail prices. Insurance pays to replace the item, so you need to know what it costs to buy it new today, not what you paid for it three years ago.

Mistake 2: Ignoring Professional Liability

I thought liability was only for people visiting my house. I didn’t realize “Professional Liability” (E&O) covers my work mistakes. If I give bad advice and a client loses money, they can sue me. A standard BOP often excludes this, so I had to add it as an extra rider. It costs me an extra $200 a year, but it protects my savings from lawsuits.

Conclusion: Your Safety Net Needs an Upgrade

Protecting your home office with business insurance isn’t about being paranoid. It’s about treating your business like a real business. I slept much better at night once I knew a single theft or fire wouldn’t wipe out my livelihood.

You don’t need to spend a fortune. You just need the right paperwork.

Here is exactly what to do next:

Step 1 (Next 5 minutes): Take your smartphone and walk into your office. Record a 60-second video. Open every drawer and closet. Narrate what you see (“Here is my MacBook Pro, serial number X…”). Save this video to the cloud immediately.

Step 2 (Next 30 minutes): Find your current homeowners declaration page. Check the “Business Personal Property” limit. If it is under $2,500, you are in the danger zone.

Step 3 (Next 24 hours): Get one quote. If you are a freelancer, call your current home insurer about an endorsement. If you sell products, go online and get a quote for a BOP. It’s deductible, it’s affordable, and it’s necessary.